Charts of the Week

Charts of the week from 15 to 19 September 2025: number of persons in employment, activity in construction and Slovenian industrial producer prices

In July, the number of persons in employment remained broadly unchanged compared with previous months and was 0.4% lower year-on-year. It remained lower than a year earlier primarily in administrative and support service activities, construction, and manufacturing, while it was higher in public service activities. With high growth in July, construction activity continued to exhibit high volatility. Activity increased by one-tenth month-on-month (seasonally adjusted), and in the first seven months of the year it was 1% higher than in the same period last year. Slovenian industrial producer prices rose slightly month-on-month in August, while year-on-year growth moderated further due to a higher base (reaching 0.9%). Consumer goods prices recorded the strongest growth, with price growth in the manufacture of food products gaining momentum.

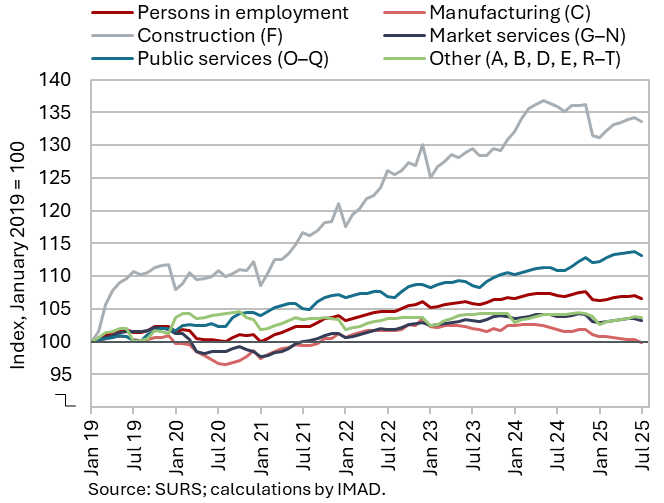

Number of persons in employment, July 2025

In July, the number of persons in employment remained broadly unchanged compared with previous months (seasonally adjusted) and was 0.4% lower year-on-year. The number of foreign citizens in employment increased by 1.9% year-on-year, while the number of Slovenian nationals in employment declined by 0.7%. The steepest year-on-year decreases in employment were recorded in administrative and support service activities (–3.9%, mainly due to a decline in employment agencies), manufacturing (–1.9%), and construction (–1.7%). Conversely, employment continued to rise in public service activities, most notably in human health and social work activities (+3.4%) and in education (+1.5%).

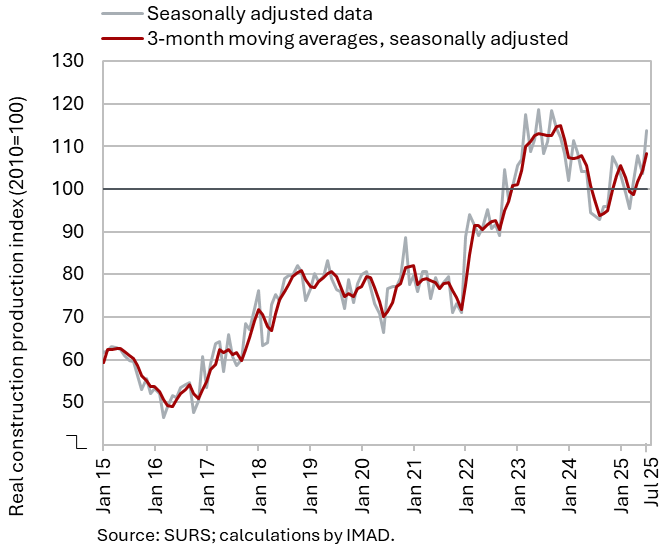

Activity in construction, July 2025

With high growth in July, construction activity continued to exhibit high volatility. After a decline in the first quarter and growth in the second, construction activity strengthened further in July, increasing by as much as 10% (seasonally adjusted). In the first seven months of the year, the total value of construction put in place was 1% higher than in the same period last year. It increased in specialised construction activities (by 9%) and in the construction of non-residential buildings (by 7%), remained unchanged in the construction of residential buildings, and declined by 7% in civil engineering.

The sentiment indicator in construction, which had fallen in 2022 and 2023, has stabilised over the past year and a half and now exceeds its long-term average. Companies generally assess new orders as “normal”. The most significant constraint remains the shortage of skilled labour, while insufficient demand is cited by only around one tenth of companies. This indicates that the current challenges in construction are primarily driven by supply-side constraints rather than demand-side pressures.

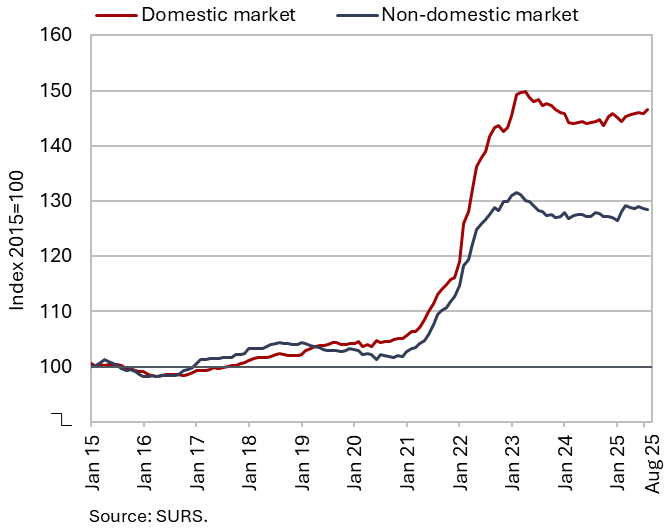

Slovenian industrial producer prices, August 2025

Slovenian industrial producer prices increased slightly month-on-month in August (0.2%), while year-on-year growth eased further due to a higher base (to 0.9%). Differences in price growth between the domestic market (1.5%) and foreign markets (0.4%) widened this time, as a result of a stronger monthly increase in prices on the domestic market (0.5%). Producer prices on foreign markets were marginally lower month-on-month. Consumer goods continued to record the strongest year-on-year growth, which edged up to 3.6%. This reflected a 0.8 p.p. acceleration in the growth of durable goods prices (to 1.2%), while the growth of non-durable goods prices remained unchanged (4.2%). Within non-durable goods, price growth in the manufacture of food products strengthened again (4.9%). Price growth in the intermediate goods group remained moderate (0.4%) and slowed for the second consecutive month. Prices of energy (-4.9%) and capital goods (-0.4%) remained lower year-on-year amid subdued economic activity.