Competitiveness

Related Files:

Slovenian Economic Mirror 5/2017

This year activity is increasing in most activities and the prospects remain favourable. The labour market situation continues to improve under the impact of favourable economic conditions, while wage movements remain moderate. Year-on-year growth in consumer prices has been down again in the last few months. Amid favourable economic developments and moderate expenditure growth, the general government deficit on a cash basis was low in the first four months.

Related Files:

- International environment

- Economic developments

- Labour market

- Prices

- Balance of payments

- Financial markets

- Public finance

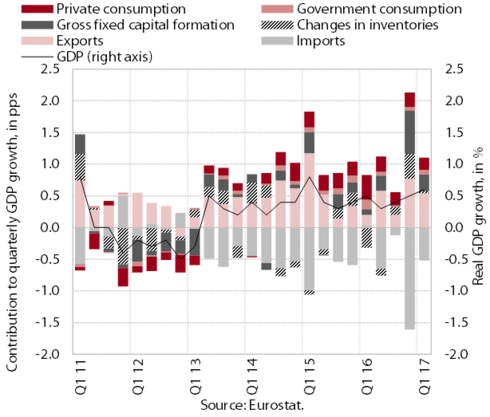

n the first quarter economic growth in the euro area strengthened further. GDP rose by 0.6% and was 1.9% higher year on year. Growth continues to be driven by domestic demand; exports are also rising, amid the recovery of the global economy and trade. Growth in private consumption is underpinned by higher employment and improving consumer confidence. The recovery in investment continues to be stimulated by favourable borrowing conditions and higher profitability of firms.

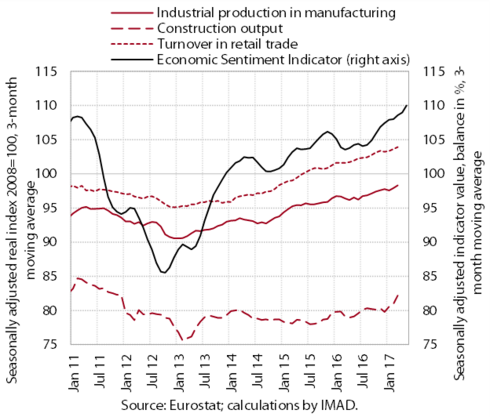

At the beginning of the second quarter the growth of activity in the euro area continued to strengthen and the prospects remain favourable. The value of construction output rose strongly in the first four months and the increase in the number of building permits indicates further growth. Production volume in manufacturing rose further; amid rising orders, firms also expect production growth in the future. Turnover in retail trade increased again and consumer confidence remains high.

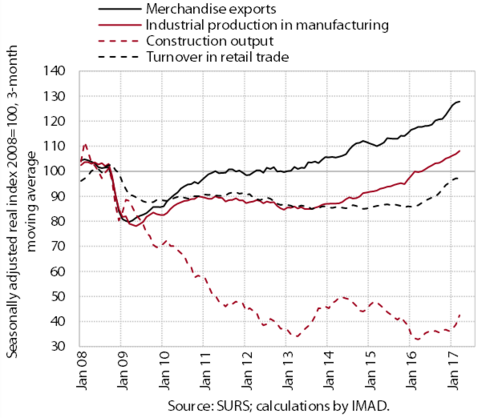

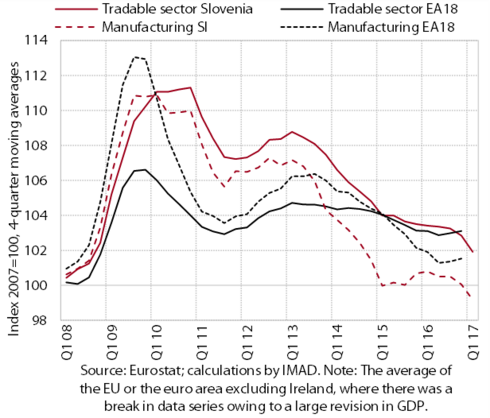

This year activity is increasing in most sectors and the prospects remain favourable. Higher foreign demand and competitiveness gains boost further growth in exports and manufacturing production. The improvement in economic conditions and the recovery of the property market are reflected in the strengthening of construction activity. Private consumption, which is rising under the impact of favourable labour market conditions and high consumer confidence, is contributing to turnover growth in trade and services, particularly those related to leisure. This is also due to a higher number of foreign tourist arrivals. Amid the strengthening of domestic and foreign demand, turnover is also rising in most other market services. Economic sentiment remains high.

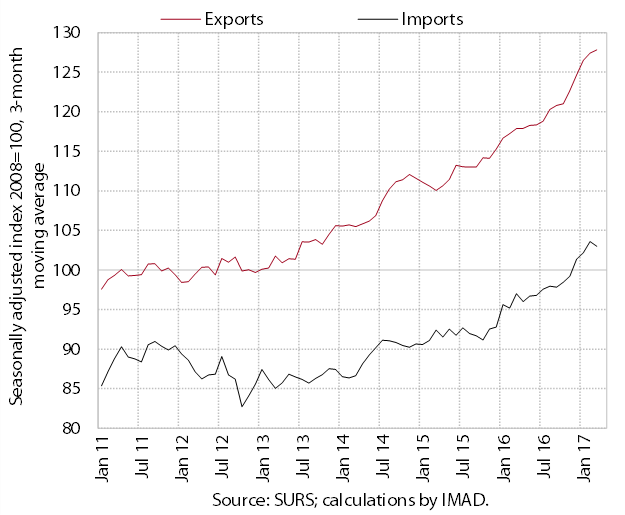

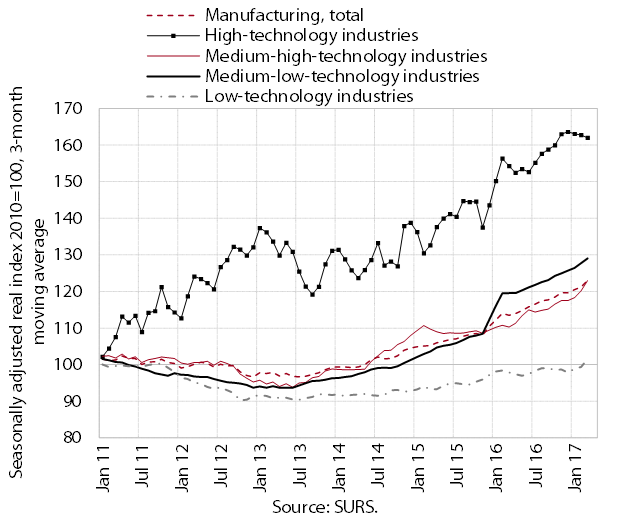

Real exports and imports of goods remained high in April after the pronounced growth in previous months. In the first four months exports were up 7.3% year on year. Their growth continued to be underpinned by rising foreign demand and competitiveness gains in manufacturing. The greatest contribution to export growth came from technologically more intensive industries. Imports recorded 7.6% growth in this period. In addition to favourable export trends, it was underpinned by rising domestic private and investment consumption.

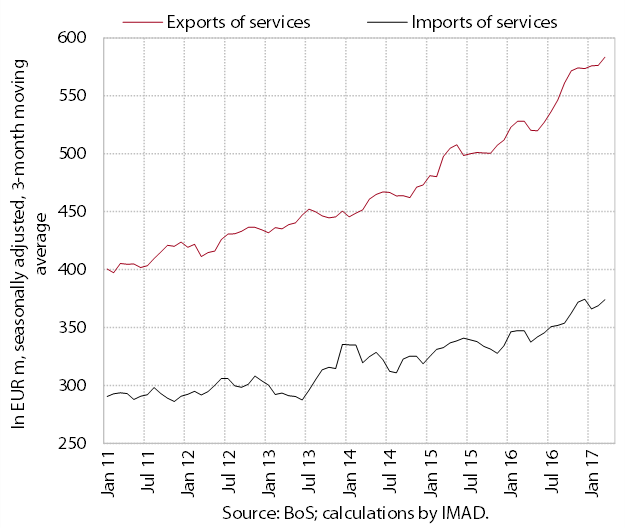

Nominal exports of services rose further in April; imports remained high. In the first four months exports were up 10.9% year on year, their growth being mainly driven by exports of transport services and technical, trade-related and other business services. Imports were 7.4% higher year on year in this period, largely owing to increased imports of transport services and professional and management consultancy services.

Production volume in manufacturing remained high in April after growth in previous months. This year it continues to rise particularly in medium-low- and medium-high-technology industries. In high-technology industries, which made a significant contribution to total production growth in manufacturing last year, production has maintained similarly high levels since the end of last year. The recovery of low-technology industries – which generate the bulk of their turnover on the domestic market, where demand is recovering more slowly than abroad – remains modest.

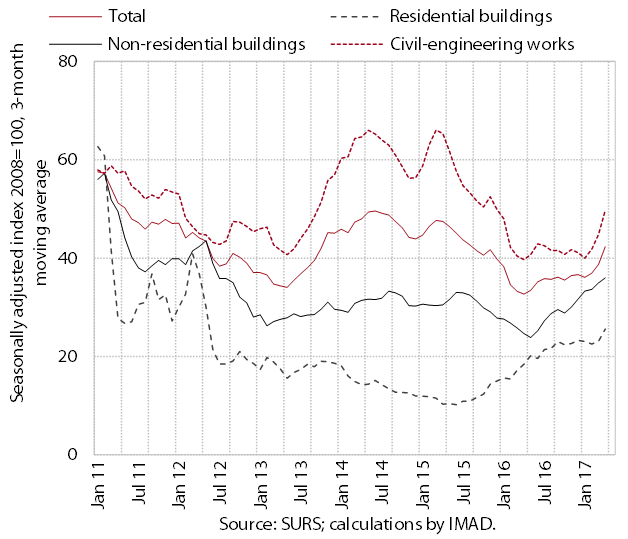

The value of construction output strengthened at the beginning of this year. The construction of buildings is picking up, amid a general improvement in economic conditions and a gradual rebound of the property market. Activity in the construction of residential buildings started to recover mid-2015; the recovery in the construction of non-residential buildings started up mid-2016 and continued at the beginning of 2017. The construction of civil-engineering works, which dropped sharply last year due to lower government investment, rose at the beginning of the year.

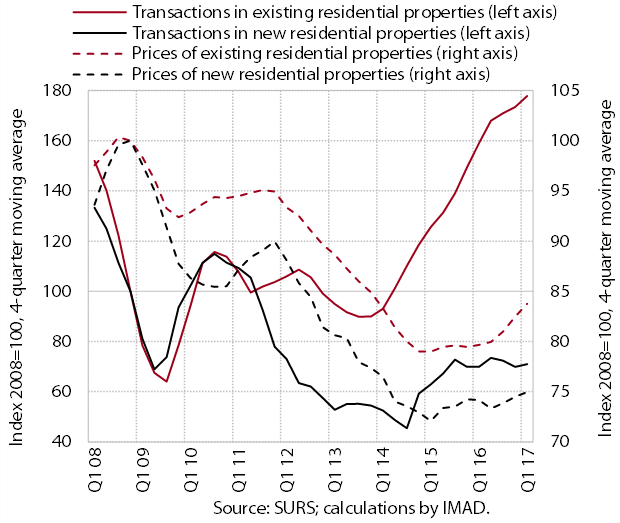

With the continuation of high sales, residential property prices rose further in the first quarter. Prices were up 5.9% year on year and around one-fifth lower than the 2008 peak. The prices of existing flats, which account for around two-thirds of total sales, rose the most in Ljubljana. The prices of existing flats outside Ljubljana were also up. The number of transactions in these flats was the highest in ten years. The number of transactions in new properties remains half lower than the 2007 peak.

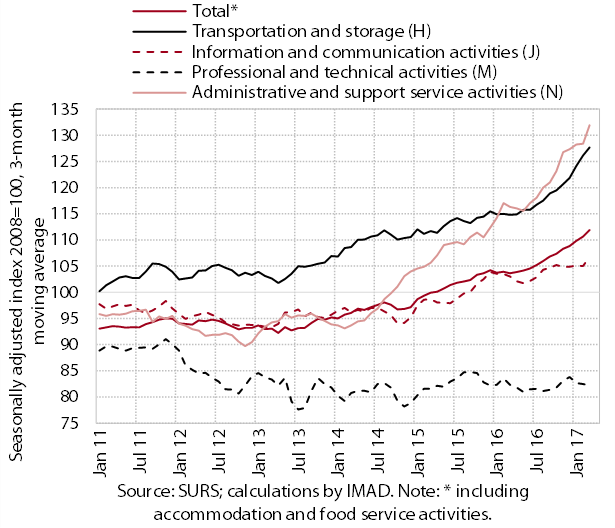

In April nominal turnover continued to grow in most market services. With the strengthening of employment, turnover continues to increase rapidly in employment services (part of N activities). Foreign demand is boosting growth in more export-oriented service sectors, such as road transport and computer services. Activity in professional and technical activities remains low, particularly in architectural and engineering services, where turnover continues to decline.

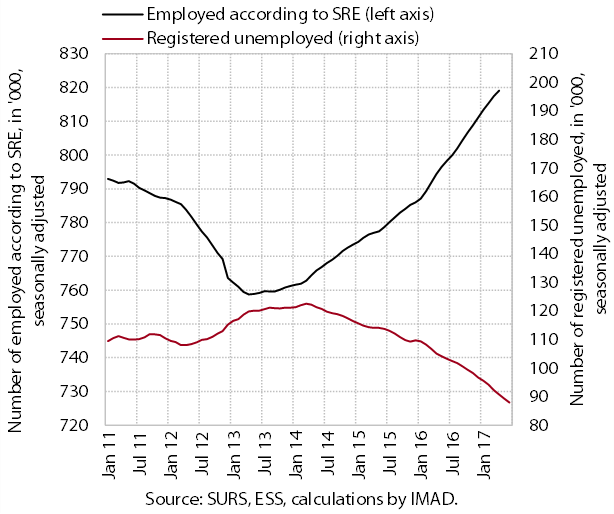

Growth in the number of employed persons remains strong and continues in most activities. In recent months the number of employed has reached the level from the beginning of 2007. Short-term expectations of enterprises about future employment indicate a continuation of favourable trends. However, a certain segment of enterprises, particularly in manufacturing, is already facing a shortage of skilled labour. Given the relaxation of hiring restrictions in 2016, the number of employed persons in public service activities remained higher year on year particularly in the health sector and primary education.

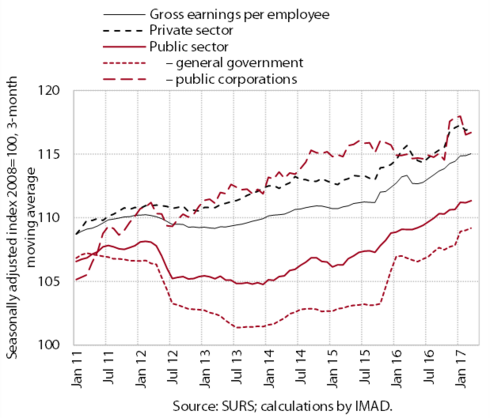

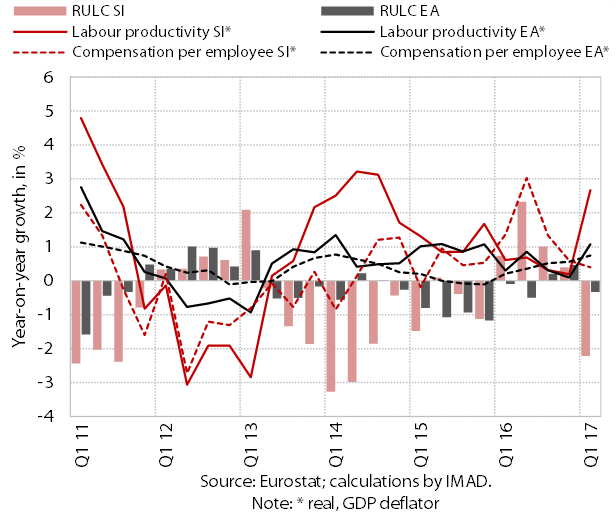

Wage movements remain moderate. After the stagnation in the first quarter, average gross earnings in the private sector remained almost unchanged in April; in the public sector they rose slightly. In the first four months both sectors recorded somewhat slower wage growth than in the same period of 2016.

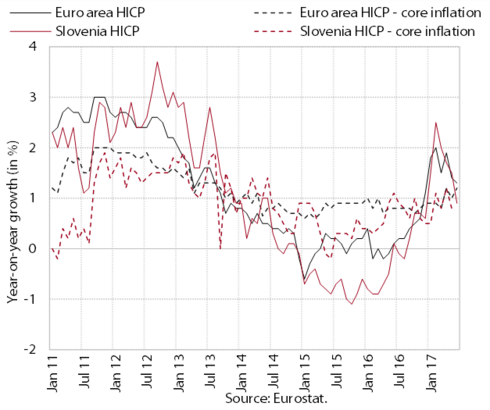

Year-on-year consumer price growth has been down again in the last few months. This is mainly related to the smaller contribution of energy prices owing to the decline in global prices of oil. Food price growth has also eased. Services prices remain up year on year particularly as a result of a further strengthening of private consumption (accommodation and food service activities). Prices of durable and semi-durable goods have remained lower year on year.

Industrial producer prices and import prices continue to increase year on year. The growth of import prices is slowing as a result of declining commodity prices on global markets. In May the growth of domestic industrial producer prices remained similar to that in April.

In the first five months price competitiveness improved slightly year on year and remained stimulative for exporters. In the recent period the euro has otherwise strengthened in nominal terms, but was still lower year-on-year against most of the main currencies in and outside the EU. The real effective exchange rate deflated by relative consumer prices consequently declined to just below the level from one year before, which is close to the lowest figures since Slovenia’s entry into the ERM2 in 2004 recorded two years ago.

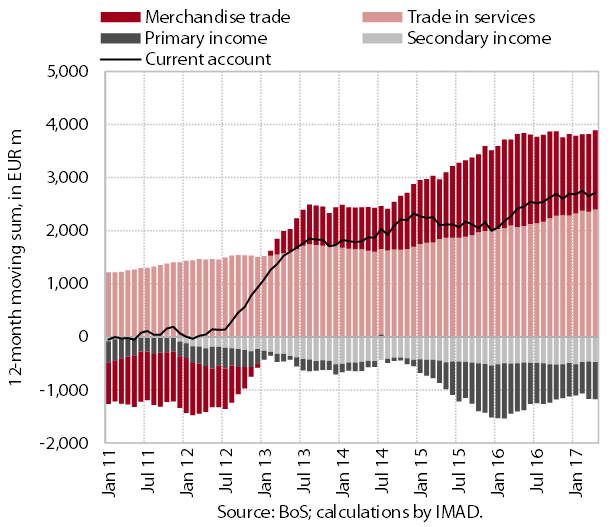

Despite the deterioration in the terms of trade, the current account surplus remained high in the first four months. In the twelve months to April it totalled EUR 2.7 billion (6.5% of GDP). The higher surplus in current transactions in comparison with the previous 12-month period was mainly due to the higher trade surplus in services, while the surplus in trade in goods was lower due to the faster volume growth of imports than exports and deteriorated terms of trade. The deficit in primary income was down mainly owing to lower net payments of interest on external debt and lower estimates for reinvested profits, while the deficit in secondary income was down owing to higher transfers to the private sector.

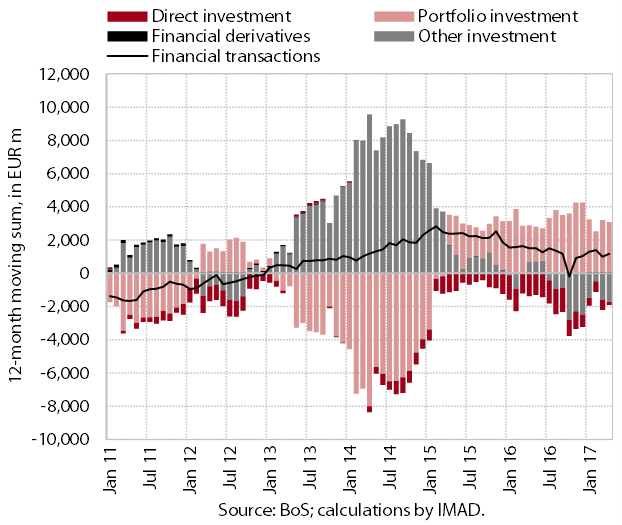

The net outflow of external financial transactions continues. The financial flows of the government sector were roughly balanced. The private sector recorded a net outflow. Enterprises increased short-term trade credit to the rest of the world, which is related to the growth of exports of goods and services, while commercial banks were buying foreign debt securities in particular and deleveraging. The BoS increased financial investment in foreign securities, but recorded a net inflow by borrowing from the Eurosystem.

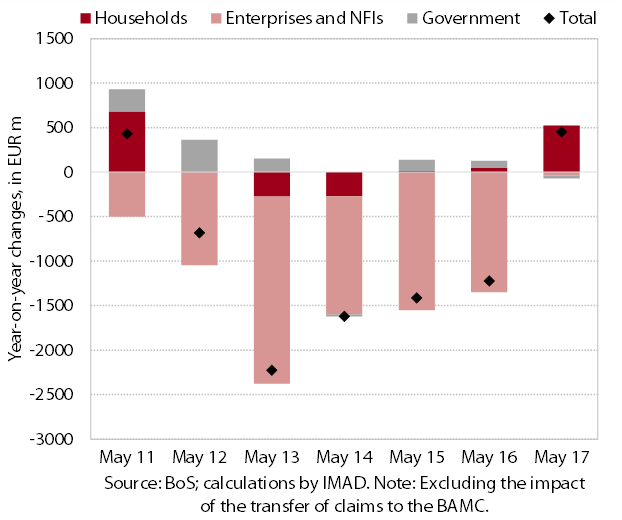

In May the volume of loans to domestic non-banking sectors continued to increase gradually year on year. Household borrowing is rising. The year-on-year decline in the volume of corporate and NFI loans has almost come to a halt. Lending conditions being more favourable abroad, enterprises continue to borrow from foreign banks, particularly in the form of long-term loans (with maturities over one year), where interest rate differences are greatest. Among sources of finance, banks continue to reduce liabilities to foreign banks, substituting them by deposits of domestic non-banking sectors, particularly households and non-financial corporations.

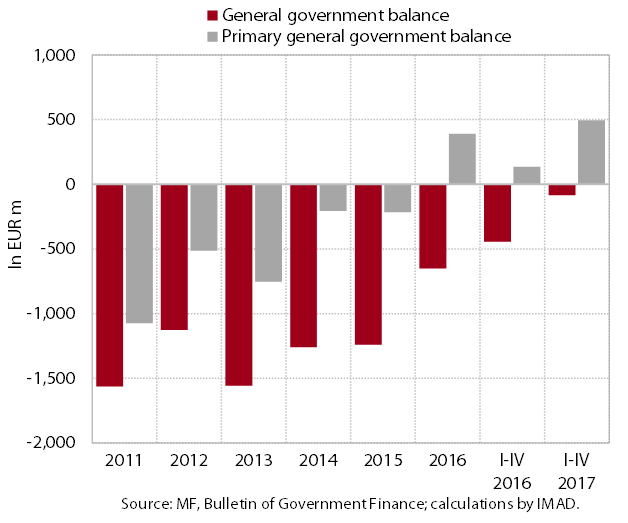

The favourable fiscal movements at the beginning of the year are based on relatively rapid year-on-year growth in most revenue categories and moderate growth in expenditure. In the first four months the general government deficit on a cash basis reached one-fifth of the figure from the same period of last year, while the surplus of the primary balance was significantly higher. In addition to certain one-off factors, the strong revenue growth is attributable primarily to favourable economic conditions, including the labour market situation. Owing to the relaxation of austerity measures, the greatest contribution to expenditure growth is coming from compensation of employees and some current transfers to individuals and households; the rapid growth of sickness benefits also continues. Total expenditure growth nevertheless remains moderate, the main reasons being low growth in investment amid the modest absorption of EU funds and year-on-year lower payments into the EU budget.

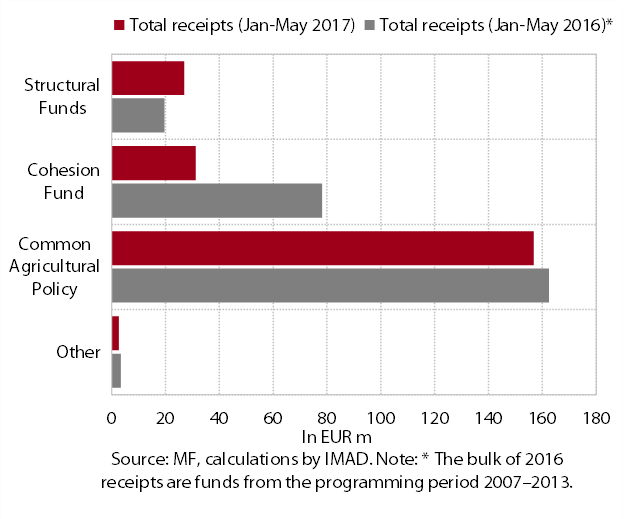

Slovenia’s net budgetary position against the EU budget was positive in the first five months (EUR 53.6 million). The bulk (two-thirds) of receipts were a consequence of the absorption of funds under the Common Agricultural and Fisheries Policy. In May the Slovenian government adopted starting points for the revision of the Operative Programme, taking into account the changed circumstances with regard to the estimated needs, priority investments and acceleration of EU funds absorption. The starting points envisage that Slovenia will be allocated additional EUR 56 million for infrastructure and human resource development with the emphasis on active ageing. One of the more important reallocations is the reallocation of a portion of funds for the construction of the second rail track on the Koper–Divača line.