Slovenian Economic Mirror

Related Files:

Slovenian Economic Mirror 7/2023

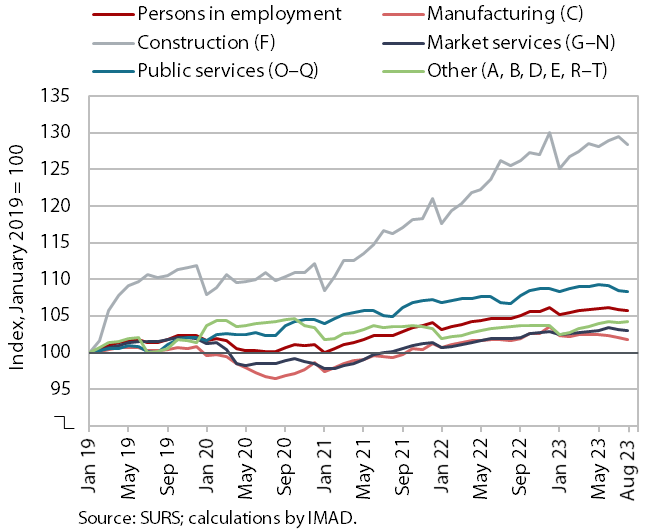

In Slovenia, the slowdown in economic growth is also reflected in the labour market. The year-on-year growth in the number of persons in employment has slowed, and the decline in the number of registered unemployed, which had been strong until the middle of this year, has also slowed. Despite the slowdown in employment momentum, around half of companies in construction, a third in trade and a quarter in manufacturing state that their business activities are hampered by labour shortages. Labour shortage has also led to an increase in the employment of foreigners, whose numbers have accounted for more than 90% of the year-on-year increase in the number of persons in employment for several months now. The year-on-year increase in consumer prices slowed slightly in October (to 6.9%). This was mainly due to the continued moderation of price increases of food and non-alcoholic beverages, which remain the largest contributors to inflation among all 12 CPI groups. Inflation remains above the euro area average (as measured by the harmonised index of consumer prices – HICP, which enables a Europe-wide comparison). The difference has widened since September. This was mainly due to the expiry of some of the measures taken to mitigate the consequences of rising prices in Slovenia. The difference in October was particularly marked in energy prices, partly due to higher excise duties on petroleum products.

Related Files:

- International environment

- Economic developments

- Labour market

- Prices

- Financial markets

- Balance of payments

- Public finance

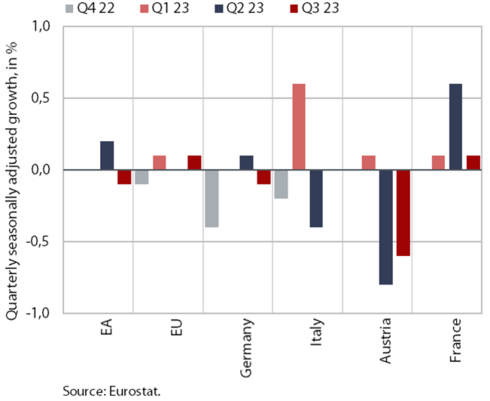

Quarterly GDP change in Slovenia’s main trading partners, Q3 2023

According to Eurostat’s flash estimate, euro area GDP contracted in the third quarter compared to the second. After recording modest growth in the second quarter (0.2%), it shrank by 0.1% in the third, while it rose by 0.1% year-on-year. Among Slovenia’s main trading partners for which data is available, only France’s GDP rose quarter-on-quarter (by 0.1%, by 0.7% year-on-year). Following a relatively sharp decline in the second quarter (of 0.8%), Austrian GDP also fell significantly in the third quarter (by 0.6%, by 1.2% year-on-year). German GDP also shrank (by 0.1%, by 0.4% year-on-year), while Italian GDP stagnated. Manufacturing activity in the euro area was on average 3.1% lower in July and August than in the second quarter. Turnover in retail trade and construction activity in July and August were also on average below the level of the previous quarter (by 0.9% and 0.3% respectively).

Composite Purchasing Managers’ Index (PMI) for the euro area, October 2023

Survey indicators for the euro area point to a contraction in economic activity also at the beginning of the fourth quarter. The value of the composite Purchasing Managers’ Index (PMI) in October was the lowest in three years (46.5). The indicators that form the composite PMI, i.e. for manufacturing and services together, fell further below the 50 mark (the threshold between economic expansion and contraction). The composite PMIs for most of Slovenia’s main trading partners (Germany, Italy, Austria, France) also pointed to a contraction in activity in October. The Economic Sentiment Indicator (ESI) for the euro area, which has been below its long-term average since July last year, was similar in October to the previous month and lower than a year ago. With weak external demand and tighter financing conditions weighing on investment and consumption, activity is expected to remain subdued in the coming quarters. In October, the average forecast for economic growth in the euro area was 0.5% this year and 0.6% in 2024.

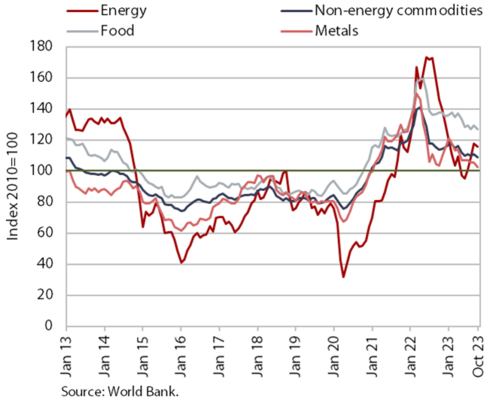

Commodity prices, October 2023

Prices of oil and non-energy commodities on international markets fell slightly in October. The average dollar price of Brent crude oil in October was USD 90.8 (-3.1% month-on-month) and the euro price was EUR 86 (-2% month-on-month). After a pronounced oil price rise in September following Saudi Arabia and Russia’s decision to extend their production cuts, the start of the war in the Middle East had no significant impact on the average price in October. Year-on-year, the dollar Brent oil price was 2.7% lower in October and the euro price was 9.5% lower. The euro prices of natural gas on the European market (on the Dutch TTF) rose by 27.6% month-on-month in October, mainly due to pumping problems at some fields and damage to the Baltic Sea pipeline, while they fell by 65.3% year-on-year. According to the World Bank, the average dollar price of non-energy commodities in October fell by 1.6% month-on-month and by 4.1% year-on-year. Prices of food and fertilisers fell significantly year-on-year on the international commodity markets in October.

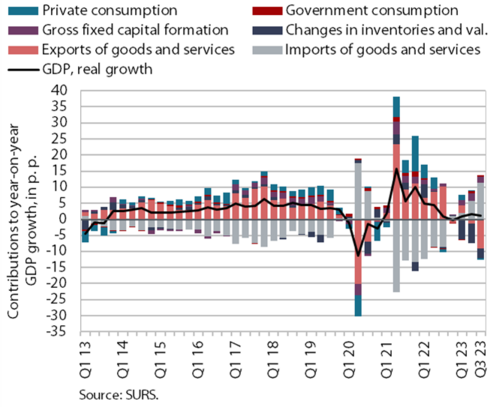

Gross domestic product, Q3 2023

In the third quarter of 2023, gross domestic product (GDP) fell by 0.2% quarter-on-quarter, while it increased by 1.1% year-on-year (not seasonally adjusted). The year-on-year growth came from construction investment and government consumption and from some service activities. After private household consumption had risen in the first half of the year, it fell year-on-year. International trade, particularly in goods, also declined year-on-year. The decline in imports was stronger than that in exports, as the latter was affected by the continued year-on-year fall in domestic consumption. The contribution of the external balance of goods and services was thus again strongly positive, at 2.4 p.p. Value added in the predominantly export-oriented manufacturing activities remained unchanged year-on-year.

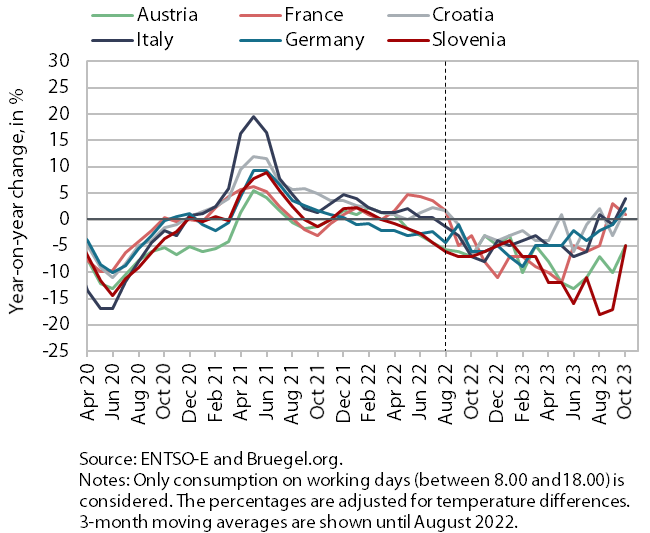

Electricity consumption, October 2023

Electricity consumption was 5% lower year-on-year in October. The year-on-year decline was significantly lower than in previous months, which was partly due to last year’s relatively low base resulting from the slowdown in economic activity and high electricity prices. Among Slovenia’s main trading partners, lower consumption compared to October 2022 was recorded by Austria (-5%), while consumption in other trading partners was higher year-on-year, in France by 1%, in Croatia and Germany by 2%, and in Italy by 4%.

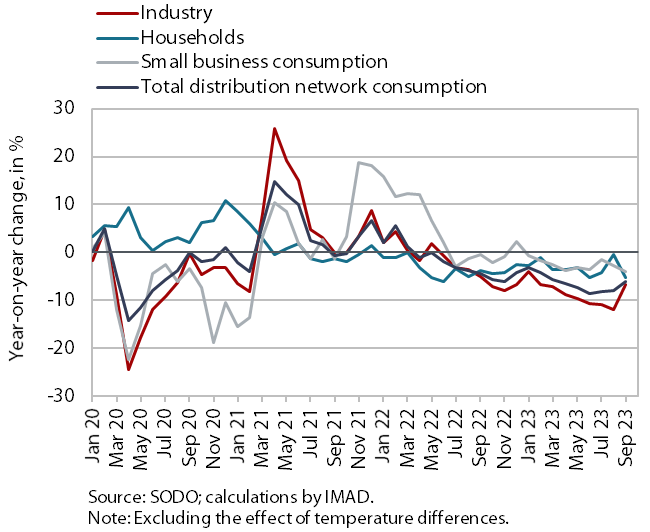

Electricity consumption by consumption group, September 2023

In September, electricity consumption in the distribution network was lower year-on-year in all consumption groups. With one less working day, industrial consumption was 6.7% lower year-on-year, a smaller decline than in previous months. The latter may have been influenced by last year’s relatively low base, which was the result of weakening economic growth. Household consumption and small businesses consumption were also lower year-on-year in September (by 5.2% and 4.1% respectively).

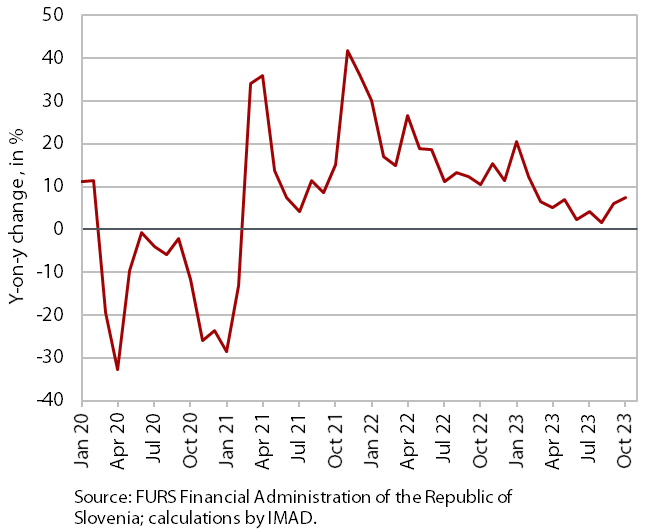

Value of fiscally verified invoices – nominal, October 2023

The nominal value of fiscally verified invoices was 7% higher year-on-year in October. Following weaker growth in August, growth in total turnover increased year-on-year for the second month in a row in October and was the highest since February. Turnover in trade rose 7% year-on-year, following a 1% increase in August and a 4% increase in September. Turnover in retail trade, which accounted for almost half of the total value of fiscally verified invoices, increased by 5% year-on-year, turnover in the sale of motor vehicles by 18% and turnover in wholesale trade by 4%. Year-on-year turnover growth in accommodation and food service activities, certain creative, arts and entertainment activities and sports services, and betting and gambling, which had increased significantly in September, slowed slightly in October but remained relatively high.

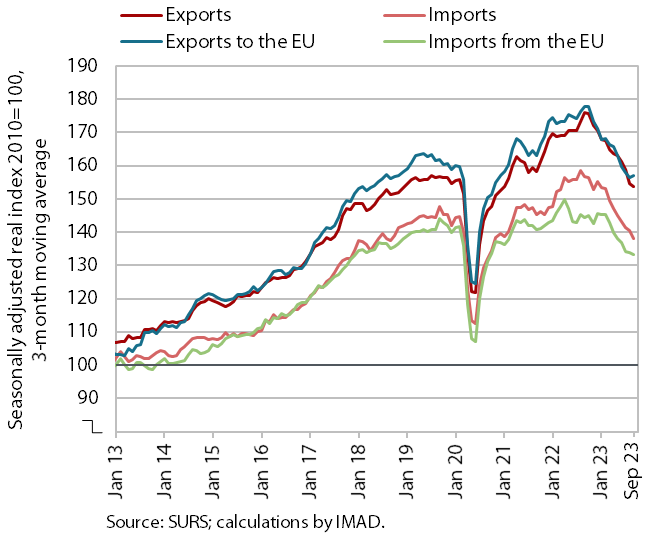

Trade in goods – in real terms, September 2023

Trade in goods slowed in the third quarter compared to the second. Amid strong monthly fluctuations, real exports of goods fell by 4.7% and imports by 3.7% compared to the previous quarter. As in the previous quarters, this was due to a decline in demand from Slovenia’s main trading partners and lower export demand in Slovenia. According to the detailed data, lower trade with Germany, Italy, Austria and Croatia contributed significantly to the decline, and the decline in exports of intermediate products (metals and other materials) and of machinery and equipment excluding vehicles was also noticeable. Year-on-year, the decline in exports and imports in the third quarter was even more pronounced than in the previous quarters (-13.5% and -12.5% respectively). At the beginning of the last quarter, sentiment in export-oriented manufacturing activities remained very low in Slovenia, but it has not deteriorated any further. As in the previous quarters, companies state that the uncertain economic situation, low domestic and foreign demand, and the lack of skilled labour are the main obstacles to business activity. Export orders also remain very low.

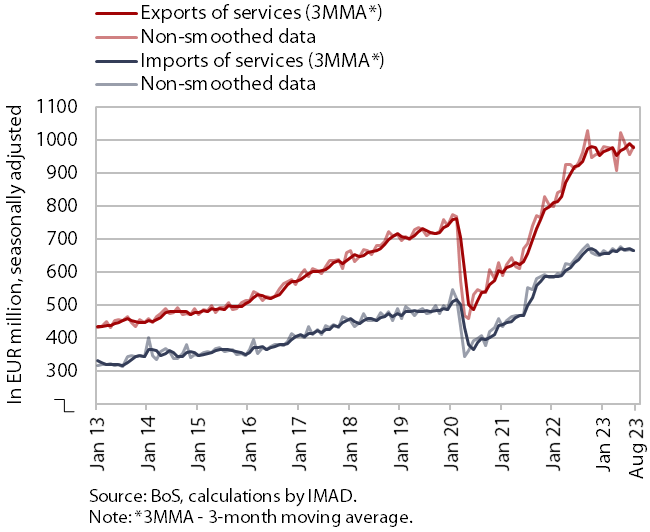

Trade in services – nominal, August 2023

Trade in services remained at a high level in July and August, though year-on-year growth continued to slow. Compared to the previous month, exports of services increased in August, while imports decreased slightly (seasonally adjusted). Among the main service groups, trade in other business services and construction services increased. The favourable monthly trends continued in trade in tourism-related services, which for the first time since the epidemic accounted for the largest share in the structure of trade again in July and August. After several months of decline, trade in transport services remained at the previous month’s level, while the decline in trade in ICT services continued (seasonally adjusted). Year-on-year growth of trade in services has slowed gradually in recent months. In the first eight months of this year, exports rose by an average of 8% year-on-year, while imports increased by 6.1%. The relatively high growth was mainly due to a significant recovery in trade in tourism-related services.

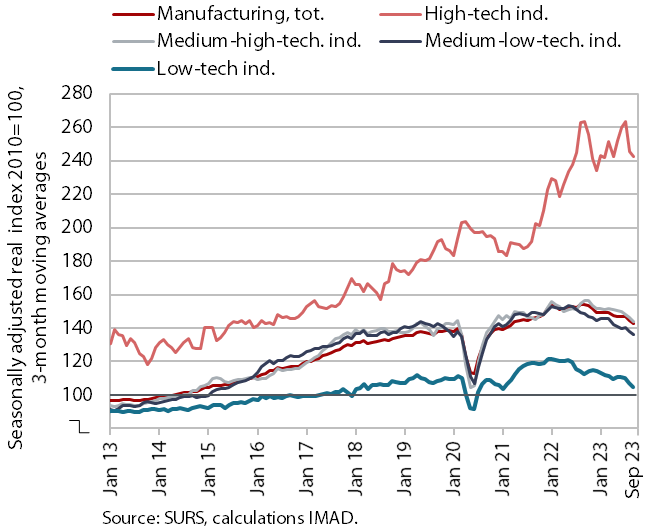

Production volume in manufacturing, September 2023

Manufacturing output continued to shrink in the third quarter. The decline compared to the previous quarter deepened despite the growth in production volume in September. Production continued to shrink in medium- and low-technology industries and, for the first time this year, in high-technology industries (which are characterised by significant monthly fluctuations in production). Compared to the same period last year, production in the third quarter was also down in all industry groups according to technology intensity (by an average of 8%). The decline continued to be strongest in the majority of energy-intensive industries (manufacture of chemical products, paper and basic metals). Only in the manufacture of food products, manufacture of machinery and equipment n.e.c., and repair and installation of machinery and equipment was the production higher year-on-year. In these industries, and in high-technology industries and the manufacture of leather, production in the first nine months was higher year-on-year. On average, production in manufacturing in the first nine months was 3.8% lower year-on-year.

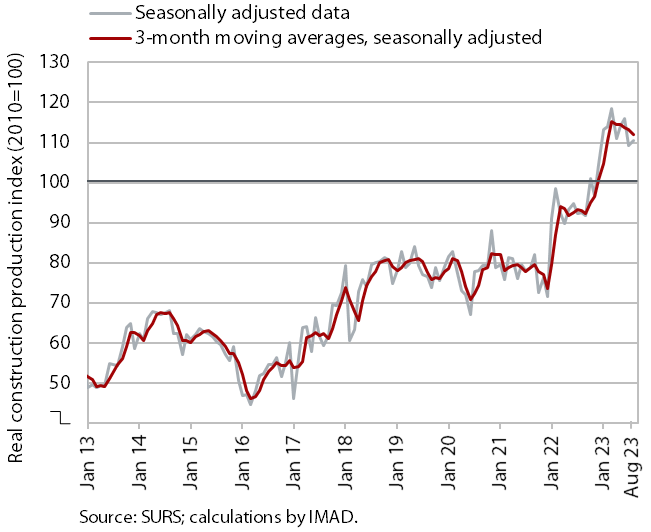

Activity in construction, August 2023

According to data on the value of construction work put in place, construction activity increased in August and remained significantly higher than last year. After high growth in the value of construction work at the beginning of the year, activity fluctuated around the level reached in the following months. In the first eight months, it was on average 22% higher than the same period last year. In this comparison, activity was higher in all three segments covered by the statistics: most markedly in specialised construction (up 36%), followed by civil engineering and building construction (up 20% and 16% respectively).

Some other data, however, point to much lower growth in construction activity. Data on the value of industrial production in two activities traditionally strongly linked to construction do not point to such high growth. Production in other mining and quarrying was 4% lower in the first eight months of the year, while it was 11% lower in the manufacture of other non-metallic mineral products.

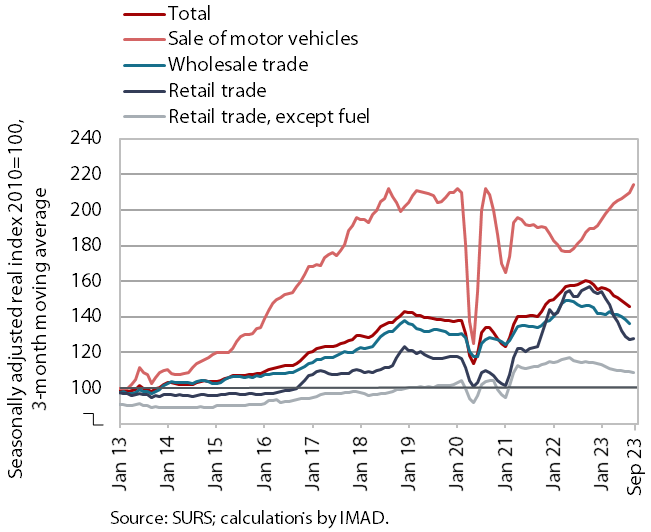

Turnover in trade, August–September 2023

In most trade sectors, real turnover continued to fall in August and, according to preliminary data, also in September; only turnover in the sale of motor vehicles remained higher year-on-year. Turnover in wholesale and retail trade (excluding automotive fuels), which has been declining since the spring, was down 5% year-on-year in the first eight months. Turnover in retail sale of food, beverages and tobacco fell by 4% year-on-year, while in the sale of non-food products it fell by 5%. Among non-food products, the largest year-on-year decline was seen in the sale of durable and certain semi-durable goods. In the first eight months of the year, turnover in the sale of motor vehicles, which has been recovering in current terms since the second half of last year, increased by 14% year-on-year. According to preliminary SURS data, turnover in September was still lower year-on-year in retail trade, while it was higher in the sale of motor vehicles.

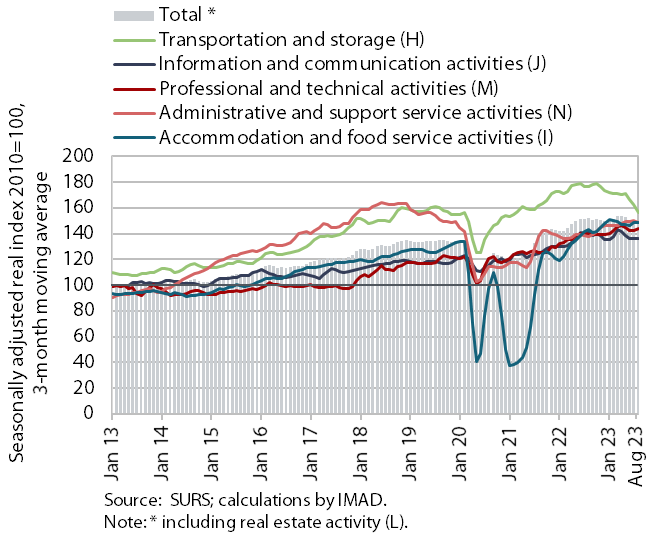

Turnover in market services, August 2023

The level of real turnover in market services remained unchanged in August. Total turnover stagnated in current terms, having already declined significantly in the second quarter (by 2.3%). The decline of turnover in transportation and storage further deepened, with the negative trend continuing since May last year. The decline was mainly due to postal activities and land transport. Against the backdrop of a sharp decline in overnight stays, which was also influenced by the floods in August, turnover in accommodation and food service activities also fell significantly. It also fell slightly in administrative and support service activities and in information and communication. Only professional and technical activities saw an acceleration in turnover growth. Year-on-year, total turnover fell by 2.2% in real terms in August, due to declines in information and communication, transportation, and real estate activities. It remained below pre-epidemic (August 2019) levels in employment services (by 11%).

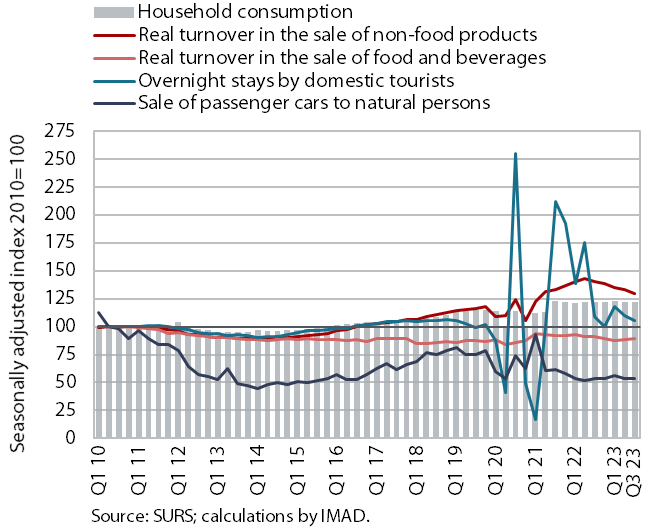

Selected indicators of household consumption, August–September 2023

Household consumption in the third quarter was 0.8% lower year-on-year. Purchases of non-food products (down 8% in real terms), food, beverages and tobacco (down 2% in real terms), and overnight stays by domestic tourists in Slovenia (down 8%) were still lower year-on-year. After growth in previous two quarters, sales of new passenger cars also declined year-on-year (by 1%). Expenditure on tourist services abroad remained higher year-on-year in July and August (together by 14% in nominal terms), while the number of overnight stays by Slovenians in Croatia fell by 2% year-on-year.

According to data on the fiscal verification of invoices, turnover in the third quarter was 4% higher year-on-year in nominal terms, but in real terms it declined year-on-year for the second time in a row.

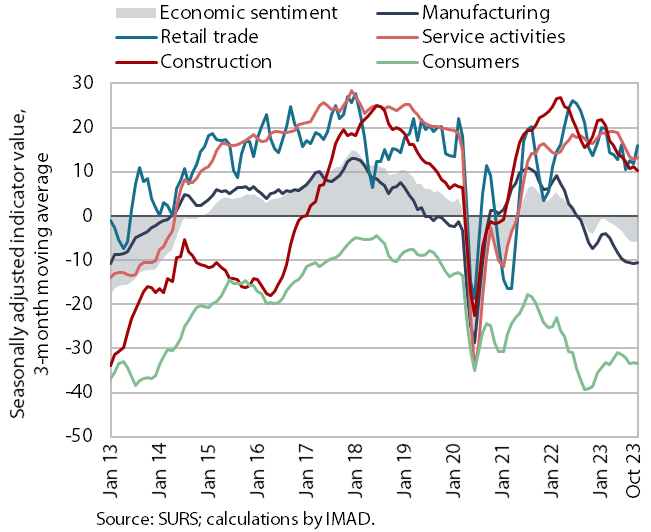

Economic sentiment, October 2023

In October, the value of the sentiment indicator deteriorated slightly. Month-on-month, confidence fell in manufacturing, retail trade and construction, while it rose in services. Consumer confidence remained at a similar level to the previous month and higher than in October last year, but it was still well below the long-term average. In retail trade, the indicator remained above the long-term average and was also higher year-on-year. In other activities, however, confidence was lower than a year ago, particularly in construction, which is also due to the labour shortage.

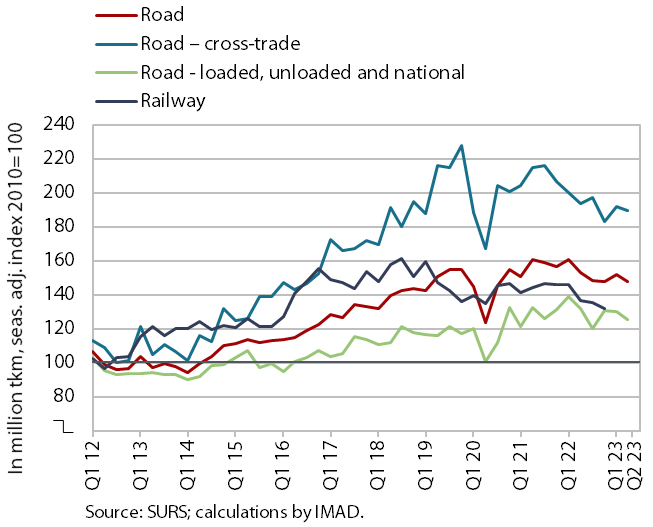

Road and rail freight transport – Q2 2023

The volume of road and rail freight transport decreased again in the second quarter. After a one-off increase in the previous quarter, the volume of road transport performed by Slovenian vehicles fell again slightly, by 4% year-on-year. It was one-tenth higher compared to the second quarter of 2019 (cross-trade was 7% higher, while other road traffic performed at least partially on Slovenian territory was 12% higher). The share of cross-trade in total transport, which was above 50% before the epidemic, remained low in the second quarter of this year, at about 45%. Rail freight transport, already declining before the epidemic, was 10% lower year-on-year in the second quarter and the lowest in seven years. The recent decline in both road and rail freight transport is mainly related to the slowdown in the growth of overall economic activity. Other obstacles to higher rail transport volumes are the frequent line closures for maintenance and investment work.

Number of persons in employment, August 2023

Year-on-year growth in the number of persons in employment was lower in August than in the previous months (1%). This was mainly due to a slowdown in year-on-year growth in construction and also manufacturing. Growth was strongest in information and communication. With the number of Slovenians in employment declining, the employment of foreigners has contributed exclusively to the overall year-on-year growth in the number of persons in employment in August. Their share among all persons in employment was 14.6% in August, 1 p.p. higher than a year earlier. Activities with the largest share of foreigners are construction (48%), transportation and storage (33%), and administrative and support service activities (27%).

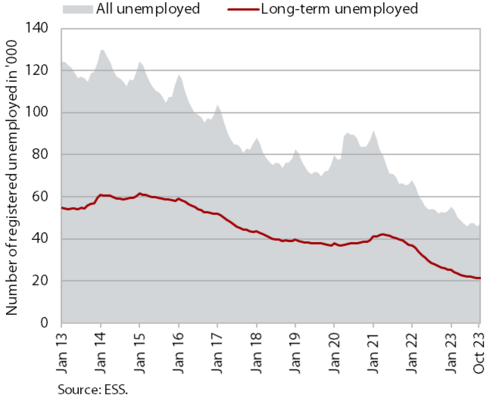

Number of registered unemployed persons, October 2023

According to the seasonally adjusted data, the monthly decline in the number of registered unemployed in October (0.6%) was similar to previous months but much lower than at the beginning of the year. According to original data, 47,232 people were unemployed at the end of October, 2.7% more than at the end of September. This largely reflects seasonal trends related to a higher inflow of first-time job seekers into unemployment. Unemployment was down 10.9% year-on-year. Amid labour shortages, the number of long-term unemployed (more than 1 year) fell by one-fifth year-on-year at the end of October.

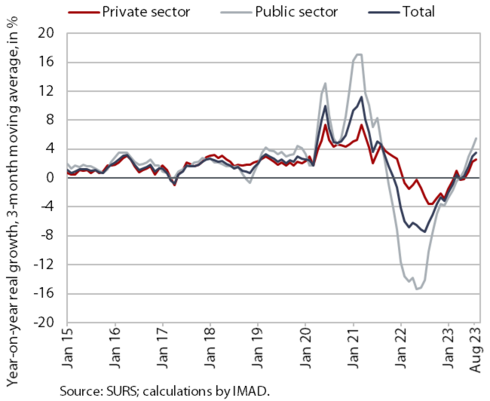

Average nominal gross wage per employee, August 2023

The average gross wage increased year-on-year in real terms in August (by 4.2%). In the private sector, it increased by 2.9% year-on-year in real terms. Growth was strongest in accommodation and food service activities, which are facing a major labour shortage. The average gross wage in the public sector increased by 6.7% year-on-year in real terms, mainly due to last year’s agreement on wage increases. Compared to August last year, the average gross wage increased by 10.7% in nominal terms – by 13.3% in the public sector and by 9.3% in the private sector. In the first eight months, the average year-on-year gross wage growth was 1.5% (1.2% in the private sector and 2.2% in the public sector).

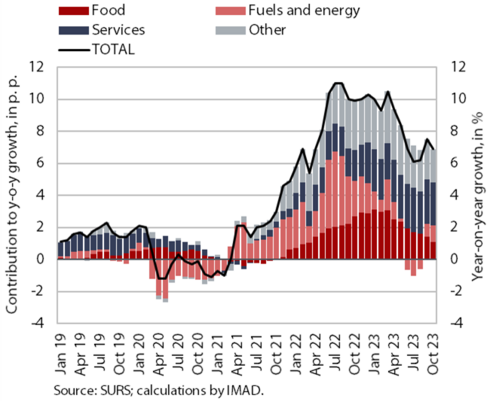

Contributions of individual price groups to inflation, October 2023

The year-on-year increase in consumer prices slowed slightly in October (to 6.9%). This was mainly due to the continued moderation of price increases in the food and non-alcoholic beverages group, which remains the largest contributor to inflation among the ECOICOP groups (1.3 p.p.). After the year-on-year price increase in this group had reached almost 20% at the beginning of the year, it fell to 7.3% by October. The slowdown in price growth in the clothing and footwear group (2.7%), where year-on-year growth has weakened significantly in the last two months, with the seasonal increase being slightly less pronounced than in the same period last year, has also contributed significantly to the downward trend in inflation. This has also slowed the year-on-year increase in semi-durable goods prices, which at 3.2% reached its lowest level since July last year, and growth in the prices of durable goods (0.4%) has also continued to weaken. Services price growth remains high, at just over 8%. Year-on-year price growth rates remain high in the health group (11.4%) and restaurants and hotels group (9.1%).

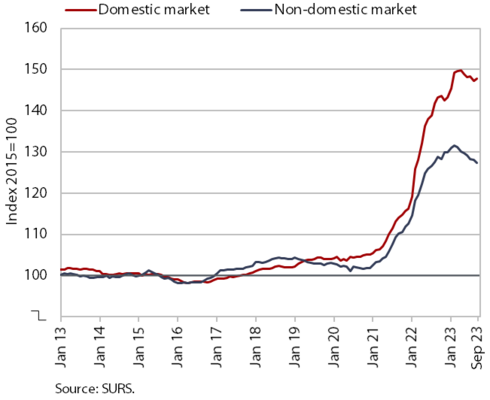

Slovenian industrial producer prices, September 2023

Slovenian industrial producer prices continued to fall in September and were only slightly above the level of a year ago. The decrease in September was minimal (0.1%) and was the result of a decline in foreign markets (by 0.3%), while the prices in the domestic market increased by 0.3%, mainly due to price increases in the energy group (2.8%). The year-on-year growth rate, which had been close to 20% at the beginning of the year, slowed further to 1%, the lowest since February 2021. The slowdown in year-on-year growth was still mainly due to developments in the intermediate goods group, where prices were 2.7% lower in September than a year earlier. Against a high base, year-on-year price growth in the energy group is also weakening rapidly (2.5%), after still exceeding 20% in the middle of the year. Price growth in consumer goods is also gradually weakening, at 6.1% year-on-year, while price growth in durable (5.7%) and non-durable goods (6.2%) is slowing. Year-on-year price growth in the capital goods group, which had been stable at between 4.2% and 4.5% in the summer months (June–August), fell to 3.7% in September.

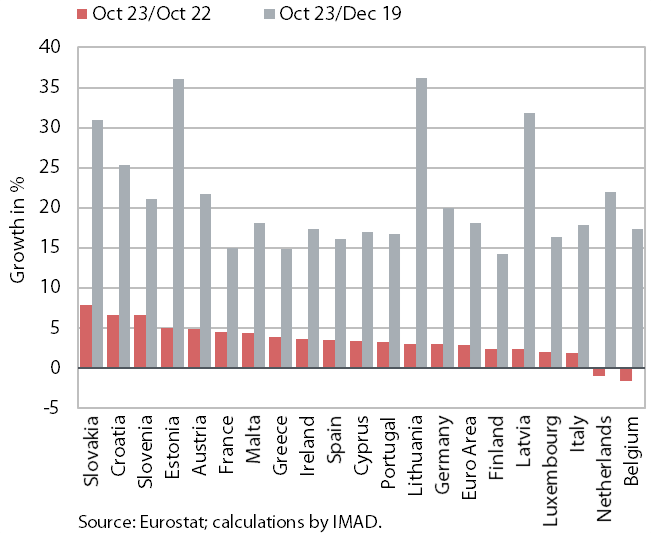

Price growth in euro area countries

In October, HICP inflation in Slovenia was 6.6% and the gap with the euro area average widened to 3.7 p.p. The difference between Slovenian and euro area inflation has widened again since September. This was mainly due to the expiry of some of the measures taken to mitigate the consequences of rising prices in Slovenia. The difference was mainly due to energy prices, as the measures taken by individual countries to curb high energy prices varied in both scope and duration. In October, energy prices in Slovenia were 8% higher year-on-year, while in the euro area they were 11.1% lower. The sharp year-on-year increase was largely due to the expiry of the temporary measures taken by the government in this regard in September (in August, energy prices in Slovenia had fallen by almost 4% year-on-year), but also reflects to a lesser extent the increase in prices for petroleum products on the global markets, which was passed on to the domestic retail market, and the higher excise duties on petroleum products. There are also considerable differences in price increases for services between Slovenia and the euro area, with price growth in Slovenia stabilising at around 8%. In the euro area, on the other hand, the increase in services prices has already gradually slowed, to 4.6% in October. The rise in prices for food, beverages and tobacco is slowing both in Slovenia (7.7%) and in the euro area (7.5%). There are also no major differences in price growth for non-energy industrial goods (3.7% in Slovenia, 3.5% in the euro area).

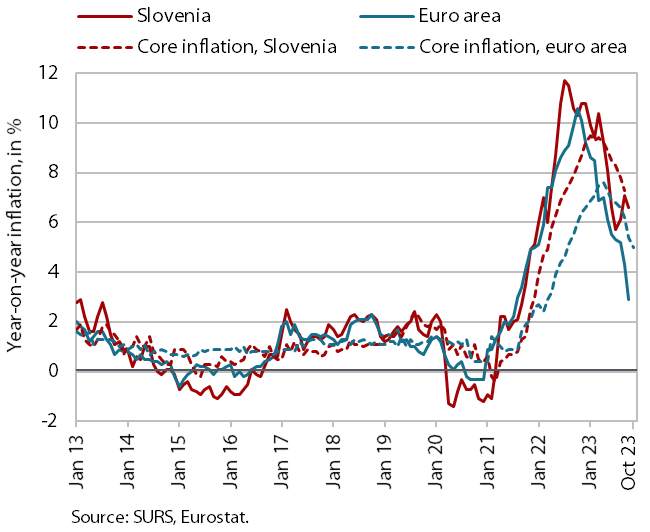

Inflation and core inflation in Slovenia and in the euro area, October 2023

A comparison of the development of consumer price indices in Slovenia and the euro area over the last 10 years shows that the greatest differences have occurred in recent years. During this period, governments have taken measures that varied in both scope and duration to mitigate the consequences of the epidemic and high energy and food prices. Average inflation in the euro area is mainly influenced by price developments in the large countries, while even potentially very large price fluctuations in Slovenia have only a very small impact on the euro area HICP average. At the same time, a comparison of inflation dynamics over a longer time horizon shows that the differences between inflation in Slovenia and in the euro area (both upwards and downwards) have never been long-lasting and have mostly lasted as long as the effects of various measures in recent years, with a time lag of 12 months. In the case of core inflation, which excludes the impact of energy and unprocessed food prices, the differences are much more constant. Here, the difference has been around 2 p.p. since the beginning of last year.

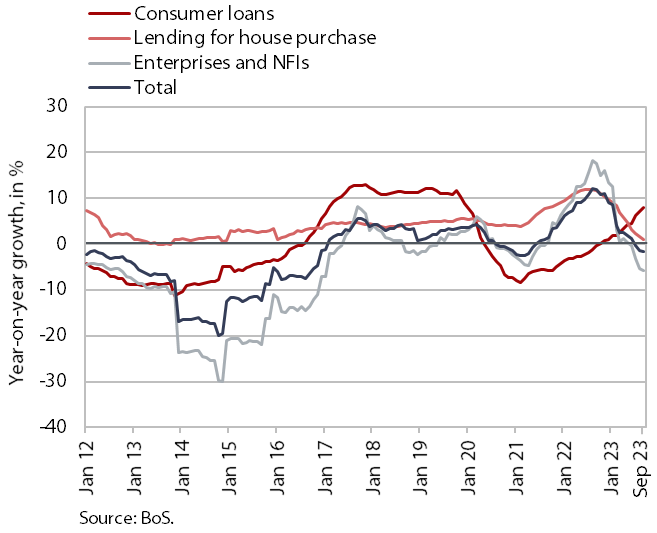

Loans to domestic non-banking sectors, September 2023

The volume of loans to domestic non-banking sectors contracted by 1.6% year-on-year in September as borrowing conditions tightened further and economic activity slowed. This was primarily due to the deleveraging of companies and (especially) NFIs, as their volume of loans from domestic banks fell by almost EUR 680 million (the volume of NFI loans fell by around EUR 540 million) in the first three quarters of this year. The volume of loans to the government was also down (by around EUR 45 million). Growth in household loans (3.4%) also fell year-on-year, due to a rapid slowdown in the growth of housing loans, which fell from around 10% at the end of last year to 1% in September. In the first nine months of this year, new borrowing in the form of housing loans amounted to around EUR 870 million, which is more than 50% less than in the same period last year. However, following the lowering of the threshold for creditworthiness at the beginning of July, year-on-year growth in consumer loans has increased, reaching 7.9% in September, and new consumer loans have increased by almost 30% year-on-year this year. The level of lending interest rates has risen significantly since June last year, with lending rates for companies not deviating significantly from the euro area average, while lending rates for households are on average around 150 basis points higher than in the euro area. Year-on-year growth in domestic non-banking sector deposits slowed slightly in September (to 4.1%). The quality of banks’ assets remains solid and the share of non-performing loans remains unchanged at 1%.

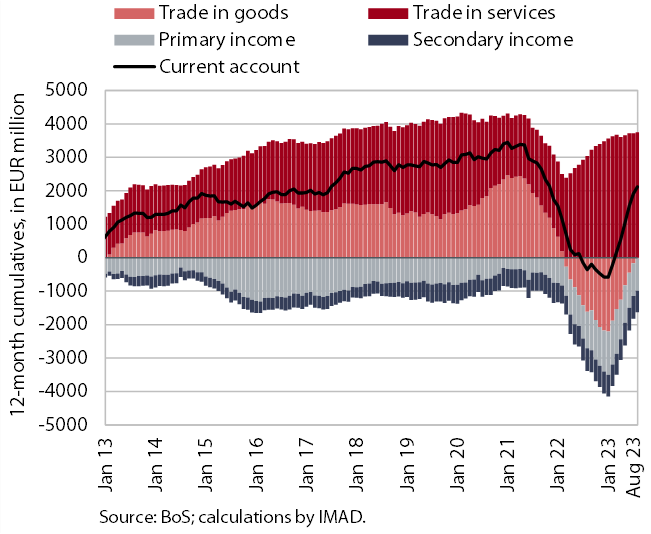

Current account of the balance of payments, August 2023

The current account of the balance of payments turned into a surplus again in August. In the last 12 months it amounted to EUR 2.1 billion, compared to a deficit of EUR 356.1 million in the previous 12-month period. The main contributor to this change was the goods trade balance, as imports of goods declined while exports of goods stagnated. The surplus in services also continued to grow, especially in trade in transport and travel services. Primary and secondary income also contributed to the improvement of the current account balance. The primary income deficit decreased year-on-year, mainly due to higher subsidies from the EU budget for the agricultural and fisheries policies. Payments to the EU budget from customs duties were also lower. The lower secondary income deficit arose from lower net outflows of private sector transfers.

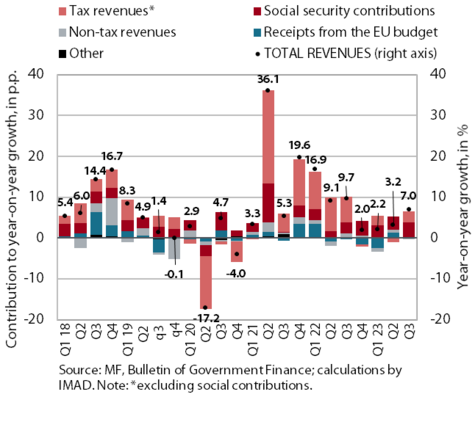

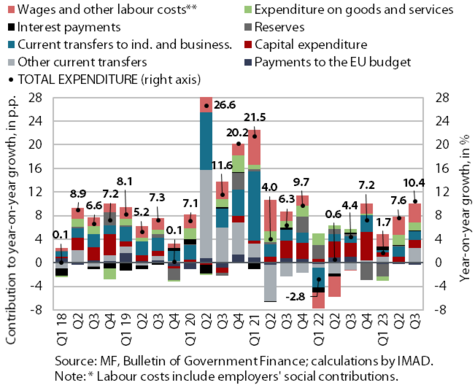

Revenue of the consolidated general government budgetary accounts, Q3 2023

In the third quarter of this year, the deficit of the consolidated balance of public finances was higher year-on-year. It totalled EUR 386 million, compared with EUR 177 million in the same period last year. It was also higher year-on-year in the first nine months (EUR 825 million this year against EUR 380 million in the same period last year). Revenues were 7% higher year-on-year in the third quarter, which means that growth accelerated compared to the second quarter (3.2%). In addition to the increase in social security contributions, the growth in tax revenues resumed in the third quarter;the growth in corporate income tax revenues resumed and the growth in personal income tax revenues also increased. The expiry of the temporary measures of reduced VAT on energy products and the CO2 tax also boosted the growth of these revenues. Expenditure was 10.4% higher year-on-year in the third quarter, which is more than in the second quarter (7.6%), with the increase being due to higher subsidies to mitigate the consequences of rising energy prices and transfers to non-profit organisations, which can be attributed to payments related to post-flood reconstruction. However, as in previous quarters, much of the increase in expenditure in the third quarter was due to the increase in wages and other remunerations as a result of the agreement on public sector wage increase. Growth in capital expenditure remained at a similarly high level (11.7%) to the previous quarter. Based on the nine-month data and the preliminary data on the realisation of the state budget in October, which is the most important part of the consolidated balance of public finances, the general government deficit is projected to be lower than estimated in budget documents.

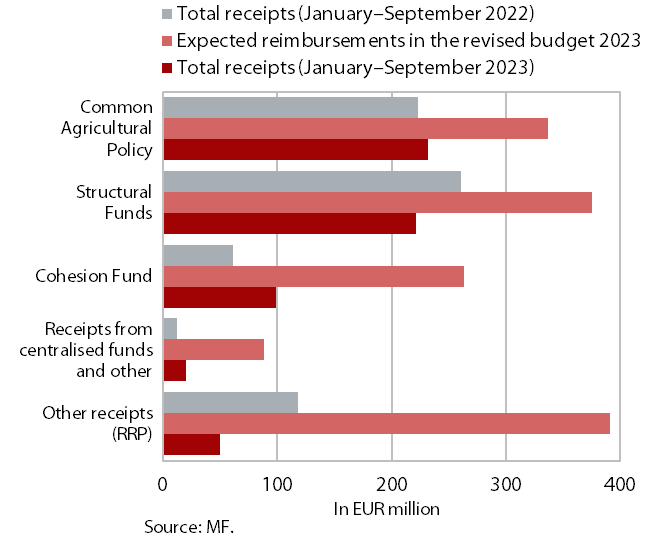

EU budget receipts, September 2023

Slovenia’s net budgetary position against the EU budget was positive in the first nine months of this year (at EUR 135.4 million). In this period, Slovenia received EUR 622 million from the EU budget (42.7% of receipts envisaged in the revised state budget for 2023) and paid EUR 486.6 million into it (66.6% of planned payments). The bulk of receipts were resources under the Common Agricultural and Fisheries Policy (37.2% of all reimbursements, 68.8% of the planned reimbursements). The Structural Funds accounted for 35.6% of total reimbursements (58.9% of the planned reimbursements in 2023) and the Cohesion Fund for 15.9% of all reimbursements (37.5% of the planned reimbursements). The highest payments into the EU budget came from GNI-based payments (55.3% of all payments).

According to the MKRR data, by the end of September funds allocated under the 2014–2020 MFF (funding decisions) accounted for 114% of all available funds, 111% of the available amount was approved and 94% disbursed.