News

Slovenian Economic Mirror 4/2025: Lower activity in the export sector and stronger household consumption at the beginning of the second quarter; noticeable slowdown in year-on-year consumer price growth in May

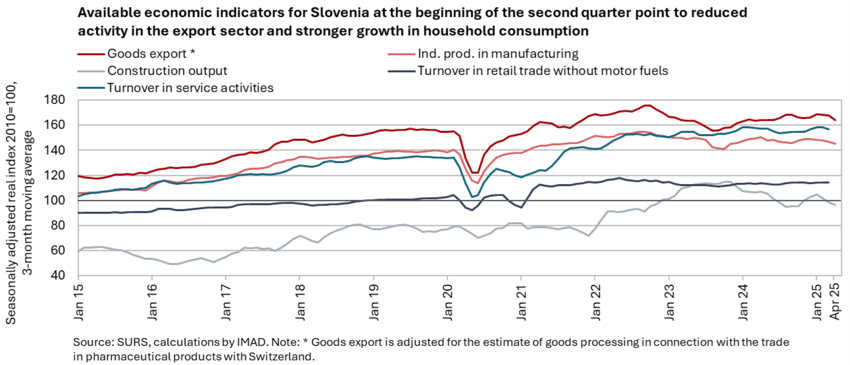

Available economic indicators for Slovenia at the beginning of the second quarter point to reduced activity in the export sector and stronger household consumption. Goods exports and imports declined both month-on-month and year-on-year in April; however, on average over the first four months of the year, both remained higher year-on-year. Manufacturing output continued to contract, and in the first four months of the year, production was lower year-on-year across most sectors. Construction activity increased in April; however, in the January–April period, it remained significantly lower than in the same period last year, with the sharpest decline observed in civil engineering. According to available data, year-on-year growth in private consumption strengthened at the beginning of the second quarter. This is also reflected in the consumer confidence indicator, which rose markedly in May. Overall economic climate also improved slightly in May compared to April, while remaining unchanged year-on-year. Inflation slowed noticeably in May, falling to 1.8%. The most significant contributors to this deceleration were lower year-on-year prices of petroleum products and motor cars, along with a slower increase in clothing and footwear prices. Year-on-year growth in food and non-alcoholic beverage prices also eased somewhat in May, though this group continued to contribute the most to overall inflation. Following a decline at the end of last year, the number of persons in employment remained relatively stable in the first four months. This edition of the selected topic focuses on the United Nations Human Development Index (HDI) for Slovenia and EU Member States, published in May, in which Slovenia achieved its highest ranking to date.

In the first quarter, economic growth in the euro area exceeded the expectations of international institutions; in its June update, the ECB maintained the downwardly revised growth forecasts published in March. According to Eurostat’s latest (third) estimate, euro area GDP increased by 0.6% in the first quarter of 2025 (1.5% year-on-year), following 0.3% growth in the fourth quarter of 2024. This marks the strongest quarterly growth since the third quarter of 2022. The stronger-than-expected growth was partly driven by a rise in exports in anticipation of a potential increase in US tariffs. Quarter-on-quarter growth in the euro area was primarily driven by higher investment activity and a positive contribution from net exports, while year-on-year growth was mainly supported by an increase in private consumption. According to economic sentiment indicators, similar economic growth is expected to persist into the second quarter. According to ECB’s baseline scenario, GDP growth in the euro area is expected to reach 0.9% in 2025, 1.1% in 2026, and 1.3% in 2027. Together with the elevated trade policy uncertainty and the recent appreciation of the euro, the higher tariffs will weigh on exports and investment, and, to a lesser extent, on consumption. By contrast, rising real wages and employment, together with less restrictive financing conditions, are anticipated to support economic activity. Over the next two years, domestic demand is also expected to be driven by increased public investment in infrastructure and defence, particularly in Germany.

Available economic indicators for Slovenia at the beginning of the second quarter point to reduced activity in the export sector and stronger growth in household consumption. Goods exports and imports declined month-on-month in April: exports due to lower exports of most main product groups, particularly metals and metal products, and imports due to a decrease in imports of intermediate goods. Goods exports and imports were also lower year-on-year in April; however, on average over the first four months of the year, both remained higher year-on-year. The contraction in manufacturing activity, ongoing since the beginning of the year, persisted in April (seasonally adjusted). Growth was recorded solely in the production of medium-high-technology industries. On average in the first four months of the year, output declined in most sectors compared to the same period last year, with the sharpest contractions observed in the manufacture of other transport equipment and in the manufacture of leather. Construction activity increased in April due to a rise in the value of all types of construction works, while remaining lower year-on-year. In the first four months of the year, it was significantly lower than in the same period last year, with the most pronounced decline observed in civil engineering. Total real turnover in market services in the first quarter was broadly unchanged compared with the fourth quarter of last year, but slightly lower on a year-on-year basis. In trade, turnover increased both month-on-month and year-on-year across all segments. Only turnover in the sales of food products was lower year-on-year, which is attributed to the different timing of Easter holidays this year. Following relatively modest household consumption growth in the first quarter, stronger growth in the second quarter is indicated by the nominal value of fiscally verified invoices, which was, on average, significantly higher year-on-year in April and May (after stagnating year-on-year in the first quarter). Higher private consumption is also indicated by the consumer confidence indicator, which rose noticeably in May on a monthly basis, reflecting improvements across all components; it was also higher year-on-year. The economic climate also improved slightly in May compared to April, while remaining unchanged year-on-year. Confidence in retail trade was higher than in April, while confidence in other activities deteriorated. In addition to higher consumer confidence, confidence in the services sector was also above the level recorded in May of last year.

Following a decline at the end of last year, the number of persons in employment remained broadly stable in the first four months of this year, while the number of unemployed persons decreased slightly in May (both seasonally adjusted); year-on-year wage growth remained relatively high in March. Year on year, the number of persons in employment was down 0.4% in April. The number of registered unemployed persons continued to decline slightly in May (–0.5%, seasonally adjusted) and was 2% lower year-on-year. The smaller year-on-year decline compared to the beginning of the year is mainly related to a slightly higher inflow of redundant workers into unemployment. Year-on-year nominal growth in the average gross wage was slightly higher in March (6.6%) than in January and February, primarily due to stronger growth in the private sector (6.3%). In our assessment, this is attributable not only to last year’s lower base, but also to excess demand for labour in certain segments of the economy, as indicated by the increase in the job vacancy rate in the first quarter. In the public sector, year-on-year growth remained high (10.9%) due to the agreed increase in basic wages at the beginning of the year (as part of the wage reform).

Year-on-year consumer price growth slowed significantly in May. With prices remaining unchanged on a monthly basis, the inflation rate declined by 0.5 p.p. to 1.8%. The main contributors to lower inflation were the year-on-year decline in prices within the transport group (–1.9%), particularly oil products and motor vehicles, as well as a deceleration in the growth of clothing and footwear prices (1.3%). Following a sharp monthly increase in April – most notably in footwear prices (20%) – prices in this group edged down slightly in May. Year-on-year growth of food and non-alcoholic beverage prices moderated slightly in May, yet at 5.5% year-on-year, it remained the highest among all CPI groups. Year-on-year growth in service prices (3.2%) stayed close to levels observed in recent months. Year-on-year growth in Slovenian industrial producer prices slowed slightly in April (to 1%); the growth rate was the same on both domestic and foreign markets.

In the first four months of this year, the deficit of the consolidated balance of public finances was higher year-on-year. It totalled EUR 288.2 million, compared with EUR 54.1 million in the same period last year. Revenues were 5.3% higher year-on-year in the first four months. Growth has been driven mainly by relatively high growth in social contribution revenues, although this growth is lower than last year, when it was boosted by the transformation of supplementary health insurance into a mandatory health contribution. Tax revenues have also made a significant contribution to growth, particularly revenues from value added tax and personal income tax. Due to the April settlement of tax liabilities, corporate income tax revenues dropped sharply this year, despite the higher tax rate. Total receipts from the EU budget were also lower year-on-year. Expenditure was 7,9 % higher year-on-year in the first four months (compared to 10.8% last year). The bulk of the growth stemmed from: current transfers to individuals and households, other current transfers (such as agricultural subsidies and transfers for the provision of public utility services in public transport), wages and work-related income, which are affected by the wage reform (implementation began in January this year), and interest payments. Expenditure on investment, which was still lower year-on-year in the first quarter, exceeded last year’s level in the first four months.