Slovenian Economic Mirror

Related Files:

Slovenian Economic Mirror 4/2025

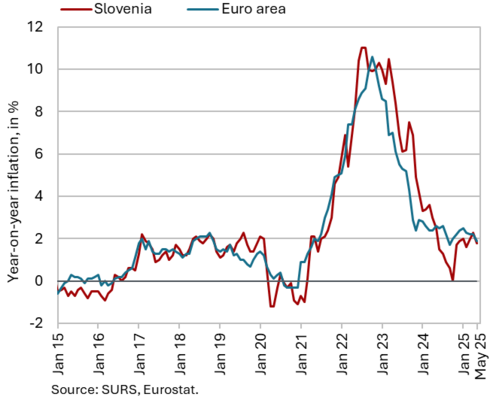

Available economic indicators for Slovenia at the beginning of the second quarter point to reduced activity in the export sector and stronger household consumption. Goods exports and imports declined both month-on-month and year-on-year in April; however, on average over the first four months of the year, both remained higher year-on-year. Manufacturing output continued to contract, and in the first four months of the year, production was lower year-on-year across most sectors. Construction activity increased in April; however, in the January–April period, it remained significantly lower than in the same period last year, with the sharpest decline observed in civil engineering. According to available data, year-on-year growth in private consumption strengthened at the beginning of the second quarter. This is also reflected in the consumer confidence indicator, which rose markedly in May. Overall economic climate also improved slightly in May compared to April, while remaining unchanged year-on-year. Inflation slowed noticeably in May, falling to 1.8%. The most significant contributors to this deceleration were lower year-on-year prices of petroleum products and motor cars, along with a slower increase in clothing and footwear prices. Year-on-year growth in food and non-alcoholic beverage prices also eased somewhat in May, though this group continued to contribute the most to overall inflation. Following a decline at the end of last year, the number of persons in employment remained relatively stable in the first four months. This edition of the selected topic focuses on the United Nations Human Development Index (HDI) for Slovenia and EU Member States, published in May, in which Slovenia achieved its highest ranking to date.

Related Files:

- International environment

- Economic trends

- Labour market

- Prices

- Financial markets

- Balance of payments

- Public finance

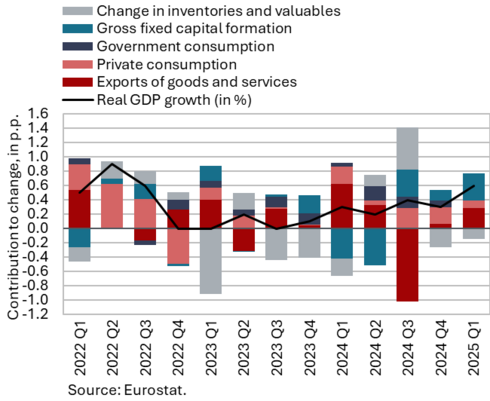

Contributions to GDP growth in the euro area, Q1 2025

Economic growth in the euro area strengthened in the first quarter of 2025. According to Eurostat’s latest (third) estimate, GDP in the euro area expanded by 0.6% quarter-on-quarter (1.5% year-on-year), following 0.3% growth in the fourth quarter of 2024. Quarterly GDP growth in the EU also stood at 0.6%, with year-on-year growth reaching 1.6%. Quarter-on-quarter growth in the euro area was primarily driven by higher investment activity and a positive contribution from net exports, while year-on-year growth was mainly supported by an increase in private consumption. Sentiment indicators suggest that similar growth dynamics may continue into the second quarter. In May, the composite Purchasing Managers’ Index (PMI) remained slightly above 50 (a threshold indicating expanding activity). The services PMI deteriorated slightly (49.4), indicating a contraction in services activity for the first time since November 2024, while the manufacturing PMI (51.5) continued to improve. The Economic Sentiment Indicator (ESI) improved on a monthly basis in May, reflecting increased confidence across most activities (except services) and among consumers, though it remained lower year-on-year. The Ifo Business Climate Index for Germany edged up slightly, reflecting improved business expectations.

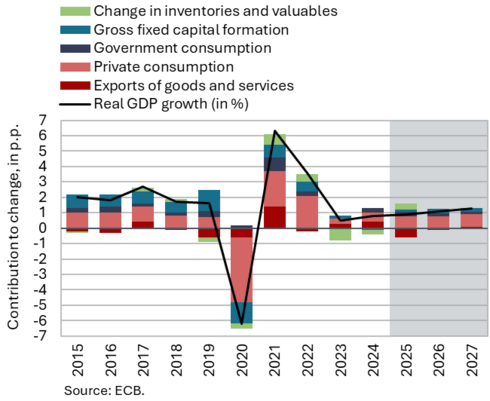

ECB economic outlook, June 2025

In June, the ECB maintained its already downwardly revised March projections for economic growth in the euro area. The June forecast factored in a slightly more pronounced negative impact from US tariffs; at the same time, economic activity in the first quarter exceeded expectations, partly due to the frontloading of exports in anticipation of higher tariffs. In the following two years, economic growth is seen to be supported by new fiscal policy measures. According to the ECB’s baseline scenario, GDP growth in the euro area is expected to reach 0.9% in 2025, 1.1% in 2026, and 1.3% in 2027. Together with the elevated trade policy uncertainty and the recent appreciation of the euro, the higher tariffs will weigh on exports and investment, and, to a lesser extent, on consumption. By contrast, rising real wages and employment, together with less restrictive financing conditions, are anticipated to support economic activity. Over the next two years, domestic demand is also expected to be driven by increased public investment in infrastructure and defence, mainly in Germany.

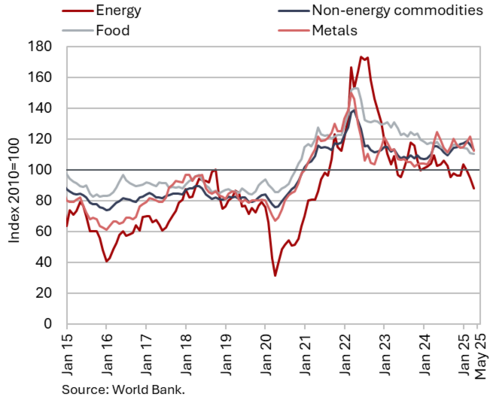

Commodity prices, May 2025

The average price of Brent crude oil continued to decline in May, while prices of non-energy commodities rose slightly on a monthly basis. The average dollar price of Brent crude oil decreased by 5.7% in May compared to April, to USD 64.32, while the euro price fell by 6.2% to EUR 57.04 due to a stronger euro. Year-on-year, the oil price was 21.4% lower in US dollars and 24.7% lower in euros. The decline in oil prices is attributed to heightened uncertainty related to US trade policy and the announced increase in oil production by OPEC+. The price of Brent crude oil surged in mid-June following Israel’s attack on Iran, approaching USD 75 per barrel. The average euro price of natural gas on the European market (Dutch TTF) remained unchanged in May (EUR 35.2/Mwh) after a decline in April; on a year-on-year basis, it was up by 10%. According to the World Bank, the average dollar price of non-energy commodities rose by 1% month-on-month in May, while it was 1.3% lower year-on-year. On a monthly basis, the largest price increases were recorded for raw materials for beverages (tea, cocoa); prices of fertilisers, metals and minerals, as well as wood, also rose. Year-on-year, prices of beverage raw materials (coffee, cocoa) and fertilisers were also significantly higher in May.

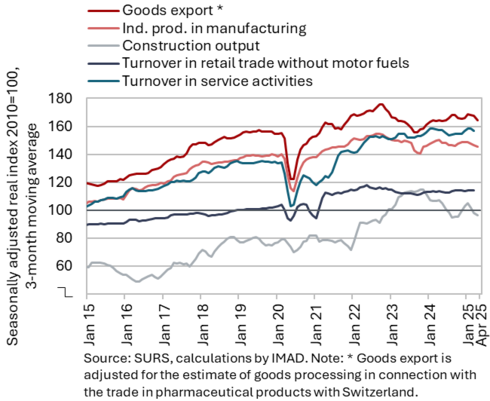

Short-term indicators of economic activity in Slovenia, March–April 2025

Available economic indicators for Slovenia at the beginning of the second quarter point to reduced activity in the export sector and stronger growth in household consumption. Goods exports and imports declined month-on-month in April: exports due to lower exports of most main product groups, particularly metals and metal products, and imports due to a decrease in imports of intermediate goods. Goods exports and imports were also lower year-on-year in April; however, on average over the first four months of the year, both remained higher year-on-year. The contraction of manufacturing activity continued in April (seasonally adjusted), with growth recorded only in medium-high technology industries. On average in the first four months of the year, output declined in most sectors compared to the same period last year, with the sharpest contractions observed in manufacture of other transport equipment and in the manufacture of leather. Construction activity increased in April due to a rise in the value of all types of construction works, while remaining lower year-on-year. In the first four months of the year, it was significantly lower than in the same period last year, with the most pronounced decline observed in civil engineering. Total real turnover in market services in the first quarter was broadly unchanged compared with the fourth quarter of last year, but slightly lower on a year-on-year basis. In trade, turnover increased both on a monthly and annual basis across all segments. Only turnover in sales of food products was lower year-on-year, which is attributed to the different timing of Easter holidays this year. Following relatively modest household consumption growth in the first quarter, stronger growth in the second quarter is indicated by the nominal value of fiscally verified invoices, which was, on average, 4% higher year-on-year in April and May (after year-on-year stagnation in the first quarter).

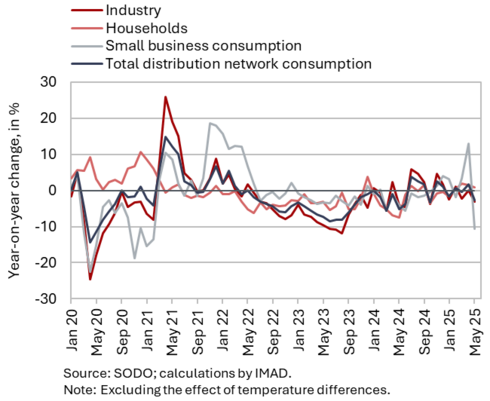

Electricity consumption by consumption group, May 2025

Electricity consumption in the distribution network was 2.6% lower year-on-year in May. With one fewer working day this May, industrial consumption, which can serve as an indicator of economic activity, was 3% lower year-on-year. Household consumption rose by 0.9% year-on-year, while small business consumption – which accounts for only a small share of total consumption – was 10% lower.

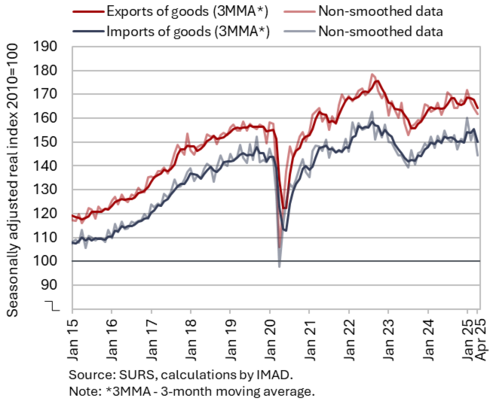

Trade in goods – in real terms, April 2025

Both exports and imports of goods decreased month-on-month in April, and their volume was lower than a year ago. Real seasonally adjusted exports of goods fell for the third consecutive month in April, this time by 1.5%. The decline was significantly influenced by lower exports to Italy, Austria and Germany. Exports decreased in most major product groups, particularly in metals and metal products. After several months of decline, exports of road vehicles increased in April, and exports of pharmaceutical products were also higher1. Real imports of goods, which fluctuate considerably on a monthly basis, declined by 6.9% in April, primarily due to lower imports of intermediate goods¹ (all seasonally adjusted). Exports and imports were also lower year-on-year in April, but on average in the first four months of the year, they remained higher year-on-year (by 0.6% and 1.8% respectively).

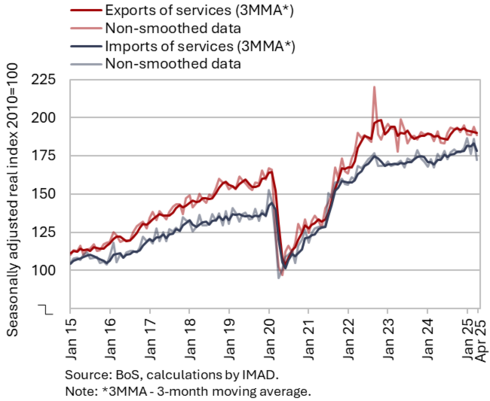

Trade in services – in real terms, April 2025

In April, real exports and imports of services declined both month-on-month and year-on-year; however, in the first four months of the year, both were higher than in the same period last year. On a monthly basis (seasonally adjusted), exports and imports decreased across most major service groups, with the exception of tourism-related services. Exports of these services rose in April to their highest level in the past year, accompanied by an increase in imports (seasonally adjusted). The largest contributions to the decline in total exports came from lower exports of other business services and ICT services, while the decline in imports was primarily driven by lower imports of other business services and transport services. Fluctuations in other business services have been high in recent months, particularly in trade with Switzerland.

In the first four months of the year, service exports were higher than in the same period last year, primarily due to year-on-year growth in exports of other business services during the first three months. Most other major service groups, however, remained lower year-on-year. Service imports over the four-month period were significantly higher than a year earlier (driven mainly by increased imports of other business services, ICT services, and transport services).

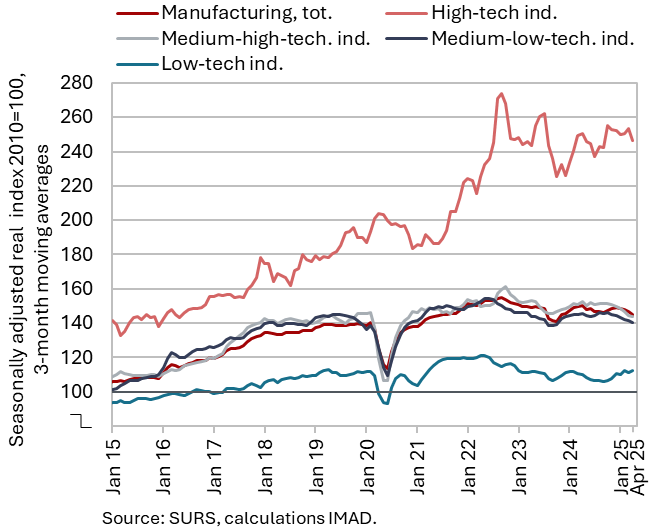

Production volume in manufacturing, April 2025

Manufacturing activity continued to contract in April (seasonally adjusted), with overall output over the first four months lower than a year earlier. Growth was observed only in medium-high-technology industries, while output in the remaining three technology-intensity categories continued to decline (seasonally adjusted). On average in the first four months, output in most sectors was lower year-on-year (down by 2.4%, working-day adjusted). The largest declines were observed in the manufacture of other transport equipment, as well as in the manufacture of leather. Output also fell in the manufacture of fabricated metal products, other machinery and equipment, ICT equipment, and in some low-technology industries. Following growth in the previous year, activity in the energy-intensive paper industry and manufacture of basic metals remained largely unchanged year-on-year, while activity in other energy-intensive activities – chemical industry and the manufacture of non-metallic mineral products – was higher than a year earlier. Production in high-technology industries was similar to the level recorded a year earlier; according to our estimates, it remains higher than last year in the pharmaceutical industry.

The confidence indicator in manufacturing remained at a similarly low level in May as observed over the past two years.

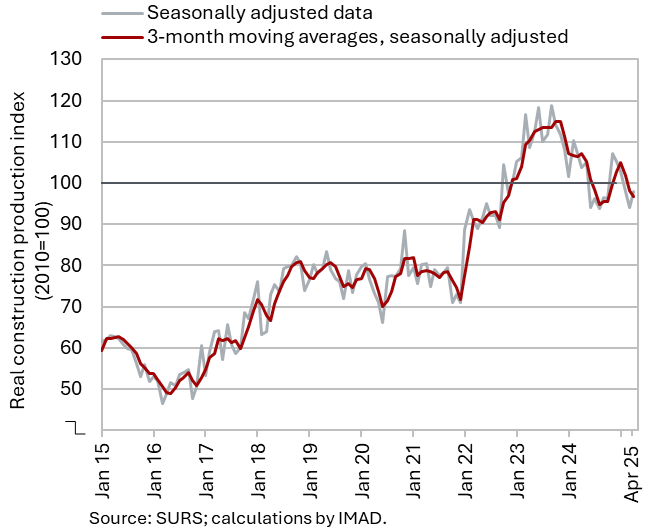

Activity in construction, April 2025

Following a decline in the first quarter, construction activity increased in April, though it remained lower year-on-year. Activity gradually declined over the course of last year, but rose sharply in the fourth quarter. In the first quarter of this year, it declined again; in April, however, it increased by 4% compared to March, as the value of all types of construction works increased. In the first four months of the year, the value of construction put in place was 8% lower than in the same period last year, with the largest decline recorded in civil engineering (-19%).

Activity in civil engineering is traditionally linked to government investment activity. Capital expenditure (according to the consolidated general government budgetary accounts) was 2% higher year-on-year in the first four months; within this, expenditure on new constructions, reconstructions, and renovations – which, in our assessment, is most closely related to construction activity – increased by 6%. The lower activity in civil engineering at the beginning of the year may thus be related to reduced investment by infrastructure companies and/or budgetary funds.

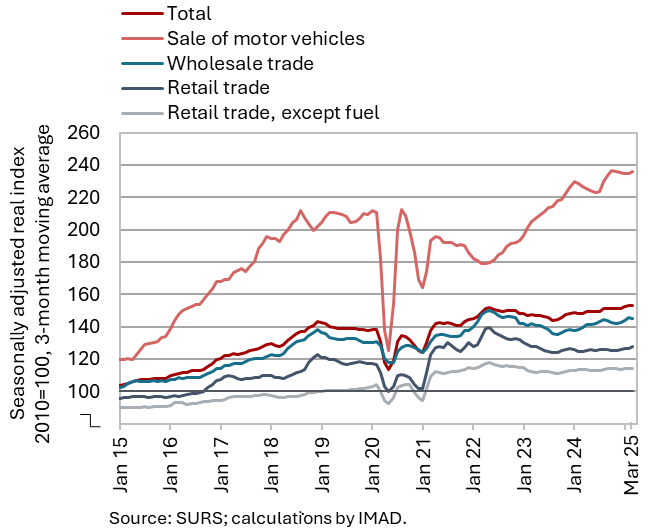

Turnover in trade, March–April 2025

In the first quarter, real turnover increased quarter-on-quarter and year-on-year in all trade sectors except in retail sales of food products. The 1% year-on-year decrease in turnover from retail sales of food products was driven by a significant year-on-year decline in March (-6%), primarily due to the timing of the Easter holidays and related pre-holiday purchases (last year these took place in March, while this year in April). In all other trade sectors, turnover increased on both a quarterly and year-on-year basis in the first quarter. Real turnover rose by 3% year-on-year in wholesale trade and in the sale of motor vehicles, while in retail trade of non-food products it increased by 2%.

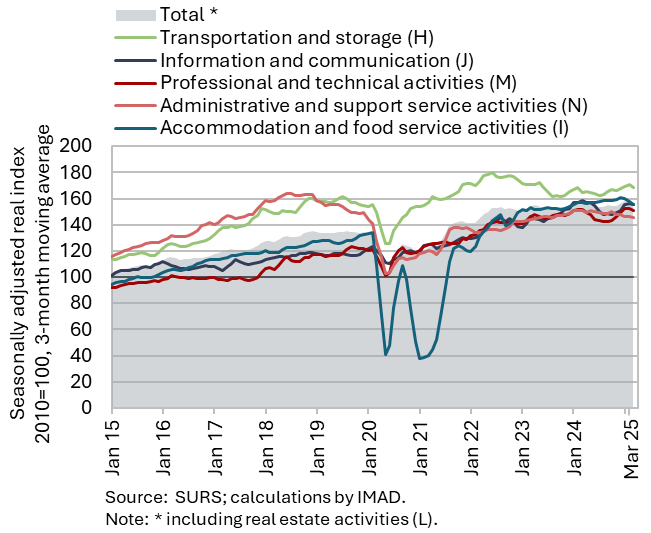

Turnover in market services, March 2025

Total real turnover in market services in the first quarter was broadly unchanged compared with the fourth quarter of last year, but slightly lower on a year-on-year basis (by 0.3%). Following strong growth at the end of 2024, quarter-on-quarter turnover growth further accelerated in the information and communication sector, supported by both main activities – telecommunications and computer services. The turnover growth observed in the second half of last year continued in the transportation and storage sector, this time with particularly strong growth in air transport. In professional and technical services, growth moderated slightly after strengthening in the fourth quarter, although turnover growth in architectural and engineering services remained particularly strong. Turnover in accommodation and food service activities, however, declined more markedly after strengthening in the second half of last year. In administrative and support service activities, where turnover has been decreasing since the second quarter of last year, the downturn deepened further, particularly in employment agencies. On a year-on-year basis, real turnover in the first quarter increased in transportation and storage as well as in professional and technical services.

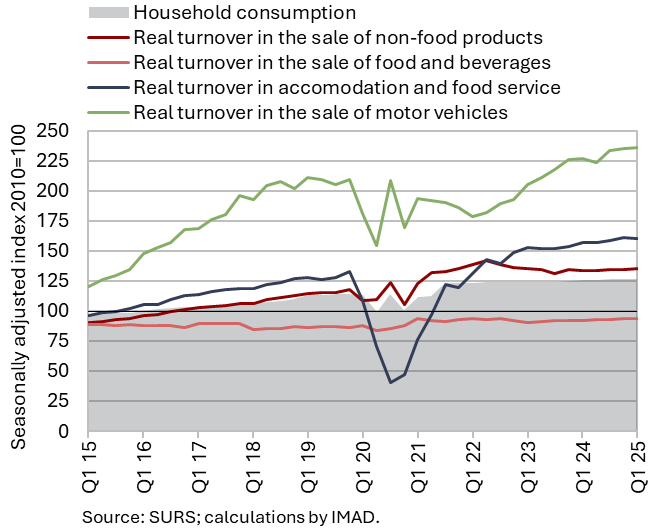

Selected indicators of household consumption, Q1 2025

Based on available data, year-on-year growth in private consumption was higher at the beginning of the second quarter than in the first. The modest growth in the first quarter (0.4%) reflected a high saving rate. Year-on-year real growth in disposable income (estimated based on developments in compensation of employees and social transfers) was significantly higher than real growth in private consumption. The timing of the Easter holidays also contributed to low consumption growth: in 2024, Easter-related purchases were made in March, whereas this year they occurred in April. In the first quarter, spending on food, beverages and tobacco products declined year-on-year, as did spending on new passenger cars. Conversely, spending on non-food products and tourism services abroad increased.

Higher year-on-year household consumption growth at the beginning of the second quarter is indicated by the nominal value of fiscally verified invoices (as a proxy for sales), which rose by 5% year-on-year in April and by 2% in May, after stagnating in the first quarter (averaging 4% growth over the two months).

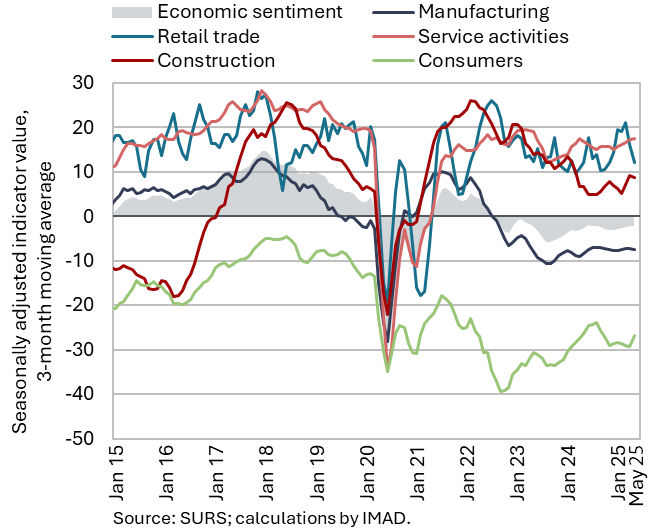

Economic sentiment, May 2025

The value of the economic sentiment indicator increased slightly in May compared to April, while remaining unchanged year-on-year. On a monthly basis, the consumer confidence indicator increased markedly, with improvements recorded across all of its components: the current financial situation of households, expectations regarding the country’s economic situation, expectations regarding households’ financial situation, and expectations concerning major purchases. Confidence in retail trade also increased, while confidence in other sectors deteriorated. The consumer confidence indicator was also higher year-on-year, and confidence in the service sector was higher than in May 2024. The economic sentiment indicator remains below its long-term average, with only the indicators for services and construction still exceeding their respective long-term averages.

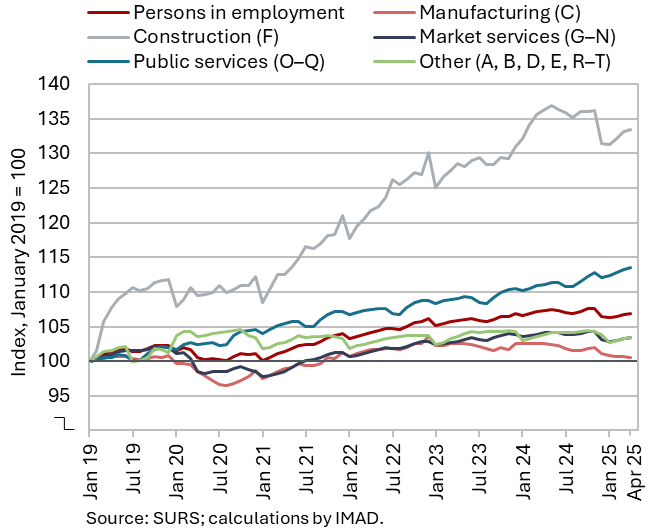

Number of persons in employment, April 2025

Following a decline at the end of last year, the number of persons in employment has remained broadly stable in recent months (seasonally adjusted). In April, the number of employed persons was 0.4% lower year-on-year. The largest decrease was recorded in administrative and support service activities (-4.8%), mainly due to a decline in employment activities. Notable year-on-year decreases were also observed in construction (-2.1%) and manufacturing (-2.0%), where labour shortages persist. In contrast, year-on-year growth was observed in public service activities, particularly in human health activities (3.3%) and education (1.7%).

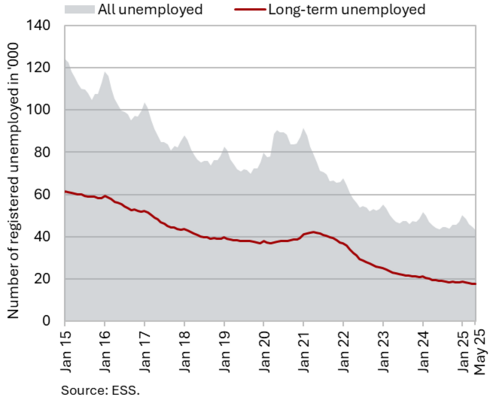

Number of registered unemployed, May 2025

In May, the number of registered unemployed persons (seasonally adjusted) continued to decline slightly (by 0.5%). According to original data, 43,196 people were unemployed at the end of May, 2.6% fewer than at the end of April. Year-on-year, the number of unemployed was 2% lower, marking a smaller decrease compared to the beginning of the year. This was influenced, alongside the still moderate outflow from the unemployment register, by a slightly higher inflow of redundant workers into unemployment. The year-on-year decrease in the number of long-term unemployed (-9.3%) and unemployed persons aged over 55 (-11.7%) was similar to the decline observed in April. In contrast, youth unemployment (ages 15–29) has been gradually increasing year-on-year since the end of last year (6.6% higher in May compared to the same month of the previous year).

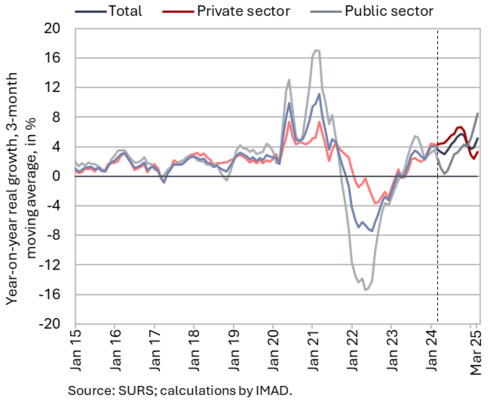

Average real gross wage per employee, March 2025

Year-on-year nominal growth in the average gross wage was slightly higher in March (6.6%) than in January and February, primarily due to stronger growth in the private sector (6.3%). In our assessment, this is attributable not only to last year’s lower base, but also to excess demand for labour in certain segments of the economy, as indicated by the increase in the job vacancy rate in the first quarter. In the public sector, year-on-year growth remained high (10.9%) due to the agreed increase in basic wages at the beginning of the year (as part of the wage reform). In real terms, the average gross wage increased by 5.8% in March – by 4.2% in the private sector and by 8.7% in the public sector.

Active and inactive population, Q1 2025

According to survey data, labour market conditions deteriorated slightly in the first quarter of this year, which can also be linked to increased uncertainty in the economic environment. The number of unemployed persons totalled 41,000, representing a 13.9% increase compared with the same quarter of the previous year. The survey unemployment rate stood at 4%, up by 0.6 p.p. year-on-year. The number of persons in employment was slightly lower year-on-year in the first quarter (-0.8%). This reflects a year-on-year increase in the number of employees in labour relation, while the number of self-employed persons and those engaged in other forms of work (e.g. student work) declined. These types of employment are typically the first to transition into unemployment or inactivity during periods of increased economic uncertainty.

Consumer prices, May 2025

Year-on-year growth in consumer prices slowed more noticeably in May, declining by 0.5 p.p. to 1.8%, while prices remained unchanged month-on-month. The main contributors to the lower inflation rate were the year-on-year decline in prices in the transport group (–1.9%) and the slower growth in prices in the clothing and footwear group (1.3%, compared with 4.2% in April). According to our assessment, the lower prices in the transport group primarily reflect cheaper petroleum products, as well as a decline in motor vehicle prices. Following a marked monthly increase in April in the prices of clothing and footwear (in particular, a 20% rise in footwear prices), prices in this group declined slightly in May on a monthly basis, deviating from the typical seasonal price patterns observed in this group. This also contributed to the moderation in the growth of semi-durable goods prices (1.6%), while prices of durable goods remained lower year-on-year (-0.7%). The growth of food and non-alcoholic beverage prices moderated slightly in May, yet at 5.5% year-on-year, it remained the highest among all groups in the consumer price index. A similar year-on-year growth rate was recorded in the restaurants and hotels group (5.3%). Year-on-year growth in service prices (3.2%) stayed close to levels observed in recent months.

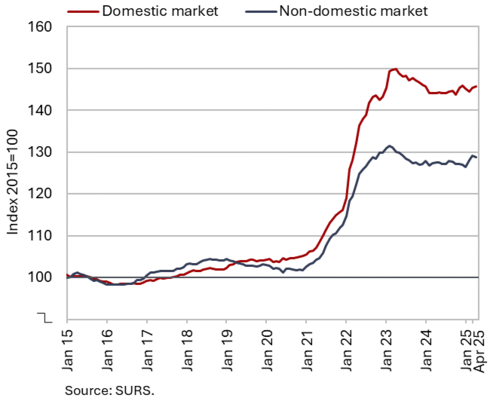

Slovenian industrial producer prices, April 2025

Year-on-year growth in Slovenian industrial producer prices slowed slightly in April (to 1%); the growth rate was the same on both domestic and foreign markets. Consumer goods prices continued to rise at the fastest pace year-on-year, maintaining a growth rate of 3%. Within this group, the growth of non-durable goods prices accelerated again, reaching 4.4% – the highest rate since October 2023 – while the decline in durable goods prices deepened further (-2.2%), reflecting a somewhat higher base. Year-on-year growth in intermediate goods prices remained moderate (around 0.7%), and growth of capital goods prices was even more subdued (0.3%). Energy prices were 4.2% lower year-on-year, following a monthly decline in the electricity, gas and steam supply sector (-3.9%).

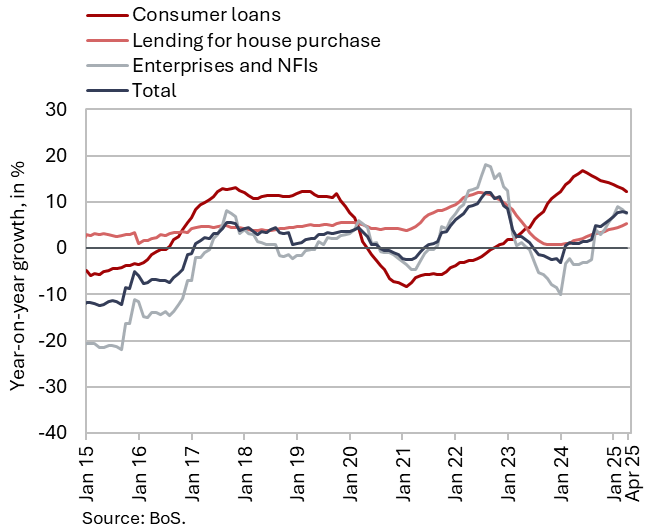

Loans to domestic non-banking sectors, April 2025

Year-on-year growth in the volume of loans to the domestic non-banking sector, which had been strengthening in previous months, remained slightly below 8% in April. Loans granted to nonmonetary financial institutions and households continued to contribute the most to growth (a combined 6.4 p.p.). Corporate borrowing, which had strengthened at the beginning of the year, slowed in March and April, with companies recording net repayments of loans taken from domestic banks during this period. As a result, loans to non-financial corporations were only 0.5% higher year-on-year. The growth of deposits held by domestic non-banking sectors, which remains around 3.5%, is still primarily driven by household deposits. Household deposits increased by 4.2% year-on-year, while corporate deposit growth reached 2.5%. Although deposits by domestic non-banking sectors are growing at less than half the pace of loans, the loan-to-deposit ratio remains stable at around 0.70. The share of non-performing claims stands at 1 %.

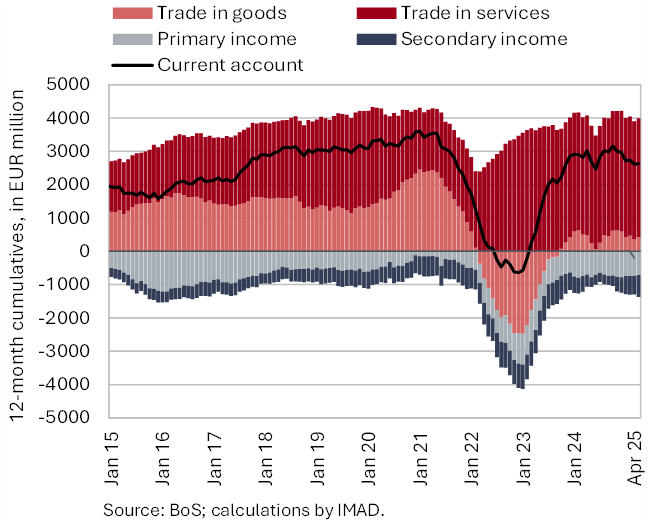

Current account of the balance of payments, April 2025

The 12-month current account surplus (until April) decreased by EUR 390,6 million compared to the previous 12-month period, amounting to EUR 2.6 billion (3.7% of estimated GDP). The largest contribution to the decline came from a higher secondary income deficit, primarily due to lower receipts from the EU budget for current international cooperation. The decrease in the current account surplus was also driven by the balances of goods and services, as well as primary income balance. The lower goods surplus was affected by a higher deficit in trade with EU countries, while the services surplus declined mainly due to a drop in construction services and travel. The primary income deficit increased mainly as a result of lower net inflows from compensation of employees: earnings of Slovenian workers abroad decreased, while earnings of foreign workers in Slovenia increased. Net outflows from equity income were also higher.

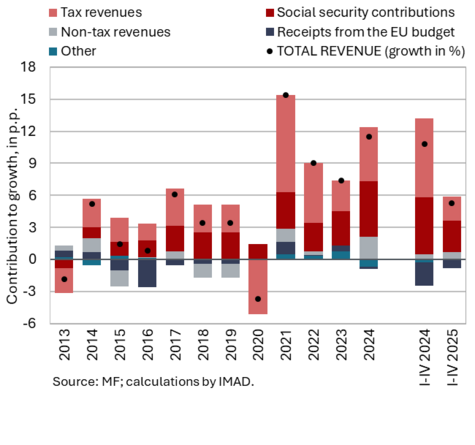

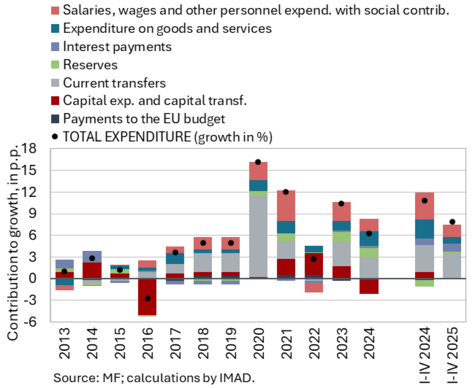

Revenue (top figure) and expenditure (bottom figure) of the consolidated general government budgetary accounts, April 2025

In the first four months of this year, the deficit of the consolidated balance of public finances was higher year-on-year. It totalled EUR 288.2 million, compared with EUR 54.1 million in the same period last year. Revenues in the first four months were 5.3% higher year-on-year (compared to 10.8% last year); the high revenue growth in 2024 was partly driven by one-off factors (the introduction of the health contribution and the non-adjustment of income tax brackets to inflation). This year’s revenue growth has been driven mainly by relatively high growth in social contribution revenues, although this growth is lower than last year, when it was boosted by the transformation of supplementary health insurance into a mandatory health contribution. Tax revenues have also made a significant contribution to overall revenue growth, particularly from value added tax and personal income tax. Due to the April settlement of tax liabilities, corporate income tax revenues dropped sharply this year, despite the higher tax rate. Total receipts from the EU budget were lower year-on-year. Expenditure was 7,9 % higher year-on-year in the first four months (compared to 10.8% last year). The bulk of the growth stemmed from: current transfers to individuals and households, other current transfers (such as agricultural subsidies and transfers for the provision of public utility services in public transport), wages and work-related income, which are affected by the wage reform (implementation began in January this year), and interest payments. Expenditure on investment, which was still lower year-on-year in the first quarter, exceeded last year’s level in the first four months.

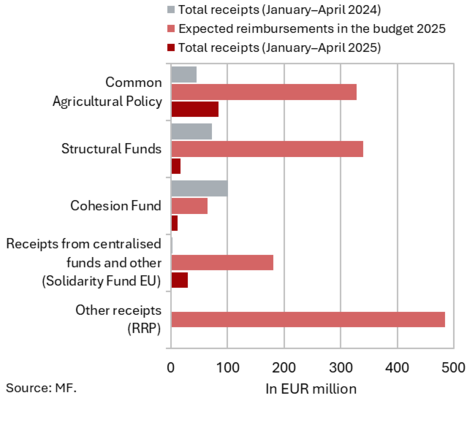

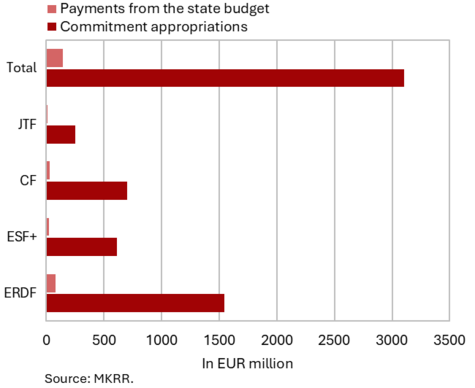

EU budget receipts, April 2025 (top figure) and absorption of 2021–2027 funds under the Cohesion policy programme (EU part) for the period 1 January 2021–30 April 2025 (bottom figure)

Slovenia’s net budgetary position against the EU budget was negative in the first four months of 2025 (at EUR 85.1 million). In this period, Slovenia received EUR 141.8 million from the EU budget (10.2% of receipts envisaged in the adopted state budget for 2025) and paid EUR 226.9 million into it (31% of planned annual payments). The bulk of revenue came from EU budget receipts for the implementation of the Common Agricultural and Fisheries Policy (59.2% of all reimbursements to the state budget, 25.6% of the planned reimbursements in 2025) and for the implementation of centralised and other EU programmes (20.8% of all reimbursements to the state budget, 16.4% of the planned reimbursements in 2025), most of which were under the Connecting Europe Facility. Reimbursements from the structural funds amounted to 11.8% of all reimbursements (4.9% of the planned reimbursements in 2025). According to the Information on the Implementation of the RRP (May 2025), two payment requests are planned to be submitted to the European Commission this year – one in the spring and one in the autumn – with a total indicative amount of EUR 944 million. The highest payments into the EU budget came from GNI-based payments (46.9% of all payments).

According to the MKRR data, under the Operational Programme for the Implementation of EU Cohesion Policy 2021–2027 (from January 2021 to the end of April 2025), payments from the state budget totalled EUR 142.2 million (EU share), representing 5% of total available funds.