News

Slovenian Economic Mirror: High growth of the Slovenian economy in the first quarter; we expect a moderation, particularly in exports

The growth of the Slovenian economy remained high in the first quarter; growth in exports and domestic consumption also continued. Growth in the export part of the economy is expected to moderate gradually in the remainder of the year, in line with the projections in our spring forecast of economic trends. These are the key findings of the current issue of the Slovenian Economic Mirror, where we also find that company performance indicators mostly exceeded their pre-crisis level.

The growth of the Slovenian economy remained high in the first quarter. Growth in exports and domestic consumption continued. The continuation of strong growth in gross fixed capital formation was mainly due to construction investment. Owing to a significant fall in inventories, gross capital formation otherwise declined slightly. Private consumption strengthened, consistent with the continuation of favourable labour market developments. Growth in domestic consumption was also driven by considerable growth in final government consumption.

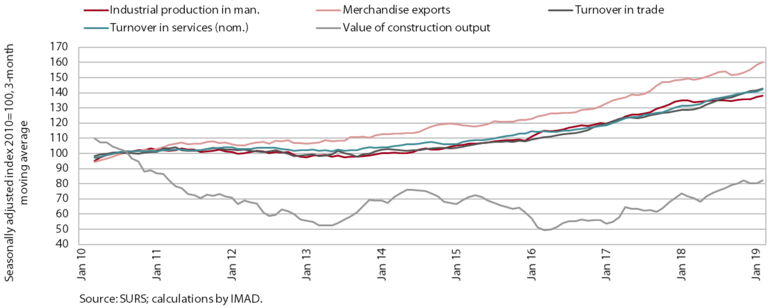

The growth of exports and industrial production was relatively high. After easing somewhat in the second half of last year as a consequence of the cooling of economic activity in main trading partners, export growth strengthened again at the beginning of the year. Goods exports increased mainly on the back of higher exports of medical and pharmaceutical products. The year-on-year growth of exports of services was driven mainly by accelerated exports of construction services, whose share in total exports has again been rising. Manufacturing output also rose in the first quarter. In the twelve months to March, the strongest growth was recorded in high- and low-technology industries, while growth in medium-technology industries was somewhat lower due to the standstill in the EU car industry and related activities. Business expectations regarding exports have been deteriorating in recent months, suggesting somewhat more moderate export growth in the remainder of the year.

The growth of activity strengthened in all sectors in the first quarter of 2019

Further growth is recorded in activities that are largely related to domestic demand. The construction sector saw further growth in the first quarter in the construction of both civil-engineering works and buildings; the indicators of future activity in construction are also favourable. Growth in construction on the one hand and particularly higher spending by households and foreign tourists on the other boosted the continuation of relatively high growth in turnover in trade and other service activities. With higher disposable income, households mainly increased expenditure on durable goods, while also spending more on other goods and services. Growth in household consumption is also reflected in higher growth in prices of services, while inflation has remained low in the last few months (around 1.5% year on year) particularly owing to lower growth in prices of goods.

The volume of loans and deposits of domestic non-banking sectors (particularly households) increased further. Housing loans are rising at a moderate pace; somewhat higher growth rates are recorded for consumer loans. Growth in domestic non-banking sectors’ deposits has strengthened further this year, slightly, not only due to growth in household deposits but also deposits of the government, which – amid favourable public finance conditions – increased deposits at domestic banks. As a consequence of good business results, deposits of non-financial corporations are also on the rise, being at the highest level since comparable data have been available (since 2005).

With faster growth in expenditure than revenue, the surplus of the consolidated balance of public finances was somewhat lower year on year in the first four months. The lower growth in tax revenue arose from the value added tax. Receipts from the EU budget also made a significantly smaller contribution to growth than last year. This year’s strengthening of expenditure growth – which is expected with regard to the adopted budgetary documents – was a result of all major categories of expenditure, the agreement on wage rises, employment growth (particularly in health care), measures in the area of transfers and strong growth in investment in transport infrastructure.

Euro area growth slightly exceeded expectations at the beginning of the year; confidence indicators remain low. Growth exceeded expectations in Slovenia’s main trading partner, Germany, where it was positive for the first time since turning negative in the second half of 2018. Growth in the euro area was based on private consumption and investment as a consequence of favourable labour market conditions, the mild winter, which accelerated activity in construction, and the wearing off of some one-off factors in manufacturing. May’s values of confidence indicators remain relatively low in comparison with the average from the past two years. The negative sentiment was, besides by the existing negative factors (the slowdown of growth in the second half of 2018, the projected cooling of the world economy and escalation of geopolitical uncertainties), also affected by the announcement of additional anti-trade measures of the US and sanctions in the Middle East.

In 2018 indicators of company performance mostly exceeded their pre-crisis levels of 2007. Profit was recorded in all sectors. For the first time since 2007, companies also reported net profit from financial operations. Revenues from sales were rising on both the domestic and foreign markets. The increased revenue growth, particularly in the EU, is related to the rapidly rising demand and the improving competitiveness of Slovenian exporters. Export orientation of companies increased further in 2018. With the recovery of domestic demand, sales revenues on the domestic market also rose markedly for the second consecutive year and exceeded the level of 2008.