Charts of the Week

Charts of the week from 13 to 17 October 2025: activity in construction, current account of the balance of payments, number of persons in employment and other charts

After contracting in the first quarter, construction activity strengthened thereafter and was significantly higher year-on-year in August. The 12-month current account surplus up to August was EUR 110.9 million lower than in the preceding 12-month period, amounting to EUR 3 billion (4.3% of estimated GDP). The decline was mainly driven by a wider secondary income deficit, primarily reflecting lower receipts from the EU budget. In August, the number of persons in employment remained broadly unchanged relative to previous months and was 0.4% lower year-on-year. Employment remained below the level of the previous year mainly in administrative and support service activities, construction, and manufacturing, while it increased in public service activities. Electricity consumption in the distribution network was 2.2% lower year-on-year in September. Industrial consumption fell by 2.1% year-on-year with one additional working day, and in the third quarter, with the same number of working days, it was 3.6% lower. The volume of road and rail freight transport decreased further in the second quarter of 2025; road freight transport was down by 13% year-on-year, and rail freight transport by 8%.

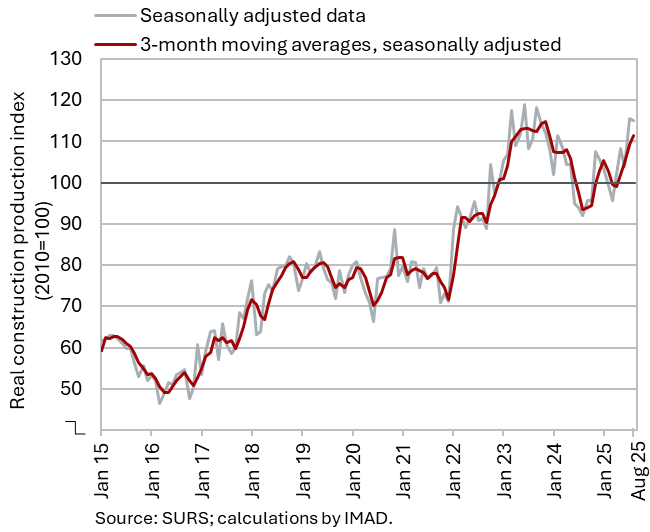

Activity in construction, August 2025

The value of construction put in place was considerably higher year-on-year in July and August. Following a decline in the first quarter, construction activity strengthened thereafter. According to SURS data on the value of construction put in place, activity in August was 25% higher than a year earlier and 4% higher in the first eight months as a whole. However, other data sources do not indicate such a strong increase in activity during the summer months. Based on VAT data, the activity of construction companies in August was 8% higher year-on-year. The discrepancy between the growth rates derived from VAT data and those from data on construction put in place amounted to as much as 17 p.p.

The confidence indicator in construction improved in September, reaching its highest level in the past year and a half. Companies generally assess new orders as normal. The main constraint continues to be a shortage of skilled labour. Only about one tenth of companies cite insufficient demand as a limiting factor, indicating that the construction sector is currently not facing demand-side problems; the constraints are primarily on the supply side.

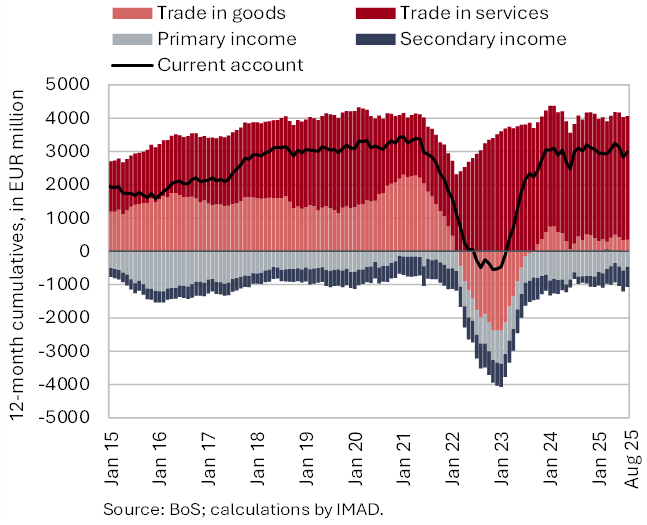

Current account of the balance of payments, August 2025

The 12-month current account surplus (until August) decreased by EUR 110,9 million compared to the previous 12-month period, amounting to EUR 3 billion (4.3% of estimated GDP). The decline was mainly driven by a wider deficit in secondary income, primarily due to lower receipts from the EU budget. The annual goods surplus was somewhat lower, and the gap was significantly smaller than in previous months’ releases, following a substantial revision of goods import values for the first seven months. The services surplus increased, particularly in the trade in other business services and transport services. The deficit in primary income narrowed, mostly due to lower net outflows of income from equity capital (dividends and profits). Net inflows of compensation of employees also increased, as the earnings of Slovenians working abroad rose more than the earnings of foreign workers employed in Slovenia.

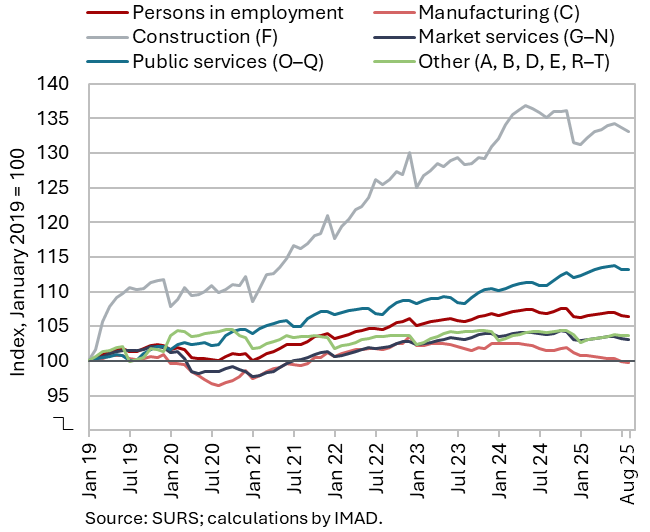

Number of persons in employment, August 2025

In August, the number of persons in employment remained broadly unchanged compared with previous months (seasonally adjusted) and was 0.4% lower year-on-year. The number of employees declined year-on-year in August (–0.6%), while the number of self-employed increased (1.5%). The steepest year-on-year decreases in employment were recorded in administrative and support service activities (–4%), mainly due to a decline in employment agencies, followed by manufacturing (–1.8%), and construction (–1.6%). Conversely, employment continued to rise in public service activities, most notably in human health and social work activities (+3.5%) and in education (+1.5%).

The number of foreign citizens in employment increased by 1.9% year-on-year, while the number of Slovenian nationals in employment declined by 0.7%.

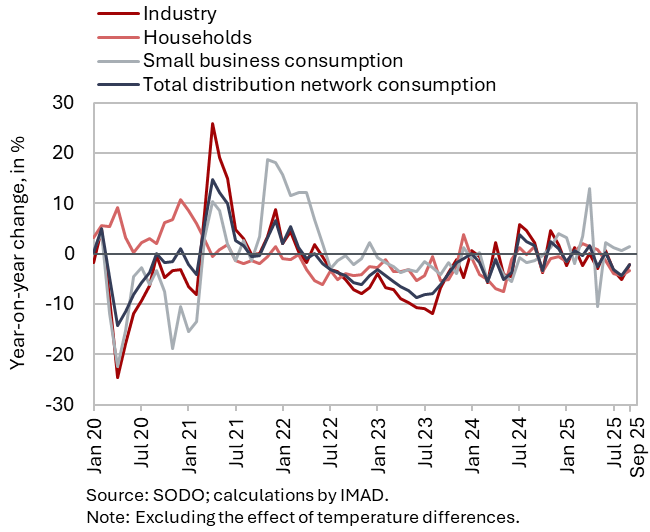

Electricity consumption by consumption group, September 2025

Electricity consumption in the distribution network was 2.2% lower year-on-year in September. With one more working day this September, industrial consumption, which can serve as an indicator of economic activity, was 2.1% lower year-on-year and household consumption was 3.4% lower. Small business consumption was 1.4% higher year-on-year. In the third quarter, industrial consumption was 3.6% lower year-on-year, with the same number of working days.

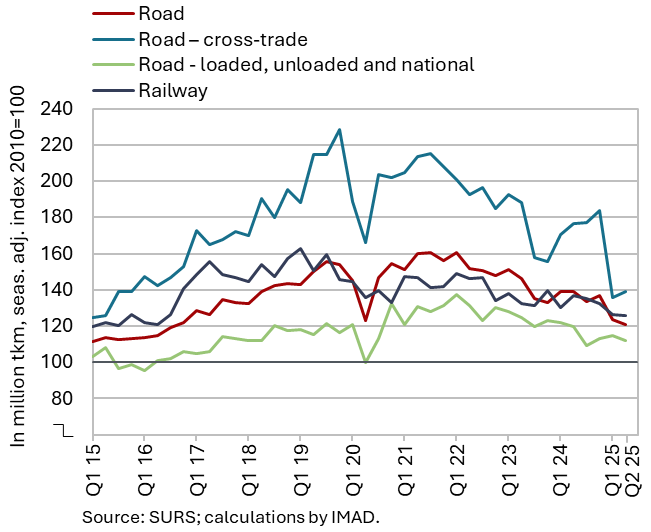

Road and rail freight transport, Q2 2025

The volume of road and rail freight transport further decreased in the second quarter of 2025. Overall, the volume of road transport decreased by 2% on a quarterly basis and by almost 13% year-on-year. In road transport performed by Slovenian vehicles, the volume of cross-trade increased slightly after a sharp decline in the first quarter, while the volume of transport at least partly taking place on Slovenian territory (exports, imports and national transport) decreased. The share of cross-trade in total transport amounted to 40%, which was 10 p.p. lower than before the COVID-19 pandemic. Rail freight transport in Slovenia declined by 1% in the second quarter and by 8% year-on-year. The volume of road and rail freight transport this year was the lowest since 2016.