Charts of the Week

Charts of the week from 25 to 29 March 2024: consumer prices, turnover in trade, production volume in manufacturing

The year-on-year growth in consumer prices continued to accelerate slightly in March, to 3.6%, mainly due to a higher year-on-year increase in services prices, while compared to March last year, inflation fell by almost 7 p.p. In the food and non-alcoholic beverages group, the year-on-year price increase continues to slow rapidly and, at 0.9%, was the lowest in three years. Real turnover in most trade sectors continued to rise in January; only in wholesale trade was it lower year-on-year. After manufacturing output had increased in the fourth quarter of last year, it continued to rise in January, but remained lower year-on-year.

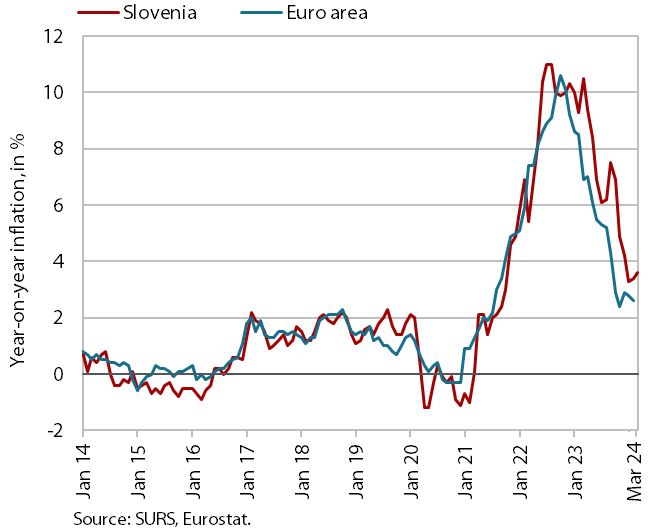

Consumer prices, March 2024

The year-on-year growth in consumer prices continued to accelerate slightly in March, to 3.6%, while it was almost 7 p.p. lower than in the same month last year. The higher annual inflation compared to February (when it was 3.4) was due to a higher contribution from services, which rose by 6.1% year-on-year (the highest increase since November 2023, when price growth was 7.4%). The acceleration is largely due to the low base effect in package holidays, which fell by 22.4% month-on-month in March last year due to seasonal fluctuations, while the drop in prices this March was less pronounced (14.3%). The year-on-year price increase in the recreation and culture group was thus 6% and more than doubled compared to February. The monthly inflation was significantly influenced by the effects of seasonal price increases in the clothing and footwear group, which pushed up the price increase for semi-durable goods to 3.6%. With prices in the restaurants and hotels group rising by 0.2% month-on-month, price growth in this group also increased year-on-year (6.7%). The contribution of the transport group also increased slightly in March due to the rise in prices for petroleum products, but in a year-on-year comparison, the price increase in this group was only 1.3%. Year-on-year price growth in the food and non-alcoholic beverages group continues to slow rapidly and, at 0.9%, was the lowest in three years. Prices of durable goods also remained down year-on-year (by 0.8%).

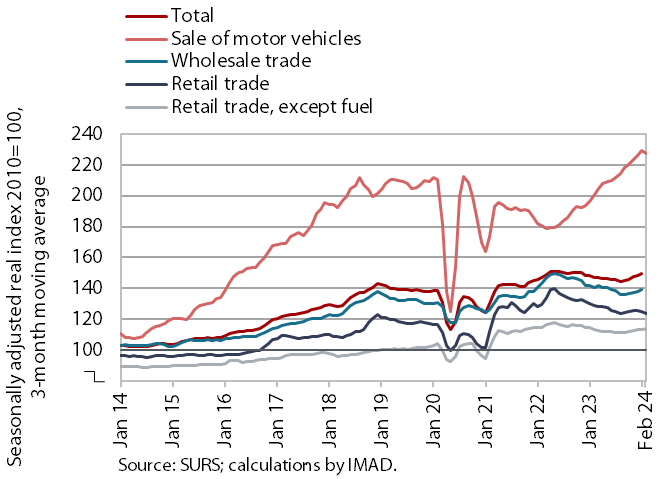

Turnover in trade, January 2024–February 2024

In most trade sectors, real turnover rose at the beginning of the year and was higher year-on-year in January and, according to preliminary data, also in February. Following high growth last year, turnover in the sale of motor vehicles remained largely unchanged in January and was 14% higher year-on-year. Following growth in the fourth quarter of last year, turnover in retail sale of non-food products, which was up 1% year-on-year, and in wholesale trade, which remained down year-on-year (-2%), continued to strengthen. After a modest increase in the second half of last year, turnover in retail sales of food, beverages and tobacco, which was 2% higher year-on-year, fell slightly in January. According to preliminary SURS data, turnover in February was again higher year-on-year in the sale of motor vehicles and retail sale of food, while turnover in retail sale of non-food products was similar to February 2023.

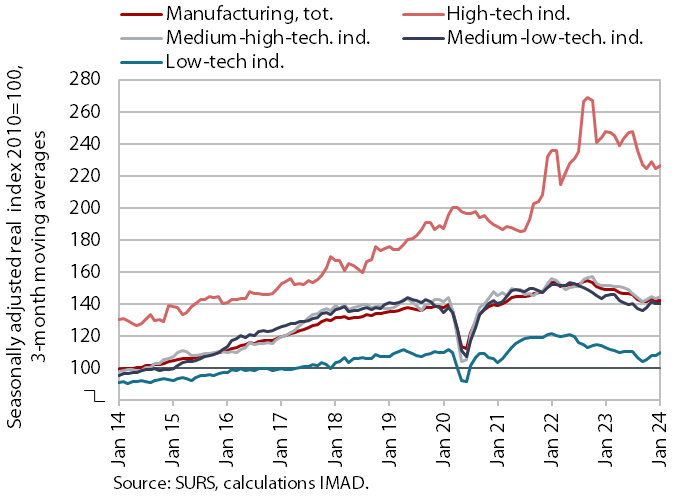

Production volume in manufacturing, January 2024 – correction of statistical data

After manufacturing output had already risen in the fourth quarter of last year, it also increased in January of this year. In most groups according to technology intensity, it was higher in January than in the fourth quarter of last year, with only medium-low-technology industries remaining largely unchanged. Compared to January last year, manufacturing output remained lower year-on-year (1.9%, working-day adjusted). The year-on-year decline in production volume was primarily due to the energy-intensive manufacture of other non-metallic mineral products n.e.c. and the chemical industry (-26.2% and -18.4% respectively), and the repair and installation of machinery and equipment (-12.5%). In most other industries, production was higher year-on-year, including in the energy-intensive paper industry (by 6.7%) and the manufacture of basic metals (by 2.6%).

According to data on business trends, total orders in manufacturing companies remained at a low level at the end of the first quarter, and the outlook for future production has not improved since the beginning of the year. Companies continue to cite insufficient foreign (and domestic) demand as the main limiting factor (one third of respondents).