Charts of the Week

Charts of the week from 27 December 2023 to 5 January 2024: consumer prices, bond, number of registered unemployed, electricity consumption and other charts

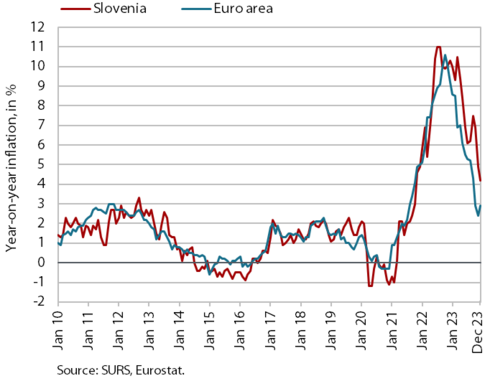

Year-on-year inflation fell to 4.2% at the end of last year and more than halved compared to December 2022. Price increases for all major consumer groups are slowing, with prices for services contributing the most to the fall in inflation in December. Yields to maturity of euro area government bonds fell slightly in the fourth quarter of last year, most markedly in December. The number of unemployed in December 2023 was almost one-tenth lower than a year earlier and, amid labour shortages, the number of long-term unemployed fell by almost one-fifth. With some large consumers increasing their production, the year-on-year decline in electricity consumption was lower in December than in previous months. Real turnover in most trade sectors rose in October after several months of decline, while real turnover in market services decreased again. In mid-December, year-on-year growth in the nominal value of fiscally verified invoices accelerated compared to previous months, and within this, year-on-year growth of turnover in trade doubled. After two months of growth, trade in goods contracted again in November amid ongoing weak activity and uncertain situation in Slovenia’s main trading partners. In the first eleven months, real exports fell by 7.1% year-on-year and real imports by 7.5%.

Consumer prices, December 2023

Year-on-year growth in consumer prices slowed markedly again in December 2023, to 4.2% (by 0.7 p.p.), and more than halved compared to the same month in 2022 (10.3%). This time, the main reason for the slowdown was lower year-on-year growth in service prices, which had been running at around 8% since April last year but began to weaken in the last two months, reaching 6.1% in December. The slowdown in the growth of services prices in December mainly came from year-on-year lower prices in the telephone and telefax services group (-0.1%), especially for mobile telephony services. With a significant monthly price fall (-8.5%), the contribution of refuse collection was also lower. The contributions of some other services, which together account for more than half of the services included in the consumer price index, were also lower or at least remained unchanged. Food price inflation continued to gradually weaken year-on-year and, at 4.2%, it was only at around one-fifth of the growth at the start of 2023. The price increase for non-energy industrial goods is also moderating. Prices for semi-durable goods rose by 2.1% year-on-year, while prices for durable goods fell by 0.3%, as car prices were 3.3% lower year-on-year. Against the backdrop of government measures to mitigate the consequences of high energy prices and favourable developments on the markets for oil and solid fuels, energy prices were 2.3% lower year-on-year.

Bond, Q4 2023

Yields to maturity of euro area government bonds decreased in the last quarter of 2023. After yields were still rising in October, they began to fall as inflation eased and ECB was expected to discontinue its interest rate hikes. The fall was most noticeable in December, when the yield on Slovenian bonds fell below 3% for the first time since September 2022. In the last quarter of last year, it fell by 4 basis points compared to the previous quarter, to 3.41%. A similar quarter-on-quarter increase was seen in the spread to the German bond, which reached 89 basis points, a good quarter less than in the same period a year earlier.

Number of registered unemployed, December 2023

According to the seasonally adjusted data, the monthly decline in the number of registered unemployed in December (0.8%) was similar to previous months, but lower than at the beginning of the year. According to the original data, 48,353 people were unemployed at the end of December, 2.5% more than at the end of November. This largely reflects seasonal trends related to a higher inflow into unemployment due to expiry of fixed-term employment contracts. Unemployment was down 9.1% year-on-year. Amid labour shortages, the number of long-term unemployed (more than 1 year) was almost one-fifth lower year-on-year at the end of December. In 2023, 48,709 persons were registered as unemployed on average, 14% fewer than a year earlier.

Electricity consumption, December 2023

Electricity consumption was 4% lower year-on-year in December 2023. The year-on-year decline was lower than in previous months, partly due to the resumption of part of the production at a big direct consumer SIJ Acroni company and also the resumption of production lines at companies affected by the floods in August. The smaller year-on-year decline was also due to a relatively low base at the end of 2022, which was caused by high electricity prices and a slowdown in economic activity. Among Slovenia’s main trading partners, lower consumption compared to December 2022 was recorded also by Austria (-1%), while consumption in other trading partners was higher year-on-year, in Italy, Germany and Croatia by 1%, and in France by 3%.

Value of fiscally verified invoices, in nominal terms, 10–23 December 2023

The nominal value of fiscally verified invoices between 10 and 23 December 2023 was 11% higher year-on-year. The stronger growth compared to that in previous 14-day periods of the third and fourth quarters of 2023 was the consequence of a doubled, 10% growth of turnover in trade. Growth of turnover in retail trade doubled to 8%, and this segment accounted for more than half of the total value of fiscally verified invoices. Growth of turnover in the sale of motor vehicles was high (28%), while growth in wholesale trade remained modest (4%). Year-on-year turnover growth in accommodation and food service activities and certain creative, arts, entertainment, and sports services and betting and gambling was similar to the previous 14-day period (overall growth in accommodation and food service activities and in other service activities was 12%).

Turnover in trade, October–November 2023

Real turnover in most trade sectors increased in October 2023 after falling in previous months. In retail trade (excluding automotive fuels), with relatively high current growth, it was higher year-on-year for the first time in 2023. This was due to growth in the sale of non-food products; the sale of food, beverages and tobacco was similar to October 2022. Turnover in wholesale trade also increased for the second month in a row, but still fell short of 2022 turnover. The high year-on-year growth was maintained by turnover in the sale of motor vehicles (18%), which was the only major trade segment to also exceed 2022 sales in the first ten months of the year. According to preliminary SURS data, this intensified in November, while turnover in retail trade was again slightly below the previous year’s figure.

Turnover in market services, October 2023

Real turnover in market services fell in October 2023. Total turnover fell by 1.3% in current terms, after having risen quite sharply in the previous month. The decline was due to a fall in turnover in accommodation and food service activities and in administrative and support service activities, which recorded strong growth in September. Other service activities recorded modest turnover growth. In transportation and storage, where the negative trend has continued since May 2022, turnover increased, particularly in maritime transport. Turnover growth in information and communication activities was mainly due to the increase of turnover in computer services on the domestic and foreign markets. Turnover in professional and technical services stagnated. Total turnover in market services rose by 1.4% year-on-year in real terms in October and by 1.5% in the first ten months of last year, driven by growth in most activities (with the exception of transport). In employment services, it remained below pre-epidemic (October 2019) levels (by 21%).

Trade in goods – in real terms, November 2023

Trade in goods fell slightly in November and the year-on-year decline deepened. After two months of growth, real exports of goods fell by 1.7% and imports by 3.5% in November. Despite the decline in November, the average trade in goods in October and November was above the average of the third quarter (seasonally adjusted). In the first eleven months, exports fell by 7.1% year-on-year and imports by 7.5%. In a year-on-year comparison, the decline in exports was more pronounced with EU countries (EU -8.2%, non-EU: -2.7%), while the decline in imports was more pronounced with non-EU countries (EU: -5.9%; non-EU: -13.0%). According to the available data, imports of intermediate goods imported by Slovenia from non-EU countries (e.g. iron and steel, non-ferrous metals) and exported to the EU (e.g. metal products, machinery) have decreased in particular. Although sentiment in export-oriented activities deteriorated slightly in December, it improved quarter-on-quarter in the fourth quarter. Amid great uncertainty in the international environment, export orders remained significantly lower than at the start of 2023.