News

Economic Mirror: Economic growth remains close to our autumn forecast for 2019; the moderation of investment growth is faster than expected

Year-on-year GDP growth in the first three quarters was 2.7%, which is a significant slowdown relative to last year and close to IMAD’s autumn forecast for 2019 as a whole (2.8%). Data on GDP growth in the third quarter otherwise show a faster-than-expected moderation of investment growth in particular. The slowdown in export growth is in line with expectations, while it is encouraging that growth in private consumption is on the rise. If there are no major negative surprises from the international environment, where uncertainty remains heightened, this year’s GDP growth will be close to that projected in our Autumn Forecast of Economic Trends 2019. These are the key findings of the Slovenian Economic Mirror released by the Institute of Macroeconomic Analysis and Development today.

Year-on-year GDP growth in the first three quarters was 2.7%, which is a significant slowdown relative to last year and close to IMAD’s autumn forecast for 2019 as a whole (2.8%). Data on GDP growth in the third quarter otherwise show a faster-than-expected moderation of investment growth in particular. Export growth is slowing in line with expectations, while it is encouraging that growth in private consumption is on the rise. If there are no major negative surprises from the international environment, this year’s GDP growth will be close to that projected in our Autumn Forecast 2019.

Uncertainty in the international environment remains elevated; confidence indicators point to a continuation of weak growth. Increased uncertainty in the euro area, which has persisted for quite some time, is mainly related to the withdrawal of the UK from the EU, protectionist measures, a global slowdown in economic growth and geopolitical tensions. All of this is reflected in confidence indicators, which were last so low in 2012. Given the moderation of activity growth in the first half of the year, international institutions have lowered their forecasts for GDP growth in the euro area for this year and next since the summer. International institutions (the EC, OECD and IMF) project stable economic growth in the euro area for the next two years under the central and thus most likely scenario, and a slight strengthening of global economic growth. Downside risks remain heightened, as we pointed out in our Autumn Forecast 2019.

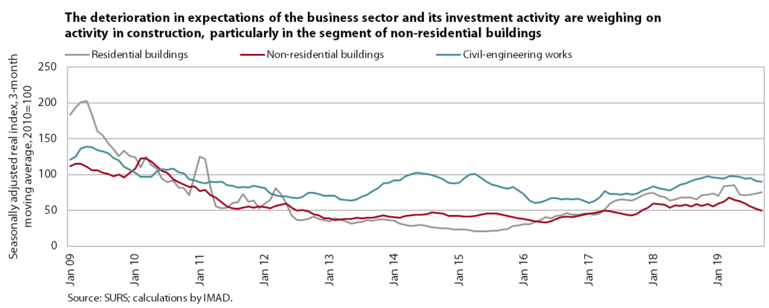

In the first quarter, activity in Slovenia strengthened further in most service activities; construction activity declined after the favourable beginning of the year. Further growth was recorded for turnover in trade and most market services. Production in high-technology industries also strengthened further, while in medium-technology industries growth came to a halt due to the moderation of growth in foreign demand. The decline in economic growth in main trading partners is also reflected in significantly weaker growth in exports of intermediate goods (in addition to exports of vehicles). Activity in construction declined gradually after the favourable beginning of the year, which was also partly due to favourable weather conditions. The fall was most pronounced in the construction of non-residential buildings, reflecting deteriorated expectations of the business sector and its investment activity. It is encouraging that the values of the stock of contracts and new contracts, the indicators of future activity in construction, are rising this year.

Household consumption is also increasing amid further growth in disposable income. Labour market conditions remain favourable. The number of employed persons is at record highs, while the decline in the number of registered unemployed persons is slowing gradually. In the first three quarters, wage growth exceeded that in the same period last year mainly on account of strong growth in the general government sector. Higher wages accompanied by higher growth in social transfers and new consumer loans encouraged growth in household consumption to continue in the third quarter. Household spending on non-durable goods and services strengthened in particular, while growth in purchases of durable goods moderated this year, as consumers are less and less optimistic about the outlook for the economy. This is also reflected in further growth in household saving.

Year-on-year price growth remained moderate in November. Growth in goods prices eased somewhat further. Solid household consumption is also reflected in higher prices of services year on year, particularly those related to housing and hotels and restaurants. Supplementary health premiums increased as well.

The surplus of the consolidated balance of public finances in the first ten months was lower than last year; revenue growth is lagging behind expenditure growth this year. Lower growth in revenue is largely due to lower non-tax revenues and receipts from the EU budget than in the same period of last year. The growth of tax revenues is also somewhat weaker than last year as a consequence of changes in the taxation of holiday allowance and lower growth in domestic consumption. Stronger growth in expenditure is mainly related to the adopted agreements on wage rises and further employment growth in the public sector and measures in the area of social transfers. Higher growth is also recorded for payments into the EU budget. Investment growth declined somewhat more year on year than planned.