Charts of the Week

Charts of the week from 22 to 26 September 2025: economic sentiment, average gross wage per employee and real estate

Economic sentiment improved further in September and was also higher year-on-year. Year-on-year nominal growth in the average gross wage was slightly lower in July than in the preceding months. In the first seven months, the overall average gross wage increased by 7.0% in nominal terms – by 9.9% in the public sector and by 5.3% in the private sector. Year-on-year growth in dwelling prices accelerated in the second quarter, supported by a higher volume of transactions, but remained below the rates observed in previous two years.

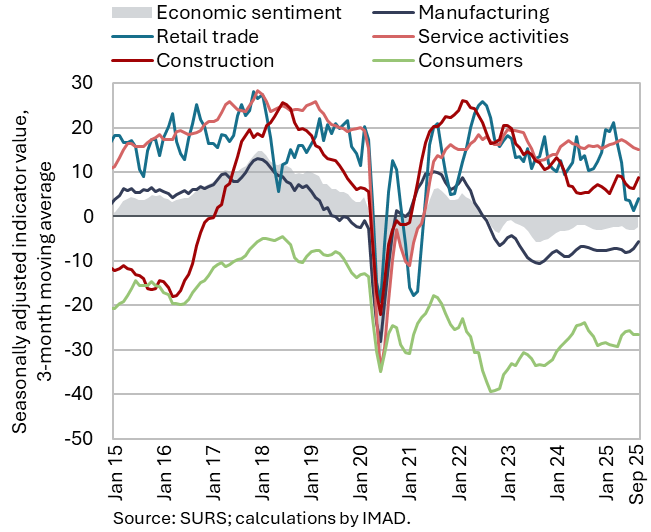

Economic sentiment, September 2025

Economic sentiment improved further in September, both on a month-to-month and year-on-year basis, although it remained slightly below the long-term average. The increase in the value of the economic sentiment indicator, which rose for the third consecutive month, was driven by improved confidence in nearly all activities (except services) and among consumers. On a year-on-year basis, sentiment in services activities was weaker, while it was significantly better in construction, and also in manufacturing and among consumers. Compared with the long-term average, sentiment remained lower in manufacturing, retail trade, and among consumers, but was higher in construction and services.

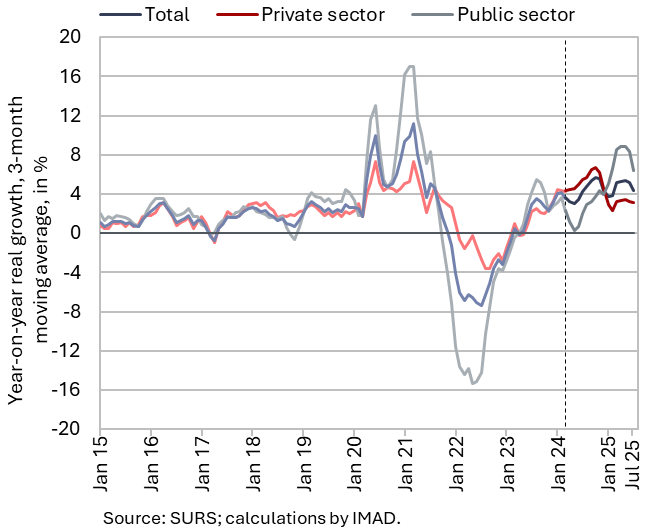

Average gross wage per employee, July 2025

Year-on-year nominal growth in the average gross wage was lower in July (5.8%, 2,9% in real terms) than in the preceding months. This was due to slower, though still high, growth in the public sector (6.1%, 3.2% in real terms), while growth in the private sector remained largely unchanged (5.4%, 2.6% in real terms). In the public sector, year-on-year growth moderated over the past two months following strong increases earlier in the year due to the implementation of the wage reform. According to our assessment, this moderation was driven not only by the higher base from last year (reflecting the increase in pay-grade values to partially offset inflation in June last year) but also by the easing of current growth in some types of payments. In the private sector, growth continues to be supported, in our assessment, by excess demand for labour in certain parts of the economy. In the first seven months, the overall average gross wage increased by 7.0% in nominal terms – by 9.9% in the public sector and by 5.3% in the private sector.

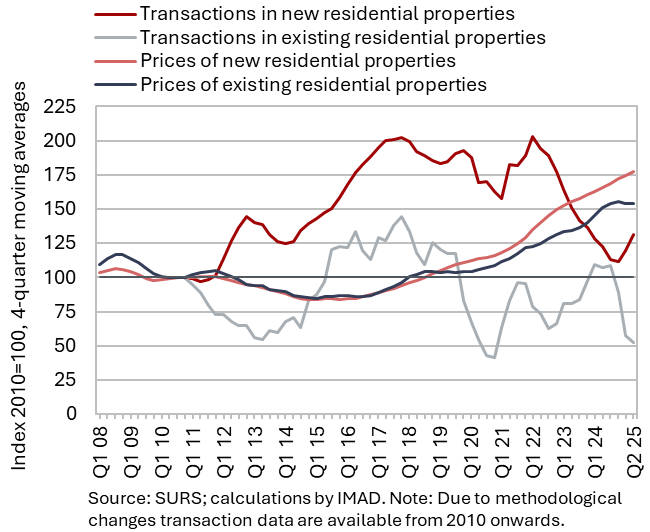

Real estate, Q2 2025

Year-on-year growth in dwelling prices accelerated in the second quarter, supported by a higher volume of transactions, but remained below the rates observed in previous years. Compared with the first quarter, prices rose by 3.8%, and relative to the same quarter last year by 5.5% (year-on-year increase in the first quarter was 3.2%, while the average year-on-year growth in 2023 and 2024 was slightly above 7%). Prices of existing dwellings increased by 6.4% year-on-year. Following a significant decline during 2022–2024, the number of transactions in this segment rose by 40% compared with the same period last year. Prices of newly built dwellings were also higher year-on-year (up 1%). However, transactions in this segment, which account for a small part of total sales (4%), declined sharply year-on-year (by more than one-third).