Charts of the Week

Charts of the week from 20 to 24 November 2023: economic sentiment, Slovenian industrial producer prices and average gross wage per employee

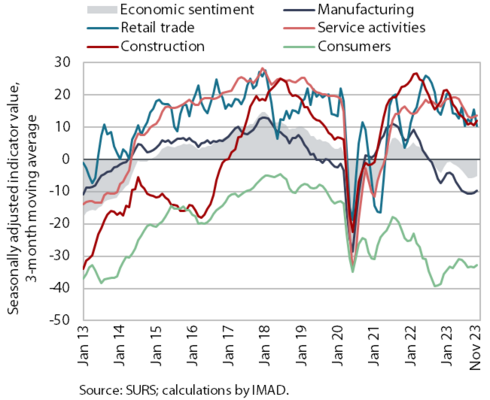

The economic climate improved month-on-month in November, but the indicator continues to show a downward trend year-on-year. Compared to the previous month, confidence was higher in manufacturing, construction and among consumers, while it was lower in retail trade and in services. On a year-over-year basis, confidence was significantly lower in all activities, while was noticeably higher among consumers. The monthly decline in Slovenian industrial producer prices continued in October and the year-on-year growth rate also slowed further. Real year-on-year growth in average gross wage slowed significantly in September amid higher inflation. In the first nine months of the year, the average gross wage was 1.8% higher year-on-year in real terms. The increase in the public sector was more pronounced than in the private sector.

Economic sentiment, November 2023

The economic sentiment indicator rose slightly month-on-month in November, while it was still down year-on-year. Compared to the previous month, confidence was significantly higher in manufacturing, where the indicators for expected production and stock of finished products improved, and in construction. Confidence was also higher among consumers, who were more optimistic about the country’s future economic situation. However, confidence in retail trade and in services was lower. Compared to last November, confidence was significantly lower in all activities, while it was noticeably higher among consumers. Here, all components of the indicator improved, especially expectations regarding the financial situation of households.

Slovenian industrial producer prices, October 2023

Slovenian industrial producer prices continued to fall in October, with year-on-year growth slowing to 0.9%. The downward momentum of prices, which have been falling month-on-month since April, has weakened in recent months. In October, they fell by 0.1% for the second month in a row. Prices on the domestic market fell (by 0.3%), while prices on foreign markets increased slightly (by 0.1%). Although the latter prices rose in current terms, they were 0.7% lower year-on-year (they were still 14.3% higher at the beginning of the year), while on the domestic market they were 2.5% higher year-on-year (they were 22.1% higher at the beginning of the year). Of all industrial groups, only intermediate goods prices were down year-on-year in October (-2.9%). Despite the slowdown, the growth of consumer goods prices remained relatively high year-on-year (5.7%), while price growth for energy and capital goods was slightly below 4%.

Average gross wage per employee, September 2023

Year-on-year real growth in average gross wage slowed significantly in September amid higher inflation (1.8%). In the private sector, real growth was 0.8% year-on-year. It was highest in administrative and support service activities, which (along with construction and accommodation and food service activities) are among the activities facing the greatest labour shortages. In the public sector, the average gross wage rose by 3.8% year-on-year in real terms. Growth was more pronounced than in the private sector due to the wage increases agreed last year (the first of which took place in October). Average gross wage growth in September (9.5%) was slightly lower year-on-year in nominal terms than in the previous three months (10.2% in the June–August period). It was 8.4% in the private sector and 11.5% in the public sector. In the first nine months, the average year-on-year gross wage growth was 1.8% (1.4% in the private sector and 2.6% in the public sector).