Charts of the Week

Charts of the week from 2 to 6 October 2023: number of registered unemployed persons, value of fiscally verified invoices, electricity consumption and other charts

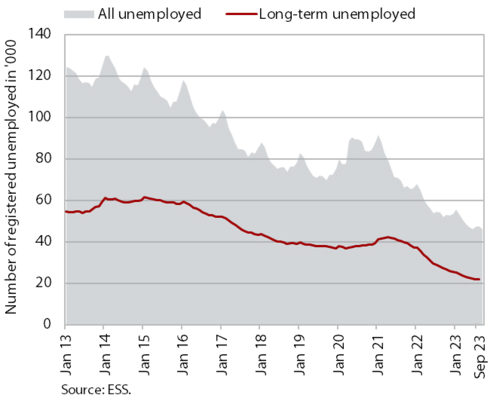

The number of registered unemployed fell further in September, by 11.6% year-on-year. Given the severe labour shortage, long-term unemployment also declined significantly. Year-on-year growth in the value of fiscally verified invoices strengthened in all activities in nominal terms in the second half of September, with the strongest growth in the sale of motor vehicles, accommodation and food service activities and other service activities. The year-on-year downward trend in electricity consumption continued in September, which we attribute to lower industrial consumption. The year-on-year decline in trade in goods deepened in August. In September, export expectations in manufacturing and export orders fell to the lowest level since May 2020 amid low activity in Slovenia’s main trading partners. The yield to maturity of the Slovenian bond increased to 3.45% in the third quarter.

Number of registered unemployed persons, September 2023

According to the seasonally adjusted data, the monthly decline in the number of registered unemployed was slightly higher in September (- 0.8%) than in the previous three months. According to original data, 45,999 people were unemployed at the end of September, 2.9% less than at the end of August. Unemployment was down 11.6% year-on-year. Amid severe labour shortages, the number of long-term unemployed (more than

1 year) fell by 21.0% year-on-year at the end of September.

Value of fiscally verified invoices – in nominal terms, 17–30 September 2023

The nominal value of fiscally verified invoices between 17 and 30 September 2023 was 7% higher year-on-year. Turnover growth remained similar to the previous 14-day period, when it picked up strongly and was the highest since the second half of April. Turnover in trade, which accounted for almost 80% of the total value of fiscally verified invoices, increased by 5% year-on-year. Turnover in retail trade increased by 2% year-on-year, turnover in the sale of motor vehicles by 25%, and turnover in wholesale trade by 1%. Turnover growth remained high in accommodation and food service activities (16%) and in certain creative, arts, entertainment, and sports services and betting and gambling (total growth in other service activities was 18%).

Electricity consumption, September 2023

Electricity consumption was 17% lower year-on-year in September. According to our estimate, this was mainly due to lower industrial consumption. The decrease in electricity consumption could also be partly due to the floods in August, which resulted in some residential and manufacturing/service units not being yet back in use in September. Among Slovenia’s main trading partners, lower consumption compared to September 2022 was recorded by Austria (-10%), Croatia (-3%), Italy (-1%) and Germany (-1%), while consumption was higher in France (3%).

Trade in goods, August 2023

The year-on-year decline in trade in goods deepened in August. After months of contraction, real exports and imports of goods rose slightly in August, mainly due to higher trade with EU Member States (seasonally adjusted). However, their year-on-year decline intensified; trade in goods thus fell to pre-2020 levels. In the first eight months of this year, exports fell by 6.1% year-on-year (by 5.7% to EU Member States) and imports by 8% year-on-year (by 6.3% from EU Member States). Weak economic activity in Slovenia’s main trading partners continued to weigh on sentiment and expectations in export-oriented activities, as expectations for exports in manufacturing fell further in September, reaching the lowest level since May 2020.

Government bonds, Q3 2023

Yields to maturity of euro area government bonds rose slightly in the third quarter of this year amid ECB’s continued restrictive monetary policy. In this period, the yield to maturity of the Slovenian government bond increased by 17 basis points, to 3.45%. The spread to the German bond fell again slightly quarter-on-quarter, to 85 basis points.