Charts of the Week

Charts of the week from 12 to 16 May 2025: GDP, number of persons in employment, activity in construction and other charts

Economic activity in Slovenia declined by 0.8% (seasonally adjusted) in the first quarter of this year, while GDP was 0.7% lower in real terms compared to the same period last year. Investment activity decreased, with a significant drop in construction investment, particularly in civil engineering. Activity in the export sector was also lower than last year, which is attributed to increased uncertainty in the international economic environment. Despite relatively high disposable income, the growth of private consumption was rather modest. The current account surplus was lower on a year-on-year basis in the first quarter of this year, as import growth outpaced export growth. The number of persons in employment has stagnated this year, but remains at a still high level.

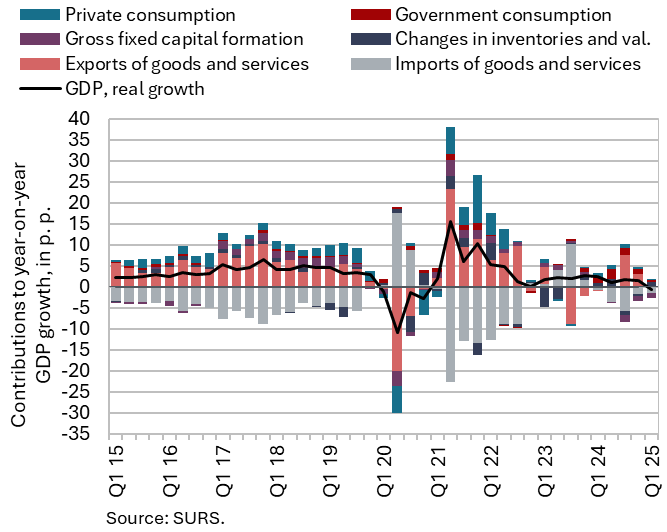

GDP, Q1 2025

In the first quarter of this year, economic activity in Slovenia declined by 0.8% (quarter-on-quarter, seasonally adjusted); compared to the same period last year, GDP was 0.7% lower in real terms. The decline in investment activity continued in the first quarter: total gross fixed capital formation was 5.1% lower year-on-year. Construction investment declined sharply, most notably in civil engineering. Activity in the export sector was also lower than last year, which is attributed to increased uncertainty in the international economic environment in anticipation of US tariff measures. As a result, value added in manufacturing was down compared to a year earlier (-2.5%), and the export of goods and services declined slightly on a quarterly basis, while remaining broadly unchanged year-on-year (0.1%). In an environment of uncertainty, the contribution of inventories to economic growth was strongly positive (1.1 p.p.). Despite relatively strong real wage growth and high employment levels, the growth of private consumption was rather modest (0.4%). This suggests a certain degree of household caution in spending, and we estimate that the savings rate increased further, as also indicated by a deterioration in consumer confidence in the early months of this year. The relatively modest growth of private consumption in the first quarter was likely also affected by the different timing of the Easter holidays and related purchases (in 2024, Easter fell in March, while in 2025 it fell in April). Government consumption rose by 2.6%, driven primarily by increased expenditure on goods and services in healthcare and higher social transfers in kind, particularly spending on medical goods and health services.

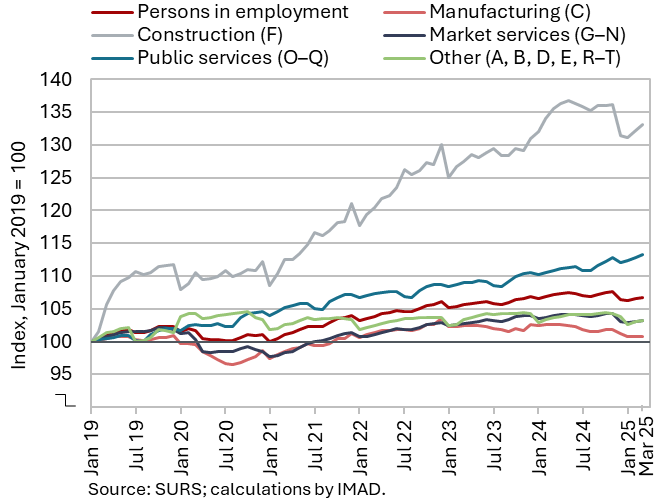

Number of persons in employment, March 2025

Following a decline at the end of last year, the number of persons in employment remained relatively stable in the first three months (seasonally adjusted). Year-on-year, the number of persons in employment decreased by 0.4% in March. The most significant decline was recorded in administrative and support service activities (-4.8%), mainly due to a significant decline in employment activities. A more notable decline was also recorded in manufacturing (-1.8%). In construction, employment was lower year-on-year in March for the third consecutive month (-1.9%), although labour shortages remain present in the sector. In contrast, year-on-year growth was observed in public service activities, particularly in human health activities (3.3%) and education (1.7%).

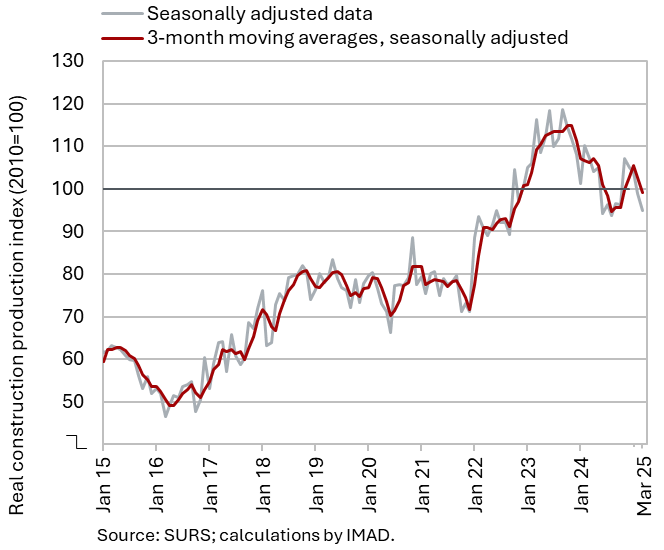

Activity in construction, March 2025

Following strong growth at the end of last year, construction activity declined in the first quarter of this year. Construction activity gradually declined over the course of last year, before surging in the fourth quarter (by 8% compared to the previous quarter). In the first quarter of this year, it declined again. The sharpest drop was observed in civil engineering, both compared to the previous quarter (-11%) and to the first quarter of last year (-22%).

Activity in civil engineering is traditionally linked to government investment activity. Capital expenditure (according to the consolidated general government budgetary accounts) was 7% higher in the first quarter than a year earlier; within this, expenditure on new constructions, reconstructions, and renovations – which, in our assessment, is most closely related to construction activity – increased by as much as 15%. The lower activity in civil engineering at the beginning of this year may thus be related to reduced investment by infrastructure companies and/or budgetary funds.

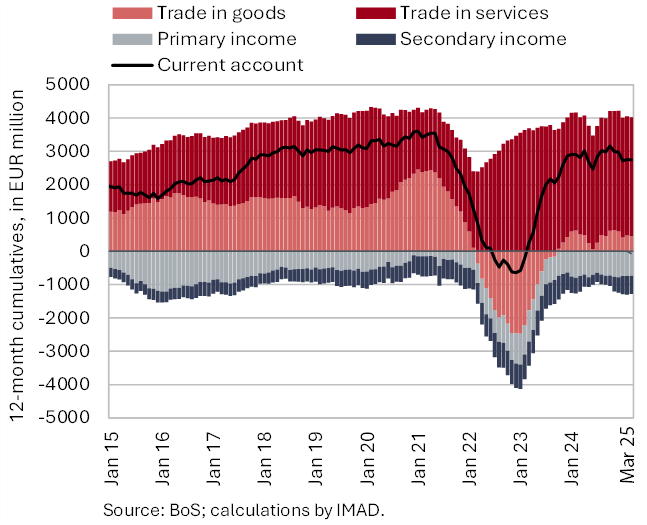

Current account of the balance of payments, March 2025

The surplus on the current account of the balance of payments was EUR 231 million lower year-on-year in the first quarter of this year, amounting to EUR 446 million. The largest contribution to the decline came from the goods trade balance (EUR 134 million). Real imports of goods increased year-on-year, while exports declined slightly. The terms of trade remained unchanged. The services surplus was lower year-on-year, mainly due to a smaller surplus in construction and a larger deficit in the trade of licences and patents. The higher secondary income deficit resulted mainly from increased net outflows of transfers by both the general government and the private sector to the rest of the world. The primary income deficit was lower year-on-year due to smaller net outflows from dividends and profits and higher net interest receipts from financial investments in securities. The 12-month balance of the current account of the balance of payments showed a surplus of EUR 2.8 billion in March (3.9% of estimated GDP).

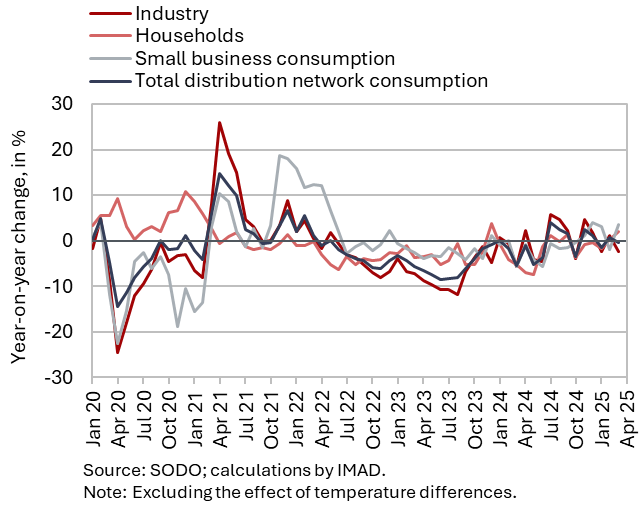

Electricity consumption by consumption group, April 2025

Electricity consumption in the distribution network was 1.7% higher year-on-year in April. Industrial consumption was roughly unchanged year-on-year in April, given the same number of working days, after having been lower year-on-year during the first three months of this year. Household consumption was 1.5% higher year-on-year in April, while small business consumption – which accounts for only a small share of total consumption – was 13% higher, due to a low base last year.