Charts of the Week

Charts of the week from 30 June to 4 July 2025: consumer prices, unemployment, exports and imports of goods and other charts

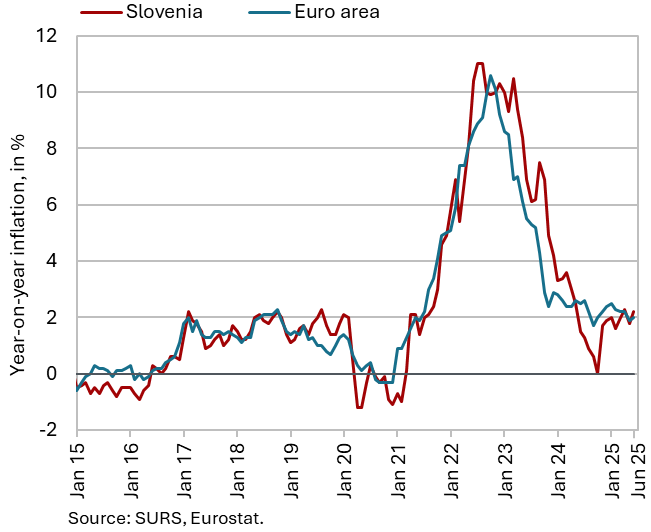

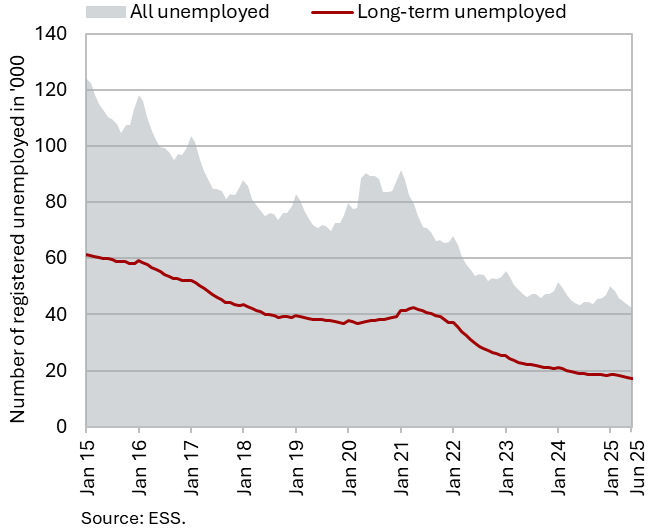

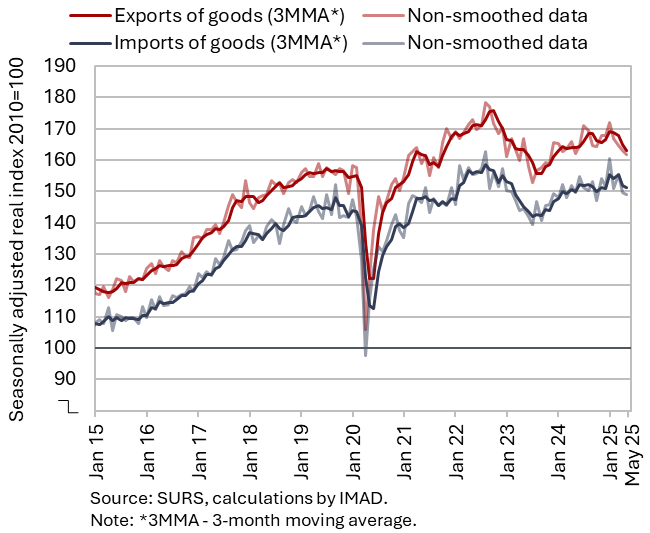

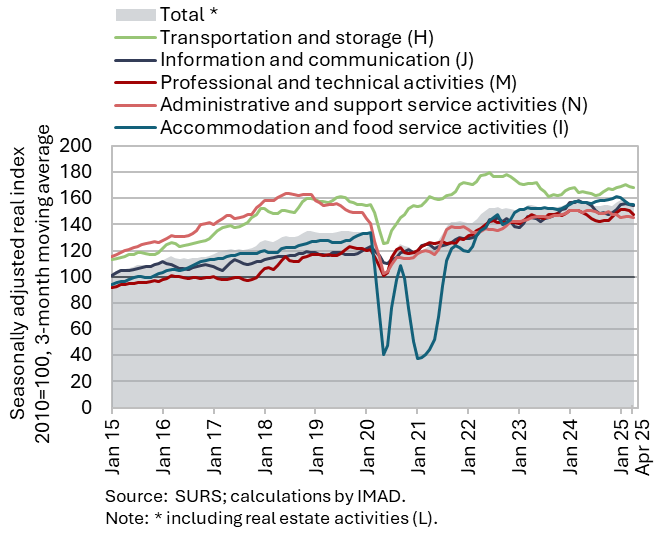

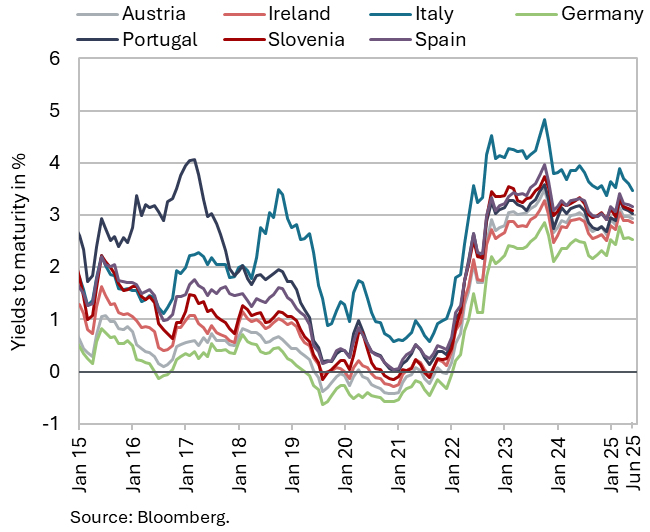

Amid higher monthly prices, year-on-year inflation strengthened slightly again in June (by 0.4 p.p. to 2.2%). Year-on-year, the highest growth continues to be recorded in the food and non-alcoholic beverages group, where inflation strengthened to 6.7% in June (from 5.5% in May), contributing more than half of the annual inflation. The number of registered unemployed persons further declined slightly in June (seasonally adjusted); year-on-year, it was 2.2% lower, which is comparable to the declines recorded in recent months. Goods exports declined on a monthly basis for the fourth consecutive month in May, and imports also fell. On average in the first five months, exports remained at a similar level as a year earlier, while imports were higher. The total real turnover of market services declined in April after stagnating in the first quarter. On average in the first four months, year-on-year growth was recorded only in transportation and storage. Yields to maturity on government bonds of euro area Member States did not change significantly in the second quarter of this year, despite the continued lowering of the ECB’s key interest rate.

Consumer prices, June 2025

After slowing in May, the year-on-year growth in consumer prices strengthened slightly in June (by 0.4 p.p. to 2.2%), while prices were 0.8% higher on a monthly basis. In addition to seasonal factors (particularly higher prices of package holidays, up by 9.1%), the monthly increase was significantly driven by higher food prices (up by 1.2%), and to a lesser extent by higher excise duties on alcohol and tobacco, where prices rose by 1.8%. Year-on-year, the highest growth continues to be recorded in the food and non-alcoholic beverages group, where inflation strengthened to 6.7% in June (from 5.5% in May), contributing more than half of the annual inflation. Price growth in the restaurants and hotels group also remained high (5.0%). The year-on-year decline in prices in the transport group was significantly smaller than in the previous month (–0.3%, May: –1.9%). Year-on-year growth in prices of semi-durable goods also slowed in June (to 1.2%), while prices of durable goods were slightly higher for the first time since November 2023 (by 0.1%). The year-on-year growth in service prices also slowed, from 3.2% to 2.6%. Inflation as measured by the HICP rose to 2.5% in June, exceeding the euro area average by 0.5 p.p.

Unemployment, June 2025

In June, the number of registered unemployed persons (seasonally adjusted) continued to decline slightly (by 0.4%). According to original data, 42,398 people were unemployed at the end of June, 1.8% fewer than at the end of May. Year-on-year, the number of unemployed was 2.2% lower, marking a similar decrease compared to previous months. The year-on-year decline in the number of long-term unemployed (–9.2%) was similar to that recorded in May, while the decrease in the number of unemployed persons aged over 55 (–11.2% in June) was slightly smaller than in previous months. In contrast, youth unemployment (ages 15–29) has been increasing year-on-year since the end of last year (5.7% higher in June compared to the same month of 2024).

Exports and imports of goods, May 2025

Goods exports and imports continued to decline on a monthly basis in May, and their volumes were lower than a year earlier. Uncertainty in the international environment and weak demand from key trading partners have had a significant impact on Slovenia’s trade in goods and on sentiment in export-oriented sectors in recent months. Real goods exports declined for the fourth consecutive month in May (–0.8%, seasonally adjusted), driven by lower exports to EU countries (–1.0%), particularly to Austria, Italy and Croatia. Exports of machinery and equipment (excluding road vehicles) have been decreasing for several months. Compared with the first quarter average, exports of primary products (excluding energy), metals and metal products, and some other materials were also lower. Imports also declined slightly (–0.3%), primarily from non-EU countries. As in the previous month, imports of intermediate goods1 decreased (all seasonally adjusted). In May, both exports and imports of goods were also lower year-on-year. On average over the first five months, exports remained broadly unchanged compared with the same period last year (–0.1%), while imports were higher (1.5%).

Export orders remained at a very low level in June and have shown no significant change for nearly two years.

Turnover in market services, April 2025

Total real turnover in market services declined in April (by 1.3%, seasonally adjusted) after stagnating in the first quarter; on average over the first four months, it was also slightly lower year-on-year (down by 0.5%). Following growth in the first quarter, the most pronounced decline in April was recorded in professional and technical activities, as turnover fell across all services within this group. A somewhat smaller decline was seen in administrative and support service activities, where negative trends have persisted for a longer period, particularly in employment services. Turnover in information and communication edged down slightly in April, following strong growth in the first quarter. Turnover in accommodation and food service activities increased in April, following a significant decline in the first quarter. It also rose in transportation and storage, where turnover has been gradually increasing since mid-2024; in April, growth resumed in both major segments (land transport and storage). In the first four months, real turnover was up year-on-year only in transportation and storage.

Bond, Q2 2025

Yields to maturity on government bonds of euro area Member States did not change significantly in the second quarter of this year, despite the continued lowering of the ECB’s key interest rate (by 50 basis points). The yield to maturity of the Slovenian government bond remained unchanged from the previous quarter (3.13%), while the spread to the German bond increased by 3 b.p., to 58 b.p.