Charts of the Week

Charts of the week from 9 to 13 June: production volume in manufacturing, activity in construction and current account of the balance of payments

The contraction in manufacturing activity, ongoing since the beginning of the year, persisted in April, with growth recorded only in medium-high-technology industries. On average, in the first four months of the year, output declined in most sectors compared to the same period last year, with the sharpest contractions observed manufacture of other transport equipment and in the manufacture of leather. Construction activity strengthened in April, supported by increased values across all categories of construction works. Nevertheless, it remained lower year-on-year. In the first four months of the year, the volume of construction works was significantly below last year’s level, with the most pronounced decline observed in civil engineering works. The 12-month current account surplus (until April) decreased by EUR 390,6 million compared to the previous 12-month period, amounting to EUR 2.6 billion (3.7% of estimated GDP). The largest contribution to the decline came from a higher secondary income deficit.

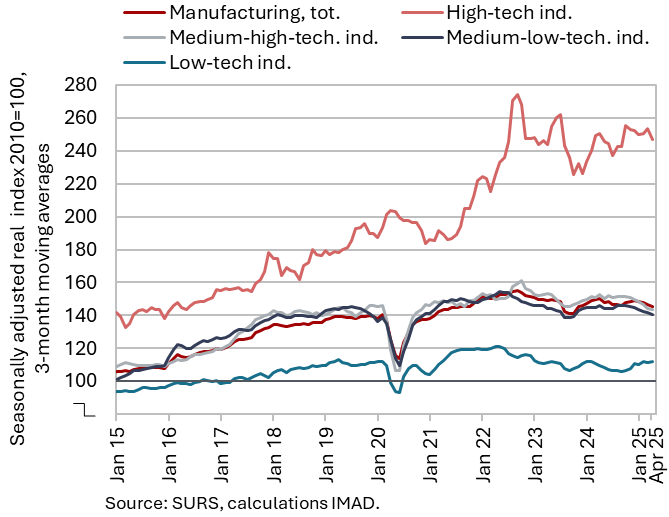

Production volume in manufacturing, April 2025

Manufacturing activity continued to contract in April (seasonally adjusted), with overall output over the first four months lower than a year earlier. Growth was observed only in medium-high-technology industries, while output in the remaining three technology-intensity categories continued to decline (seasonally adjusted). On average in the first four months, output in most sectors was lower year-on-year (down by 2.4%, working-day adjusted). The largest declines were observed in the manufacture of other transport equipment, as well as in the manufacture of leather. Output also fell in the manufacture of fabricated metal products, other machinery and equipment, ICT equipment, and in some low-technology industries. Following growth in the previous year, activity in the energy-intensive paper industry and manufacture of basic metals remained largely unchanged year-on-year, while activity in other energy-intensive activities – chemical industry and the manufacture of non-metallic mineral products – was higher than a year earlier. Production in high-technology industries was similar to the level recorded a year earlier; according to our estimates, it remains higher than last year in the pharmaceutical industry.

The confidence indicator in manufacturing remained at a similarly low level in May as observed over the past two years.

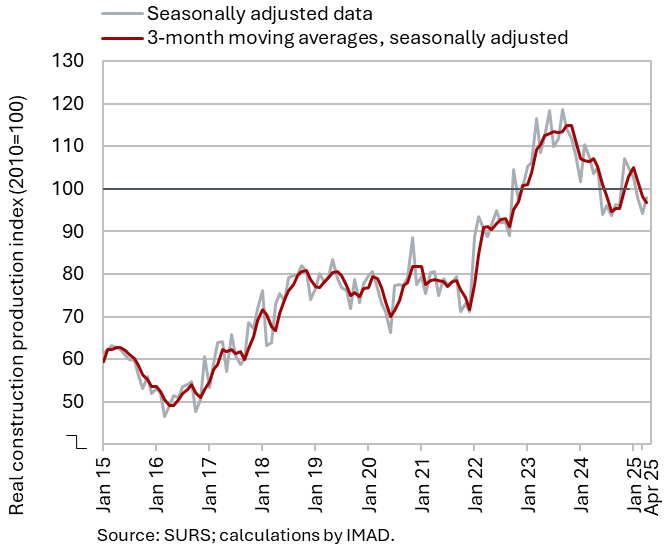

Activity in construction, April 2025

Following a decline in the first quarter, construction activity increased in April, though it remained lower year-on-year. Activity gradually declined over the course of last year, but rose sharply in the fourth quarter. In the first quarter of this year, it declined again; in April, however, it increased by 4% compared to March, as the value of all types of construction works increased. In the first four months of the year, the value of construction put in place was 8% lower than in the same period last year, with the largest decline recorded in civil engineering (-19%).

Activity in civil engineering is traditionally linked to government investment activity. Capital expenditure (according to the consolidated general government budgetary accounts) was 2% higher year-on-year in the first four months; within this, expenditure on new constructions, reconstructions, and renovations – which, in our assessment, is most closely related to construction activity – increased by 6%. The lower activity in civil engineering at the beginning of the year may thus be related to reduced investment by infrastructure companies and/or budgetary funds.

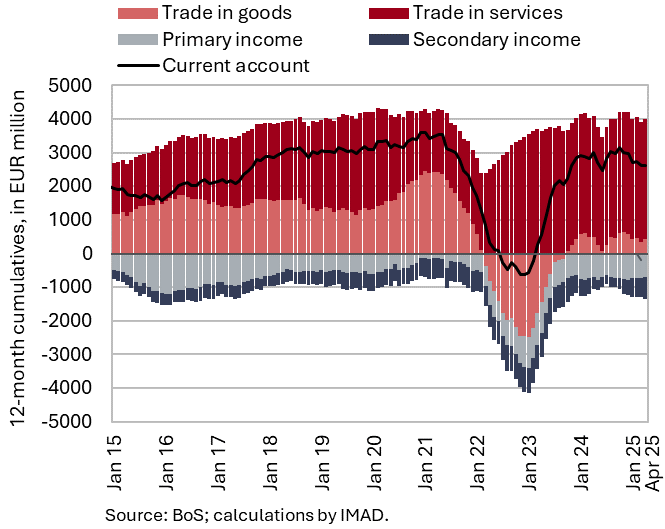

Current account of the balance of payments, April 2025

The 12-month current account surplus (until April) decreased by EUR 390,6 million compared to the previous 12-month period, amounting to EUR 2.6 billion (3.7% of estimated GDP). The largest contribution to the decline came from a higher secondary income deficit, primarily due to lower receipts from the EU budget for current international cooperation. The decrease in the current account surplus was also driven by the balances of goods and services, as well as primary income balance. The lower goods surplus was affected by a higher deficit in trade with EU countries, while the services surplus declined mainly due to a drop in construction services and travel. The primary income deficit increased mainly as a result of lower net inflows from compensation of employees: earnings of Slovenian workers abroad decreased, while earnings of foreign workers in Slovenia increased. Net outflows from equity income were also higher.