Charts of the Week

Charts of the week from 18 to 22 December 2023: economic sentiment, Slovenian industrial producer prices, number of persons in employment and other charts

In December, the value of the economic sentiment indicator continued to rise month-on-month. Confidence was higher in retail trade, and slightly also construction, manufacturing and among consumers, while it remained unchanged in services. Compared to December 2022, the value of the economic confidence indicator was still lower. Slovenian industrial producer prices continued to fall in November and were only slightly above the level of a year ago. In October, the subdued growth in the number of persons in employment continued. The year-on-year increase was driven by the employment of foreign workers, while the number of employed Slovenian citizens fell year-on-year. The average gross wage increased by 2.2% year-on-year in real terms in October. In the private sector (+2.3%) growth was highest in administrative and support service activities, which (along with construction and accommodation and food service activities) are among the activities facing the greatest labour shortages. Growth in the public sector (+1.9%) was lower than in previous months due to the higher base of last year related to the implementation of the wage increase agreement. Total turnover in real estate activities fell in the third quarter. The number of dwellings sold was the lowest since the second quarter of 2020, when the number of transactions was severely affected by business restrictions due to the outbreak of the epidemic. Growth in dwelling prices moderated further.

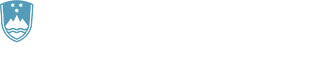

Economic sentiment, December 2023

The economic sentiment indicator further increased month-on-month in December, while it was still down year-on-year. Compared to the previous month, confidence was higher in retail trade, and slightly also in construction, manufacturing and among consumers, while it remained unchanged in services . Compared to December 2022, confidence was lower in all activities, with the exception of consumers, where it remained unchanged (last year it had fallen significantly due to lower purchasing power as a result of rising prices). On average in 2023, it was slightly higher year-on-year only among consumers, where it was still the most below the long-term average in December. Confidence in manufacturing was also significantly below the long term average. Confidence in retail trade and services averaged slightly above the long-term average in 2023, while confidence in construction was already well above it.

Slovenian industrial producer prices, November 2023

Slovenian industrial producer prices continued to fall in November and were only slightly above the level of a year ago. They fell by 0.4% month-on-month, with a similar fall in prices on the domestic and foreign markets. The year-on-year growth rate, which had been close to 20% at the beginning of the year, moderated further to 0.3%, the lowest since December 2020. The slowdown in year-on-year growth was still mainly due to developments in the intermediate goods group, where prices were 3.7% lower in November than a year earlier. In most other groups, with the exception of energy, the year-on-year price increase is gradually weakening. Although energy prices fell by 4.3% month-on-month, they were 7.1% higher year-on-year due to a lower base, and this is the highest increase of all product groups. However, the year-on-year price increase for capital and consumer goods continued to weaken gradually and was slightly below 4%.

Number of persons in employment, October 2023

Year-on-year growth in the number of persons in employment (0.8%) continued to slow in October. This was mainly due to the decline in the number of persons in employment in manufacturing in October (according to seasonally adjusted data). The overall year-on-year increase in the number of persons in employment is due to a higher number of employed foreign nationals, while the number of employed Slovenian citizens was lower. The share of foreign citizens among all persons in employment was 14.7% in October, 0.9 p.p. higher than a year earlier. Activities with the largest share of foreigners are construction (48%), transportation and storage (33%) and administrative and support service activities (27%).

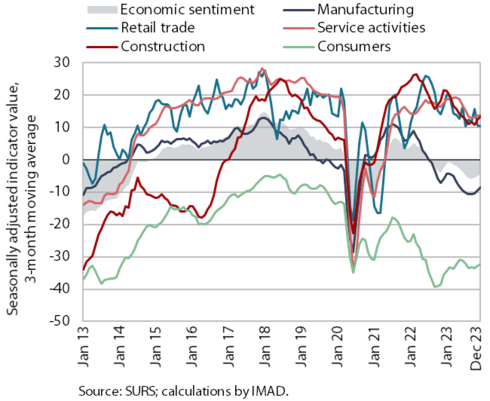

Average gross wage per employee, October 2023

The average wage growth in October (2.2%) was slightly higher in real terms than in the previous month (1.8%). It stood at 2.3% in the private sector. It was highest in administrative and support service activities, which (along with construction and accommodation and food service activities) are among the activities facing the greatest labour shortages. In the public sector, it was 1.9% year-on-year in real terms, lower than in previous months. Growth was lower mainly due to the agreement on wage increases (the first of which took place in October 2022). Nominal year-on-year growth in the average gross wage in October was slightly lower than in previous months at 9.2%. Growth in the private sector was 9.4% and in the public sector 8.9%. In the first ten months, the average year-on-year gross wage growth was 1.8% in real terms (1.4% in the private sector and 2.5% in the public sector). Year-on-year nominal growth in the same period was 10% (9.6% in the private sector and 10.8% in the public sector).

Real estate, Q3 2023

In the third quarter, the growth of dwelling prices weakened further amid the further decline in the total number of transactions. Prices rose by 0.7% compared to the second quarter and by 5.7% compared to the third quarter of 2022. Quarter-on-quarter growth was driven by relatively strong price growth in newly built dwellings (11.5%), with the number of sales rising to 4% of total transactions in the third quarter. However, for the first time since the last quarter of 2019, prices of existing dwellings fell in current terms (by 0.2%); the number of sales also continued to decline. A total of 2,397 dwellings were sold. This is a drop of more than one-fifth compared to the third quarter of last year and the lowest level since the second quarter of 2020, when the number of transactions was severely affected by business restrictions due to the outbreak of the epidemic.