Charts of the Week

Charts of the week from 27 November to 1 December 2023: consumer prices, value of fiscally verified invoices, turnover in trade and other charts

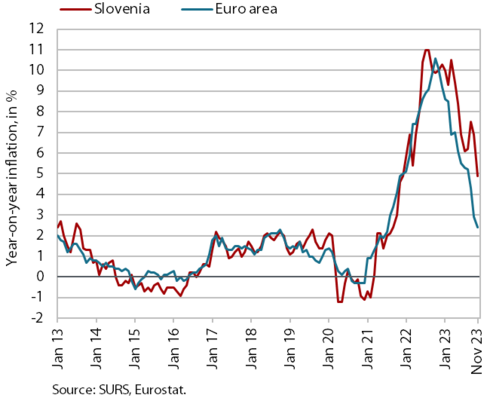

In November, year-on-year consumer price growth was the lowest in two years (4.9%). The main reason for the fall of 2 p.p. compared to October was lower contribution from energy prices, mainly due to the reintroduction of the exemption from the levy on renewable energy sources and combined heat and power. The year-on-year growth of food and non-alcoholic beverages prices continued to moderate and was more than two-thirds lower in November than at the beginning of this year. The growth of service prices remains relatively high. Year-on-year growth in the nominal value of fiscally verified invoices in the second half of November was similar to that recorded before the fluctuations in the last month (6%). Real turnover in most trade sectors continued to fall quarter-on-quarter in the third quarter; only in the sale of motor vehicles it remained higher year-on-year. According to preliminary data, trade in non-food products was also higher year-on-year in October. In market services, real turnover rose in most activities in the third quarter compared to the second quarter. According to survey data, unemployment fell slightly year-on-year in the third quarter and, as economic activity slowed, the number of persons in employment was also slightly lower, mainly due to lower number of student workers and unpaid family workers.

Consumer prices, November 2023

Year-on-year growth in consumer prices slowed to 4.9% in November (by 2 p.p.), the lowest level since the end of 2021. This was mainly due to energy prices, whose contribution fell primarily as a result of the government’s measure to completely exempt households from paying RES and CHP levies. The price of electricity fell by 18.8% month-on-month and the year-on-year growth rate fell to around 1% (around 24% in October). In November, prices for solid fuels fell further, by around one-quarter year-on-year. In addition to the decline in current terms, prices for petroleum products also fell year-on-year (by around 5% according to our estimate). The slowdown in year-on-year growth in food and non-alcoholic beverages prices is continuing. At 6.2% in November, it was more than two-thirds lower than at the beginning of this year. Year-on-year growth of service prices, which had been running at over 8% since May, fell to 7.4% in November. We believe this is also due to a significant slowdown in price growth in the health sector, which fell by almost a half year-on-year (6.4%) amid a monthly decline (-2.1%) and a high last year’s base. Price growth in the restaurants and hotels and leisure and culture groups also slowed slightly.

Value of fiscally verified invoices, in nominal terms, 12–25 November 2023

The nominal value of fiscally verified invoices between 12 and 25 November 2023 was 6% higher year-on-year. Year-on-year turnover growth in trade (6%) was similar to that seen before the fluctuations in the last two 14-day periods. Turnover in retail trade, which accounted for just over half of the total value of fiscally verified invoices, was up 5% year-on-year and turnover in the sale of motor vehicles was up 17%, while it remained largely unchanged in wholesale trade. Turnover growth in accommodation and food service activities (8% year-on-year) accelerated significantly following a slowdown in the last month, while turnover growth in creative, arts, entertainment, and sports services and betting and gambling remained strong (totalling 18% in other service activities).

Turnover in trade, September–October 2023

In most trade sectors, real income continued to fall quarter-on-quarter in the third quarter, with only the sale of motor vehicles showing a year-on-year increase; according to preliminary data, it was higher year-on-year also in sale of non-food products in October. The year-on-year decline in turnover in wholesale trade, which has been on the decline in current terms since the spring, deepened in the third quarter (to -8%). The decline in retail trade (excluding automotive fuels) was slightly less pronounced than in the previous quarters, due to the growth in sales of food, beverages and tobacco products, which nevertheless remained below the previous year’s level (-2%). Sales of non-food products, which continued to decline in current terms, was also down year-on-year (by 8%). Only turnover in the sale of motor vehicles, which has increased in current terms since the middle of last year, remained higher year-on-year (by 13%). According to preliminary SURS data, it was also higher year-on-year in October, while turnover in retail trade was similar to the previous year due to growth in the sale of non-food products.

Turnover in market services, September 2023

Real turnover rose in the third quarter compared to the second quarter in most market services. With an increase in the number of overnight stays, it increased in accommodation and food service activities, after falling in the previous quarter. After a sharp decline, it also rose in information and communication, with strong growth in both main sectors (telecommunications and computer services). Turnover also rose in professional and technical services and slightly in administrative and support service activities. In transportation and storage, on the other hand, the decline in turnover that began in the third quarter of last year continued. The largest decline in the third quarter was seen in land transport. Total turnover in market services thus stagnated in current terms, but fell slightly year-on-year (by 0.3%). In the first nine months, it was 1.5% higher year-on-year in real terms, which can be attributed to growth in most activities (with the exception of transportation). It remained below pre-epidemic levels (compared to the same quarter in 2019) in employment services (by 17%).

Active and inactive population, Q3 2023

According to survey data, unemployment fell year-on-year in the third quarter and the number of persons in employment also fell slightly. According to original data, 40 thousand persons were unemployed, which is 4.8% less than in the third quarter of last year. The survey unemployment rate (3.9%) fell by 0.1 p.p. year-on-year. The number of persons in employment fell slightly year-on-year (by 0.4%) as economic activity cooled. The number of employees in labour relation remained largely unchanged, while the number of student workers and unpaid family workers fell sharply (by 14.6% and 28.6% respectively). The number of self-employed persons increased year-on-year (by 8.6%).