Charts of the Week

Charts of the week from 16 to 20 October 2023: Slovenian industrial producer prices, electricity consumption by consumption group, road and rail freight transport and other charts

In September, Slovenian industrial producer prices further declined month-on-month and were no longer significantly above last year’s level. Electricity consumption in the distribution network was lower year-on-year in September in all consumer groups, although the decline in industrial consumption was somewhat smaller than in previous months. The volume of road freight transport was again slightly down in the second quarter of this year, as was the volume of rail freight transport, the latter due to frequent line closures for maintenance and investment works and a slowdown in the growth of overall economic activity. Year-on-year growth in the nominal value of fiscally verified invoices in the first half of October was similar to September and the highest since April. With growth in construction and manufacturing weakening, year-on-year growth in the number of persons in employment in August was lower than in previous months; overall year-on-year growth was entirely due to the employment of foreigners.

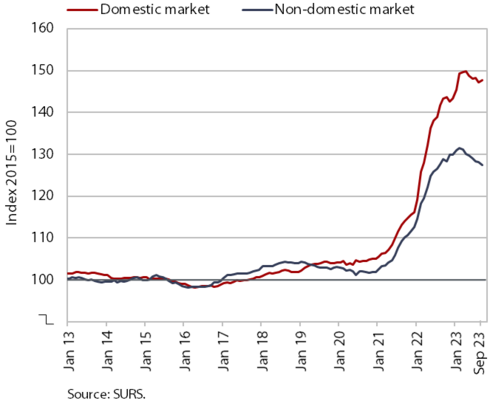

Slovenian industrial producer prices, September 2023

Slovenian industrial producer prices continued to fall in September and were only slightly above the level of a year ago. The decrease in September was minimal (0.1%) and was the result of a decline in foreign markets (by 0.3%), while the prices in the domestic market increased by 0.3%, mainly due to price increases in the energy group (2.8%). The year-on-year growth rate, which had been close to 20% at the beginning of the year, slowed further to 1%, the lowest since February 2021. The slowdown in year-on-year growth was still mainly due to developments in the intermediate goods group, where prices were 2.7% lower in September than a year earlier. Amid high base, year-on-year price growth in the energy group is also weakening rapidly (2.5%), after still exceeding 20% in the middle of the year. Price growth in consumer goods is also gradually weakening, at 6.1% year-on-year, while price growth in durable (5.7%) and non-durable goods (6.2%) is slowing. Year-on-year price growth in the capital goods group, which had been stable between 4.2% and 4.5% in the summer months (June–August), fell to 3.7% in September.

Electricity consumption by consumption group, September 2023

In September, electricity consumption in the distribution network was lower year-on-year in all consumption groups. With one less working day, industrial consumption was 6.7% lower year-on-year, a smaller decline than in previous months. The latter may have been influenced by last year’s relatively low base, which was the result of weakening economic growth. Household consumption and small businesses consumption were also lower year-on-year in September (by 5.2% and 4.1% respectively).

Road and rail freight transport – Q2 2023

The volume of road and rail freight transport decreased again in the second quarter of 2023. After a one-off increase in the previous quarter, the volume of road transport performed by Slovenian vehicles fell again slightly, by 4% year-on-year. It was one tenth higher compared to the second quarter of 2019 (cross-trade was 7% higher, while other road traffic performed at least partially on Slovenian territory was 12% higher). The share of cross-trade in total transport, which was above 50% before the epidemic, remained low in the second quarter of this year, at about 45%. Rail freight transport, already declining before the epidemic, was 10% lower year-on-year in the second quarter and the lowest in 7 years. The recent decline in both road and rail freight transport is mainly related to the slowdown in the growth of overall economic activity. Other obstacles to higher rail transport volumes are the frequent line closures for maintenance and investment work.

Value of fiscally verified invoices, in nominal terms, 1–14 October 2023

The nominal value of fiscally verified invoices between 1 and 14 October 2023 was 8% higher year-on-year. Year-on-year turnover growth, which was similar to the previous two 14-day periods, remained the highest since the second half of April. Turnover in trade, which accounted for more than three-quarters of the total value of fiscally verified invoices, increased by 7% year-on-year in the first half of October (by 6% in retail trade, by 15% in the sale of motor vehicles and by 5% in wholesale trade). Turnover growth further accelerated slightly in accommodation and food service activities (to 20%) and in certain creative, arts, entertainment, and sports services and betting and gambling (total growth in other service activities was 26%).

Number of persons in employment, August 2023

Year-on-year growth in the number of persons in employment was lower in August than in the previous months (1%). This was mainly due to a slowdown in year-on-year growth in construction and also manufacturing. The strongest growth was in information and communication. With the number of Slovenians in employment declining, the employment of foreigners has contributed exclusively to the overall year-on-year growth in the number of persons in employment in August. Their share among all persons in employment was 14.6% in August, 1 p.p. higher than a year earlier. Activities with the largest share of foreigners are construction (48%), transportation and storage (33%) and administrative and support service activities (27%).