Competitiveness

Related Files:

Slovenian Economic Mirror 2/2016

At the beginning of the year, short-term indicators of economic activity in the euro area continued to improve; the values of confidence indicators remained relatively high despite deterioration. In Slovenia, most short-term indicators of economic activity improved further at the beginning of the year.

Related Files:

- International environment

- Economic developments

- Labour market

- Prices

- Balance of payments

- Financial markets

- Public finance

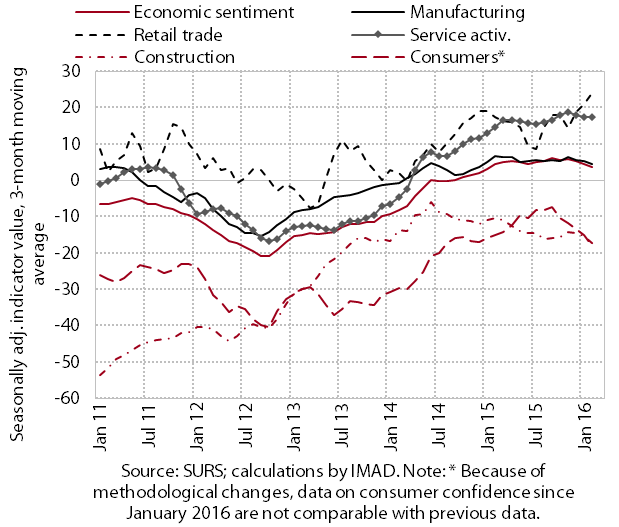

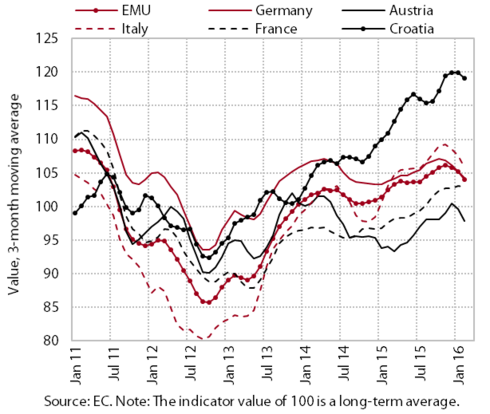

At the beginning of the year, short-term indicators of economic activity in the euro area improved further; the values of confidence indicators have remained relatively high despite deterioration. Activity increased across all sectors, notably construction. However, uncertainties remain regarding further growth in the international environment, which impacted confidence in the euro area. The value of the Economic Sentiment Indicator (ESI) fell slightly in the first three months for most of Slovenia’s main trading partners but remains above the long-term average. The Purchasing Managers’ Indicator (PMI) also deteriorated at the beginning of the year but still indicates a continuation of activity growth in manufacturing.

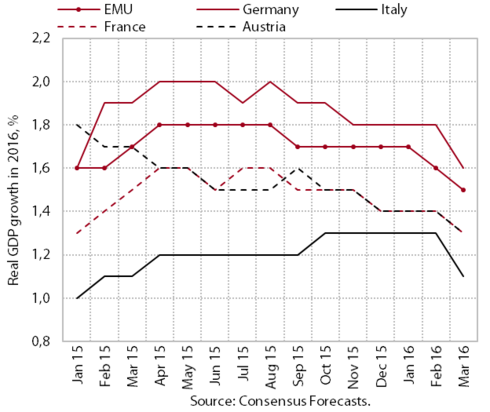

This year international institutions revised downwards their growth forecasts for the euro area. After the release of the winter forecasts by the IMF, EC, OECD and ECB, Consensus lowered its euro area forecast in March. Despite the decline for 2016, all forecasts indicate a continuation of the economic recovery for Slovenia's main trading partners except Russia. In its latest forecast the ECB predicts that euro area GDP will increase by 1.4% in real terms this year and by 1.7% in 2017. The lower growth than projected in the autumn (by 0.3 percentage points in 2016 and 0.2 percentage points in 2017) will mainly reflect lower export growth owing to weaker growth prospects for the global economy. Inflation in the euro area will remain low (0.1% this year and 1.4% in 2017).

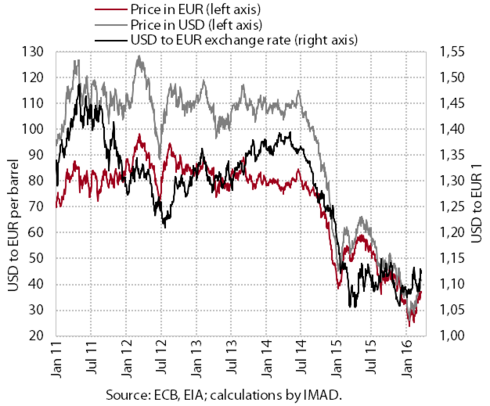

Prices of Brent crude have been rising since mid-February but remain much lower than one year earlier. In March they were almost a third lower year-on-year. According to the IEA, price rises are mainly due to the beginning of negotiations among main oil producers on limiting oil production.

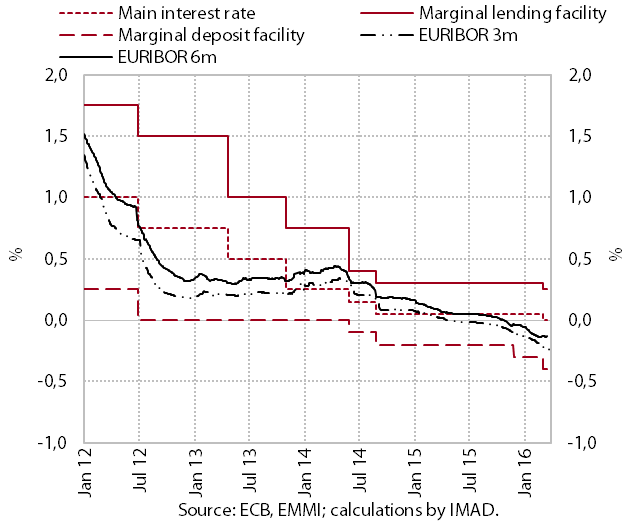

In March the ECB took further action to achieve price stability. The ECB cut its interest rate on the main refinancing operations and the interest rates on the marginal deposit facility and the marginal lending facility, expecting them to remain low for an extended period of time. It also increased its monthly purchases under the asset purchase programme (intended to run until the end of March 2017) from EUR 60 billion to EUR 80 billion and expanded the list of eligible assets for purchases to include not only government bonds, but also bonds issued by the corporate sector. Moreover, it will start conducting a new series of targeted longer-term refinancing operations (TLTRO II) in June. The adoption of these measures was reflected in the yields to maturity of euro area sovereign bonds, most of which dropped in March. The yield to maturity of the Slovenian euro bond was at the lowest level since April 2015 (at 1.44%).

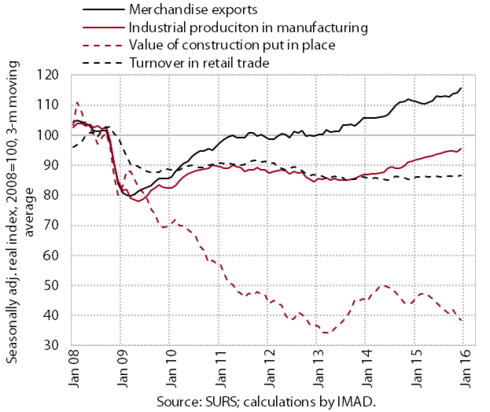

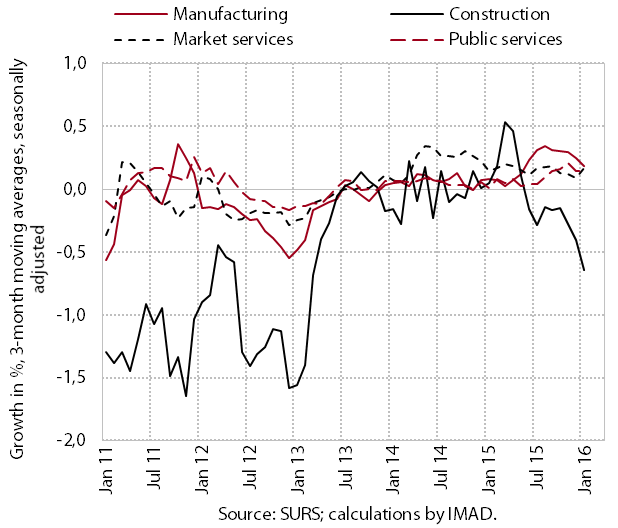

Most short-term indicators of economic activity in Slovenia improved further at the beginning of the year. After the moderation at the end of 2015, merchandise exports and manufacturing production rose significantly. Increased demand and the strengthening of production activity contributed to further turnover growth in most market services. The improvement in labour market conditions owing to higher economic activity and the pick-up in private consumption translated into further growth in some segments of trade and in tourism-related services. Activity in construction remained low at the beginning of the year and the outlook for growth also remains poor. Confidence in other sectors remains high and indicates a continuation of the gradual recovery of activity in 2016.

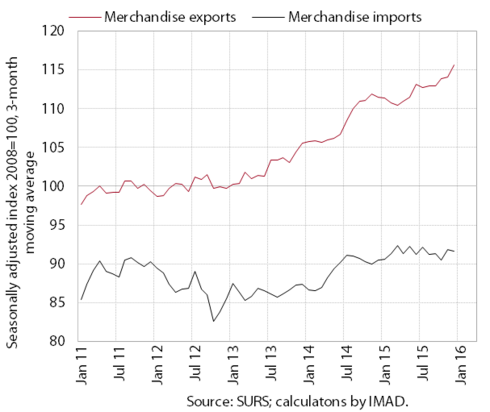

Growth in merchandise exports strengthened at the beginning of this year; imports have maintained the same level for quite some time. Exports to the EU have been picking up since the end of 2015, after maintaining the same level for a longer period. Exports outside the EU have also strengthened notably in recent months.typo3/#_ftn2 Broken down by product group, export growth is mainly driven by machinery (excluding road vehicles) and miscellaneous manufactured articles. typo3/#_ftn3Imports persist at the level of the second quarter last year, amid significant monthly fluctuations. Imports of consumer and intermediate goods increased in the last few months, while imports of investment goods declined slightly after a longer period of growth.

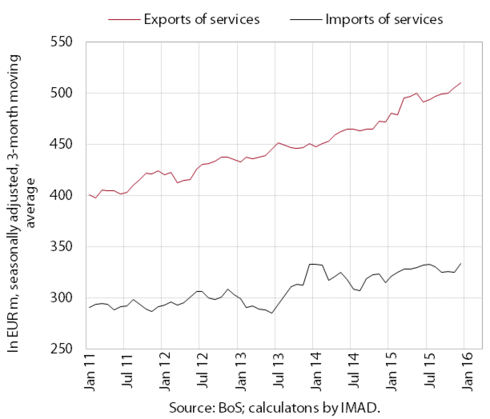

Growth in exports of services continued at the beginning of the year; imports also expanded slightly in the last few months. In January exports were up 8.0% year-on-year, driven primarily by higher exports of travel amid higher spending of foreign tourists and exports of transport services (particularly road and maritime transport). Imports were also up year-on-year (7.8%), largely as a result of higher imports of business and financial services.

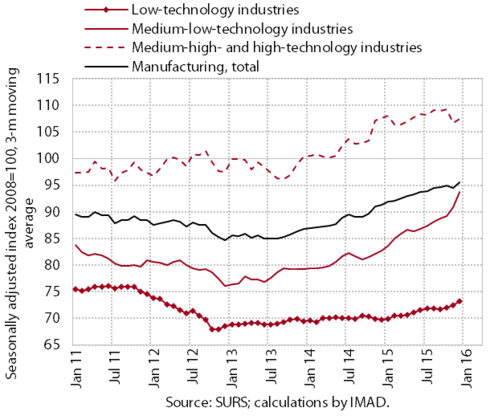

Manufacturing production recorded further growth in January. It was driven by industries of all levels of technology intensity, which, on average, also exceeded production levels recorded in January 2015. Much as in 2015, the largest year-on-year increases were recorded for some largest export-oriented industries – the metal industry and the manufacture of ICT and electrical appliances. After last year’s strong growth, transport equipment recorded significantly lower production year-on-year.

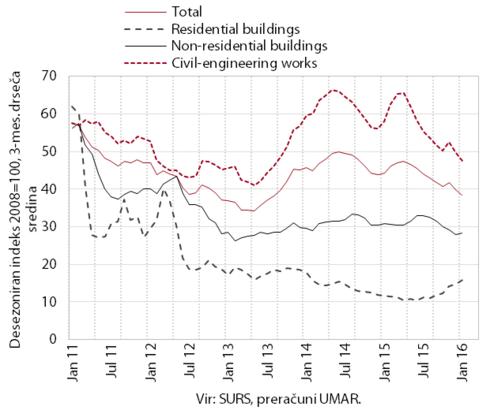

The value of construction put in place remained low at the beginning of the year. With the exception of the surge in November, activity declined in the last twelve months to January. Only the construction of residential buildings had been rising since mid-2015, but remained close to the lowest levels in the last few years. With a further decline in the stock of contracts and the value of new contracts, growth prospects remain poor for all three construction segments.

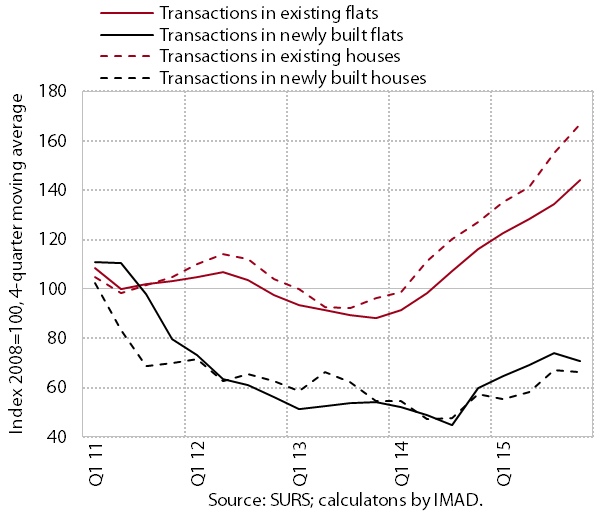

Last year, the sales of dwellings were increasing and were a quarter higher in 2015 as a whole. The sales of existing dwellings exceeded the level seen before the crisis. The sales of new dwellings also rose year-on-year, boosted by ongoing sales of dwellings from the bankruptcy estate and flats sold by the Housing Fund of the Republic of Slovenia, but were still considerably lower than in 2007. We estimate that the rebound in real estate transactions was due not only to the still low prices, but also to the relatively low effective interest rate on housing loans and the improved economic situation owing to the labour market recovery.

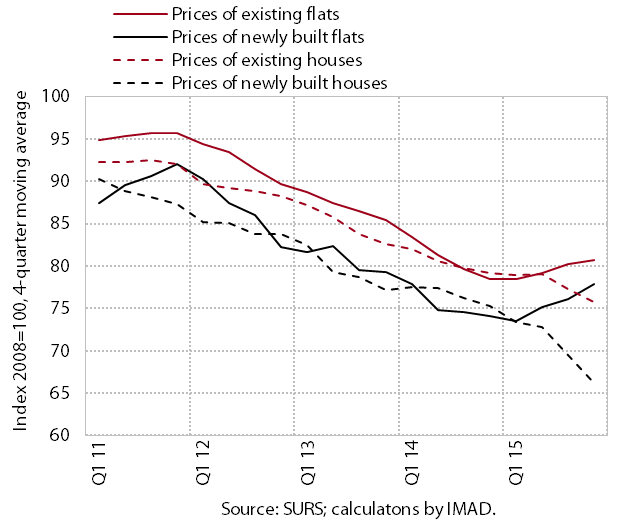

The decline in dwelling prices came to a halt in 2015, but there were significant differences between individual dwelling types. In the year as a whole, prices of flats were up for the first time since 2011,typo3/#_ftn1 while prices of family houses dropped for the seventh year in a row.

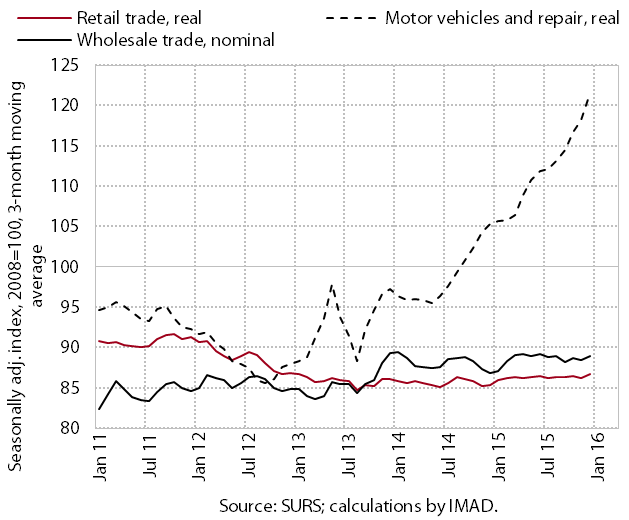

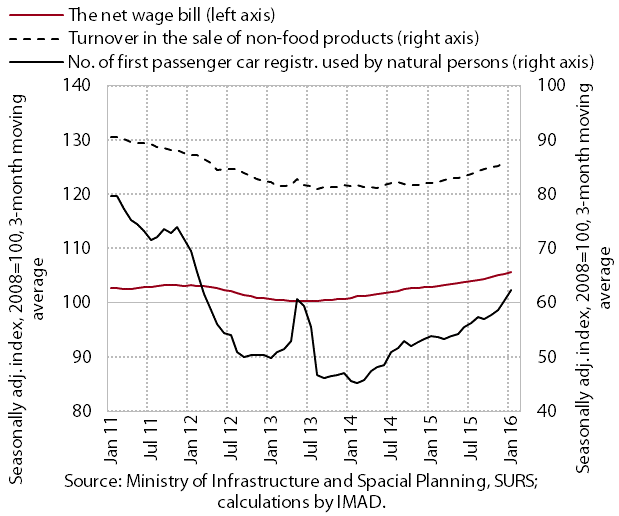

At the beginning of the year, the distributive trades sector recorded further turnover growth in the sale of motor vehicles and non-food products. The sales of passenger cars to natural and legal persons rose again. The sales of freight vehicles were also notably higher than one year earlier. Retail trade recorded further growth in turnover in durable and semi-durable non-food products. In the last few months to January, turnover also rose slightly in the sale of food products, but remained low.

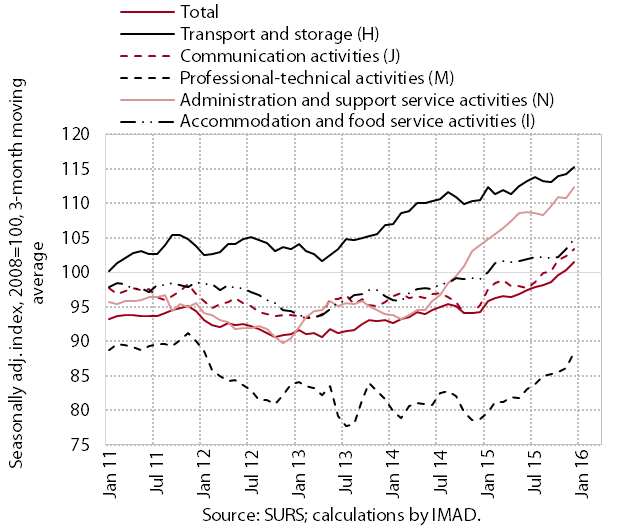

In most market services, nominal turnover rose further at the beginning of the year. Its growth was underpinned by increasing production activity (particularly in legal-accounting, management-consultancy and employment services) and private consumption (primarily in accommodation and food service activities); in some services growth also stemmed from higher sales on foreign markets (especially transportation and computer services).

Household spending increased further at the beginning of the year. Expenditure on vehicle purchases and durable goods related to residential construction and home furnishings rose further; at the same time, households also increased spending on some semi-durable goods (clothing and footwear, products for personal care). Expenditure on tourism-related services also continued to rise.

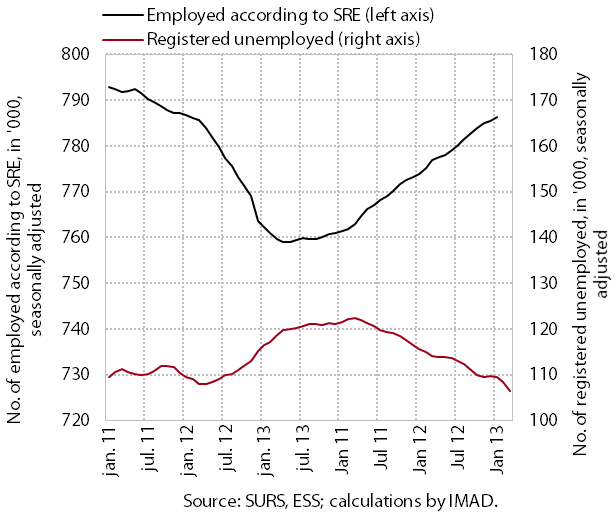

At the beginning of the year, the number of employed personstypo3/#_ftn1 continued to grow. With further growth in activity, the number of employed persons rose further in most private sector activities in January. In addition to the manufacturing sector (where most of the workers hired by employment agencies were placed, according to our estimate), employment also rose strongly in non-financial market services. It was up year-on-year particularly in medium-low technology manufacturing and trade, accommodation and food service activities and transportation. In public services it was up year-on-year particularly in the health sector; in education, it rose the most in pre-school and basic education, also owing to the more numerous generations of children.

In the first quarter the number of registered unemployed continued to decline. This was mainly due to the slightly stronger outflow into employment, which was also up year-on-year in the first three months. The inflow was smaller than in the first quarter of 2015, as a result of fewer people losing their jobs and fewer first-time job seekers. At the end of March, the number of unemployed was down year-on-year (by 6.7%), the number of registered unemployed totalling 110,226.

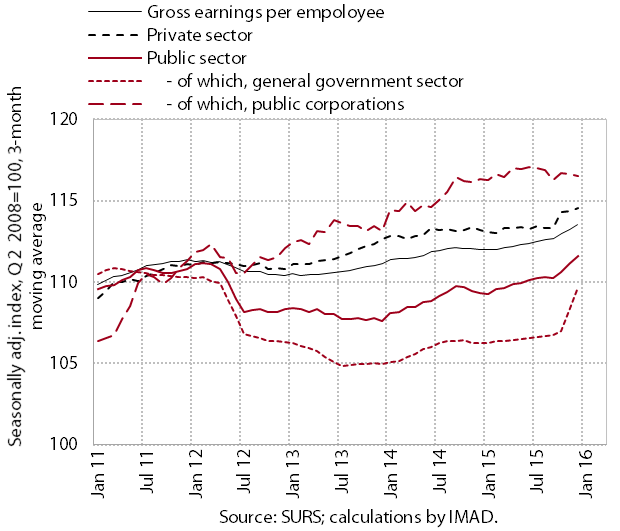

After the significant strengthening of growth at the end of last year, average gross earnings per employee also increased slightly in January. After last year’s modest growth, they increased further moderately in the private sector. Earnings in the public sector declined slightly owing to a fall in public corporations, where they fluctuate significantly between months. In the general government, they remained at the high level recorded at the end of the year due to public servants' promotion raises and higher overtime and extraordinary payments related to the increased inflows of refugees and migrants.

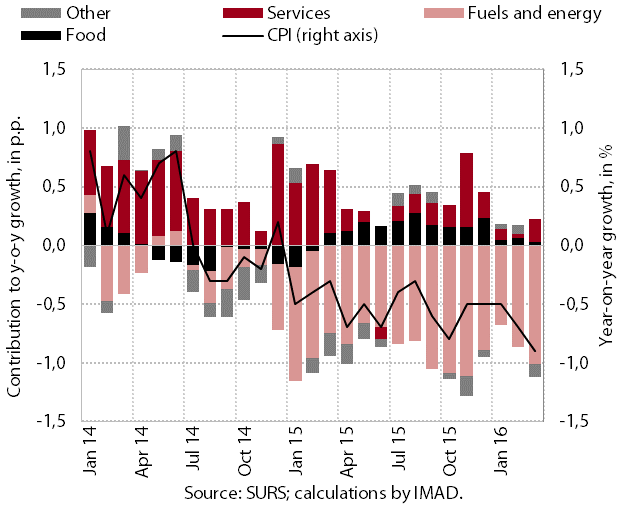

The year-on-year price decline in March (-0.9%) was mainly due to lower energy prices. Especially the prices of fuels for transport and heating declined. A slight fall was also recorded for gas and district heating. The year-on-year price decline was again the result of lower prices of durable goods, while increases in prices of food, services and semi-durables remained modest. The year-on-year fall in euro area prices (-0.1%) was also due to lower energy prices. Prices of food, services and durable and semi-durable goods were up year-on-year.

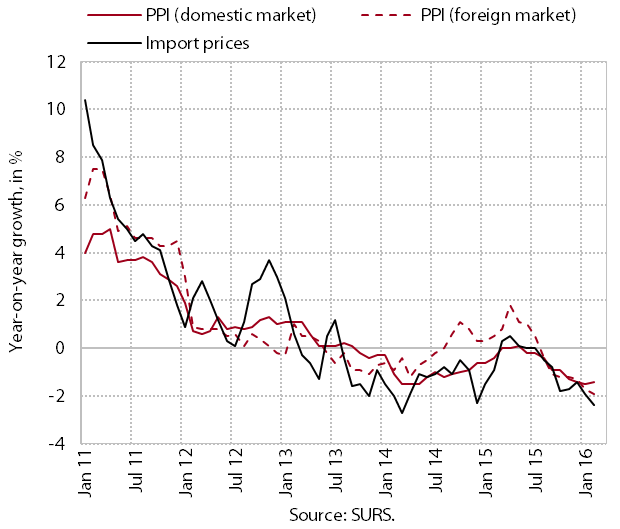

Amid lower prices on commodity markets, industrial producer prices and import prices continued to decline at the beginning of the year. The year-on-year price fall on foreign markets deepened further owing to a larger decline in the euro area. On the domestic market, the falling of prices eased at the end of last year.

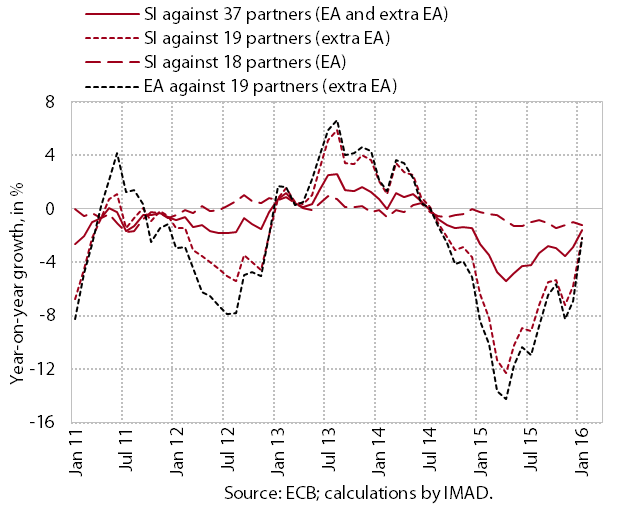

Price competitiveness improved further in January. The improvement was mainly attributable to lower relative prices. In Slovenia prices continued to decline year-on-year, while in the euro area as a whole inflation has been rising since mid-2015. Gains in price competitiveness relative to the euro area have therefore strengthened slightly in this period. Conversely, the impact of the year-on-year fall in the exchange rate of the euro was relatively smaller. It has been declining since May 2015, when the euro started to appreciate gradually at the monthly level against the currencies of Slovenia’s main trading partners. The year-on-year improvement in price competitiveness against the trading partners outside the euro area therefore slowed significantly in the second half of 2015.

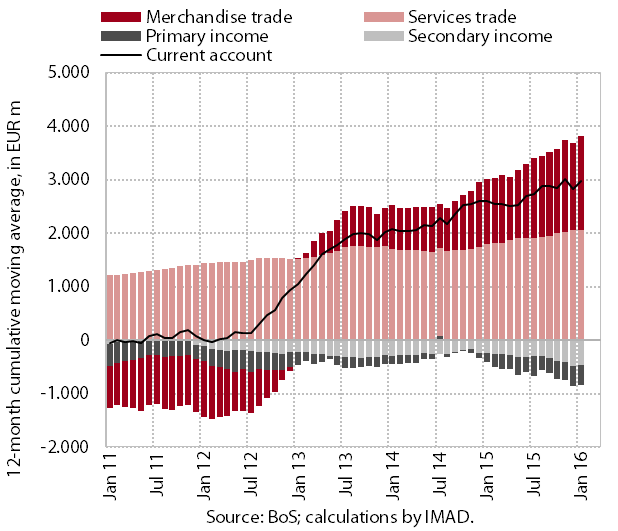

The surplus of the current account of the balance of payments remains significant. In the twelve months to January, the current account surplus totalled 7.5% of estimated GDP. It was up year-on-year primarily owing to a larger surplus in international trade in goods and services, which was also attributable to the favourable terms of trade. The deficit in primary income remained similar to that one year earlier: the costs of servicing the external debt were decreasing while the net payments of taxes were rising. The deficit in secondary income was down year-on-year primarily as a consequence of lower general government expenditure.

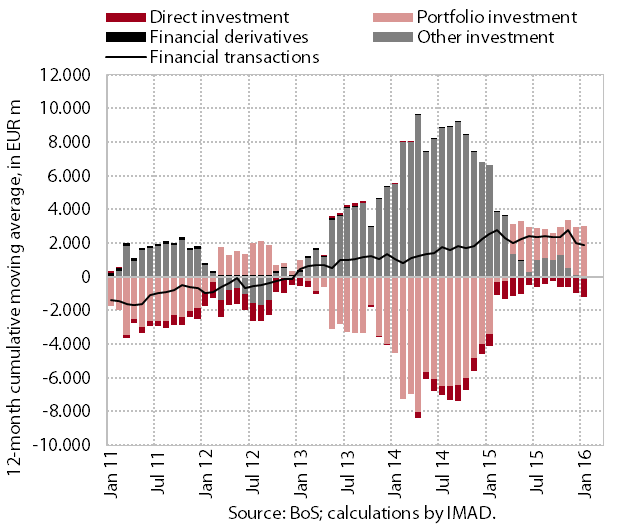

The developments in the financial account of the balance of payments in January were again characterised primarily by: higher net inflows of equity capital of foreign direct investors; withdrawals of BoS and household cash and deposits from foreign accounts; and further repayments of government and commercial bank liabilities to foreign portfolio investors.

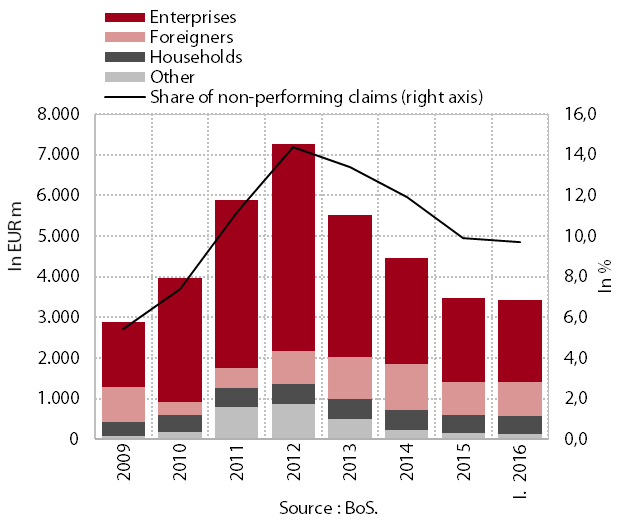

In February the decline in the volume of domestic nonbanking sector loans accelerated significantly, largely as a consequence of the liquidation of two smaller banks and, to a lesser extent, the deleveraging of non-banking sectors. Loan volume decreased by EUR 1.7 billion in the 12 months to February; not taking into account the liquidation of two smaller banks, the decline would remain at the level recorded one year before (EUR 1.3 billion), according to our estimate. In January enterprises and NFIs continued to deleverage abroad. In the twelve months to January, their net repayments totalled EUR 170 million, around 10% less than in the comparable period of 2015. Net repayments of long-term loans rose, while the inflow of short-term loans exceeded EUR 200 million. The gaps between domestic and foreign interest rates continue to narrow gradually. The share of non-performing claims has been declining at a slightly faster pace since the last quarter of 2015.

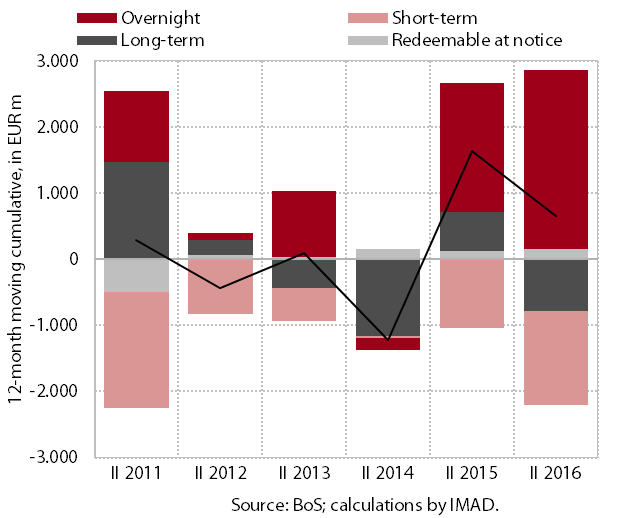

Looking at the sources of finance, banks continue to repay their liabilities abroad, while the increase in deposits by domestic non-banking sectors eased considerably. Bank deleveraging abroad, having totalled EUR 1.5 billion in the last twelve months (around 60% more than in the comparable period of 2015), slowed notably in the last six months. The increase in deposits by domestic non-banking sectors continues to slow, totalling EUR 650 million at the year-on-year level in February, which is around 40% of the level recorded in February 2015. This significant decline is mainly attributable to a fall in government deposits, but also to smaller inflows of household deposits, while the growth of corporate deposits in banks increases. The maturity structure of deposits continues to deteriorate, as growth is recorded mainly for overnight deposits.

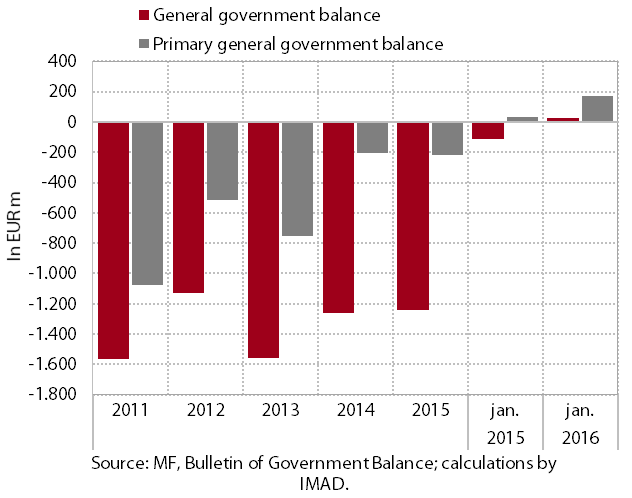

Owing to increased inflows of EU funds, the general government balance on a cash basis was positive in January and therefore more favourable than in January 2015. A significant factor in January’s surplus (EUR 25.7 million) was the dynamics of EU funds absorption at the end of the previous and the beginning of the implementation of the new financial perspective of the EU and the consequent decline in expenditure on subsidies and investment.

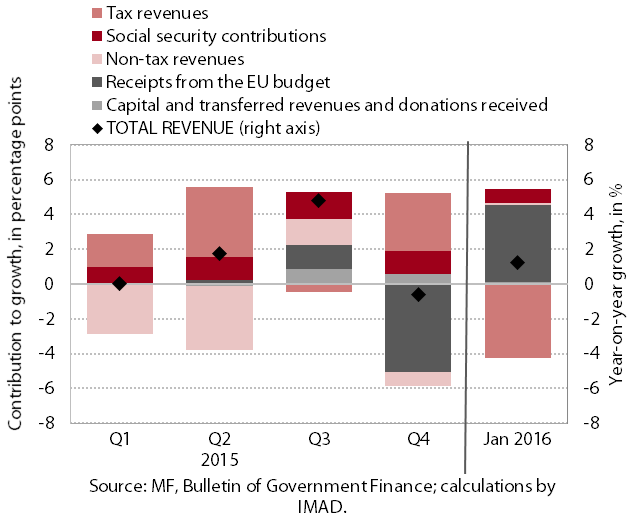

After 2015 growth, general government revenue was also slightly higher year-on-year in January. January’s year-on-year growth (1.2%) was almost entirely due to the increased receipts from the EU budget related to the previous financial perspective. Tax revenues were down year-on-year owing to the postponement of the payment of a part of excise duties from January to the beginning of February. Modest growth in personal income tax revenuetypo3/#_ftn1 arose from lower agricultural subsidies. Growth in collected VAT was also lower than in January 2015.

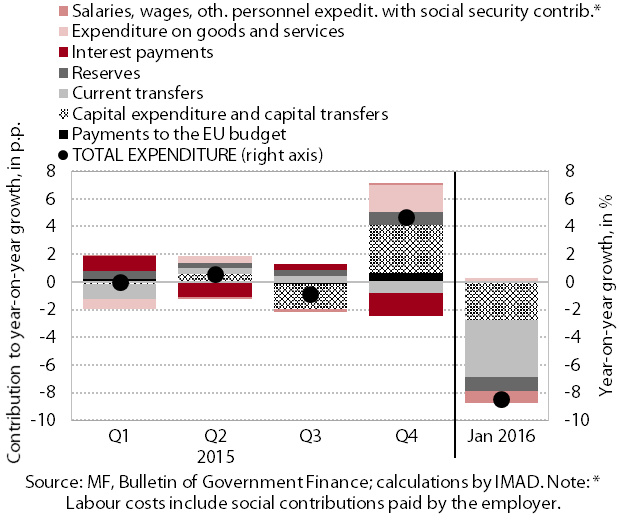

After last year’s growth, general government expenditure was significantly lower year-on-year in January. The largest contribution to January’s year-on-year decline in expenditure (-8.4%) came from lower expenditure on subsidies (particularly agricultural subsidies, which were paid with a delay) and investment, which declined due to the beginning of the implementation of the new financial perspective of the EU. A decline was also recorded for expenditure on funds for special purposes (within reserves) and the wage bill.

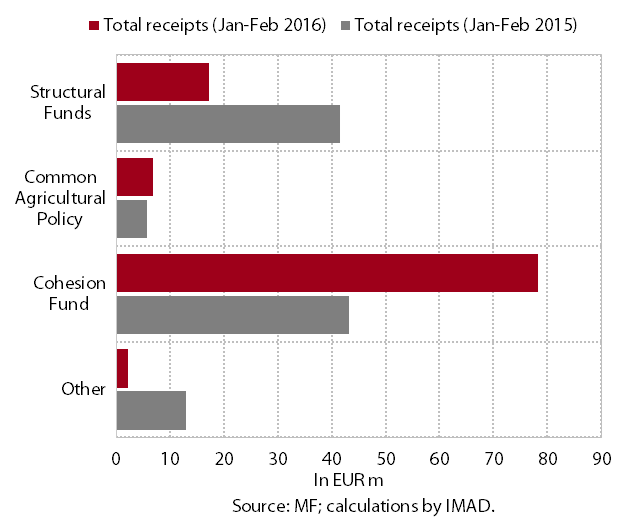

Slovenia’s net budgetary position against the EU budget was positive in the first two months (at EUR 23.6 million). Slovenia received EUR 129.2 million from the EU budget. The bulk of receipts were funds from the EU Cohesion Fund, all of which were from the previous financial perspective (2007–2013). Slovenia’s payments into the EU budget stood at EUR 105.5 million in the same period. The high amount paid in February was the result of the European Commission’s call for almost double the amount of average monthly GNI-based payments and payments for the UK correction, and triple the amount of average monthly VAT-based payments. The payments of obligations for the first two months have already covered more than a quarter of this year’s obligations of Slovenia's state budget to the EU budget.