Slovenian Economic Mirror

Related Files:

Slovenian Economic Mirror 8/2023

Most available economic indicators for Slovenia improved at the beginning of the fourth quarter. Real exports and imports of goods in October were similar to the previous month, while the year-on-year decline was slightly smaller. After manufacturing production had increased in September, it continued to rise slightly in October and was roughly at the same level as a year ago. The available data for the fourth quarter also point to a recovery in household consumption. Year-on-year growth in the nominal value of fiscally verified invoices was on average higher in October and November than in the previous quarter. After two months of year-on-year decline, sales of new passenger cars to private customers and the number of overnight stays by domestic tourists in Slovenia increased year-on-year in September and October. In October, purchases of non-food products were also higher year-on-year for the first time since January, while spending on food and beverages remained slightly below the previous year’s level. According to data on the value of construction work put in place, construction activity increased in September with the recovery from the floods and was significantly higher than last year. Sentiment in the Slovenian economy improved in November and was the highest it has been in six months, even though it is still lower year-on-year. The year-on-year decline in the number of registered unemployed is slowing, as is the year-on-year growth in the number of persons in employment. In November, year-on-year consumer price growth was the lowest in two years (4.9%). The main reason for the fall of 2 p.p. compared to October was lower contribution from energy prices, which was mainly due to the reintroduction of the exemption from the levy on renewable energy sources and combined heat and power generation.

Related Files:

- International environment

- Economic trends

- Labour market

- Prices

- Financial markets

- Balance of payments

- Public finance

Composite Purchasing Managers’ Index (PMI) for the euro area, November 2023

Economic sentiment indicators for the euro area im-proved slightly in November. The composite Purchas-ing Managers’ Index (PMI), which was at its lowest level in three years in October, rose slightly in November (to 47.6) but continues to point to weak activity in the fourth quar-ter of this year. Both indicators that form the composite PMI (for manufacturing and services) increased, although they are still below the 50 mark (the threshold between economic expansion and contraction). The Economic Sen-timent Indicator (ESI) for the euro area, which has been below its long-term average since July last year, was slightly higher in November than in October. Sentiment improved in most activities and among consumers. Com-pared to the same period last year, the economic climate remained slightly lower in November. Confidence fell in manufacturing and construction in particular, while it rose noticeably among consumers. The ifo index, which measures the business climate in Germany, improved in November for the third month in a row, which could point to a stabilisation of the German economy in the fourth quarter of this year.

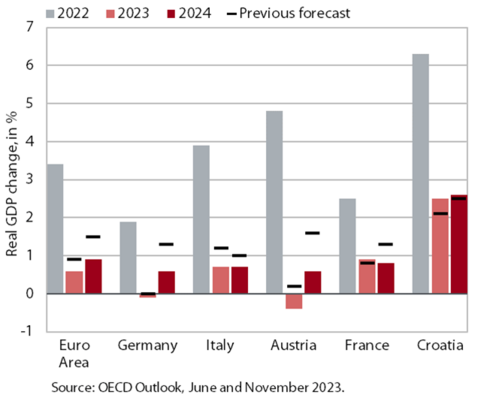

OECD economic outlook, November 2023

In their November forecasts, the OECD and the EC anticipate economic activity in the euro area to gradually recover. Growth is expected to pick up as private consumption recovers on the back of low unemployment, sustained wage growth and continued easing of inflation. November forecasts of economic growth have been revised downwards compared to the summer forecasts, however, as elevated inflation, tightened monetary policy and weak foreign demand have taken a heavier toll on activity than previously expected. In the euro area, GDP growth is projected to be 0.6% this year and between 0.9 (OECD) and 1.2% (EC) in 2024. In 2025, growth is expected to strengthen to around 1.6%. The downside risks to the economic outlook have increased due to the conflict in the Middle East. So far, its impact on the energy markets has been limited, but there is a risk of energy supply disruptions, which could potentially have a significant impact on energy prices. The recovery in China is also fraught with uncertainty. In addition, monetary tightening may weigh on economic activity for longer and to a larger degree than projected in the forecasts. The German budget crisis could also slow economic growth in the euro area.

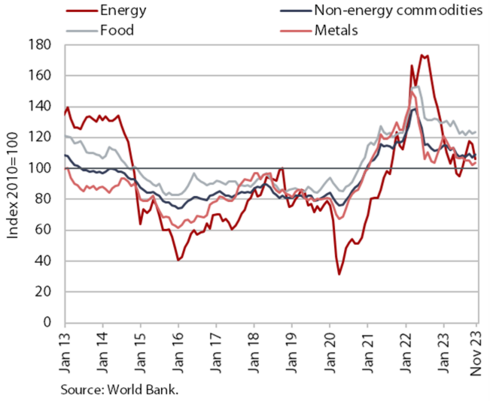

Commodity prices, October 2023

Brent oil prices continued to fall in November; prices for non-energy commodities have been largely un-changed for several months. The average dollar price of Brent crude oil in November was USD 82.9 (-8.5% month-on-month) and the euro price was EUR 76.77 (-10.5% month-on-month). After a significant oil price rise in September due to Saudi Arabia and Russia’s decision to extend their production cuts, the start of the war in the Middle East had no impact on the average price in Octo-ber and November. Year-on-year, the dollar Brent oil price was 9.3% lower in November and the euro price 14.5% lower. The euro prices of natural gas on the Euro-pean market (Dutch TTF) fell slightly in November after an increase in October related to oil extraction problems, while they were 62.3% lower year-on-year. According to the World Bank, the average dollar price of non-energy commodities has remained largely unchanged since the summer, while it was 2.7% lower year-on-year in November.

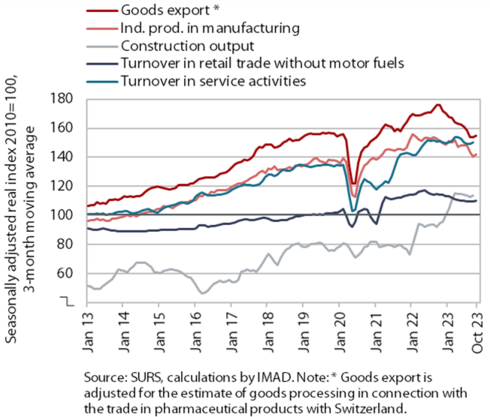

Short-term indicators of economic activity in Slovenia, September–October 2023

The deterioration in most available economic in-dicators came to a halt as we moved into the fourth quarter. Real exports and imports of goods in October were similar to the previous month, while the year-on-year decline was slightly less pro-nounced. After manufacturing production had in-creased in September, it continued to rise slightly in October and was roughly at the same level as a year ago. With the recovery from the floods, construction activity increased in September and remained signifi-cantly higher than last year. Real turnover in services rose in the third quarter compared to the second in most market services, with overall activity similar to last year. In most trade sectors, real turnover further declined compared to the second quarter. In a year-on-year comparison, it only remained higher in the sale of motor vehicles. According to preliminary data, turnover in October was also higher year-on-year in the sale of non-food products. Sentiment in the Slove-nian economy improved somewhat in November but remained lower year-on-year. The year-on-year de-cline in turnover was most pronounced in trade, con-struction and services.

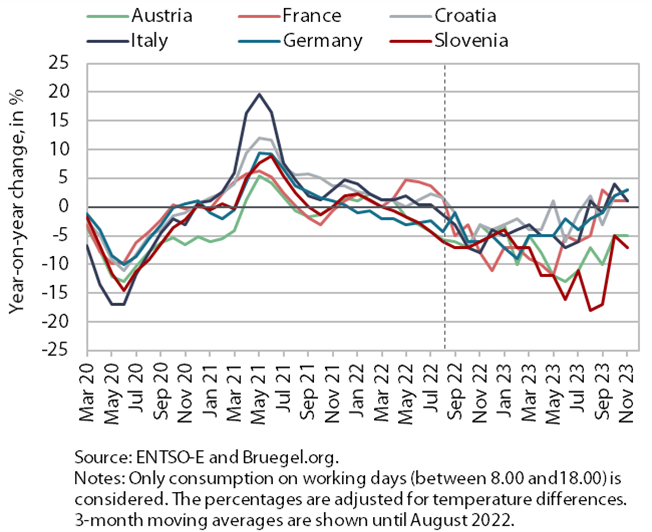

Electricity consumption, November 2023

Electricity consumption was 7% lower year-on-year in November. The year-on-year decline was less than in previous months, partly due to the resumption of part of the production at SIJ Acroni following the repair of the rolling frame’s main engine at the hot rolling mill. Among Slovenia’s main trading partners, lower consumption compared to November 2022 was recorded by Austria (-5%), while consumption in other trading partners was higher year-on-year, in France and Italy by 1% and in Croatia and Germany by 3%.

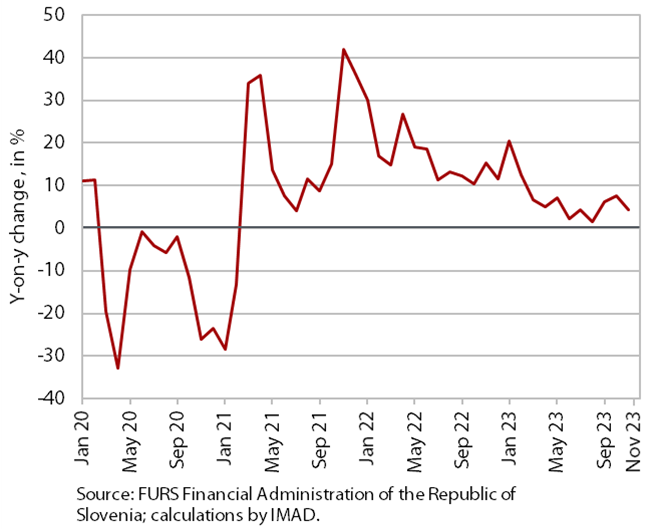

Value of fiscally verified invoices – nominal, November 2023

The nominal value of fiscally verified invoices was 4% higher year-on-year in November. Year-on-year growth in total turnover declined slightly in November, after increasing in September and October. This was mainly due to lower year-on-year growth in trade (5%; 7% in October), which accounted for almost 80% of the total value of fiscally verified invoices issued. Growth was lower in all three main trade segments. It was 4% in retail trade, 13% in the sale of motor vehicles and 1% in wholesale trade. Year-on-year turnover growth also slowed in accommodation and food service activities, certain creative, arts, entertainment and sports ser-vices, and betting and gambling (overall growth in ac-commodation and food service activities and other ser-vice activities fell from 11% to 8%).

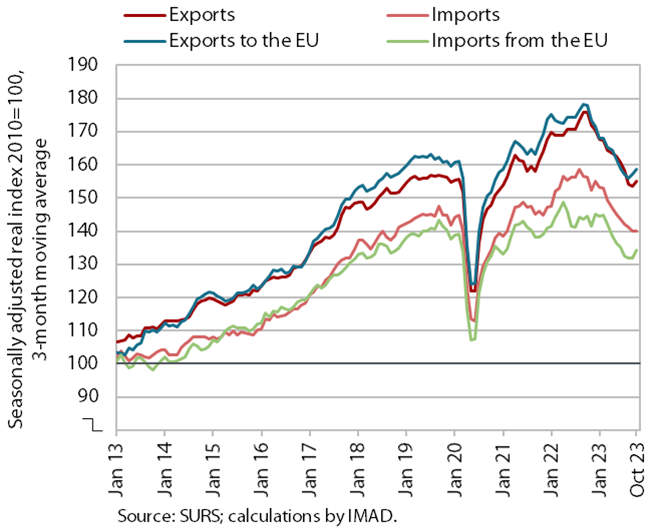

Trade in goods – in real terms, October 2023

Real exports and imports of goods in October were similar to the previous month, while the year-on-year decline was slightly less pronounced. The data on goods exports and imports over the last two months indicate that the trend of a monthly decline in goods trade (seasonally adjusted) came to a halt. According to the detailed data, this was mainly due to the slowdown in the decline in trade in intermediate goods. In the first ten months, total goods exports were 7.4% lower year-on-year and imports 7.6% lower. The decline in exports was more pronounced in the EU countries (EU -8.6%, non-EU -2.9%), while the decline in imports was more pronounced in the non-EU countries (EU -5.5%, non-EU -13.3%). Sentiment in export-oriented activities im-proved slightly in November for the second month in a row but was still much weaker than at the beginning of the year. Export orders are much lower than at the be-ginning of the year, which is mainly due to weak activity in Slovenia’s most important trading partners.

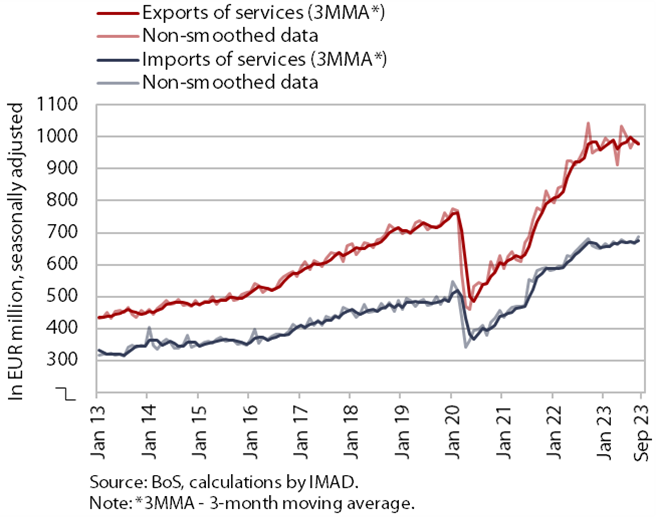

Trade in services – nominal, September 2023

In the third quarter, trade in services remained close to its peak, albeit with considerable differ-ences in the development of individual service ac-tivities. Exports of services fell slightly compared to the previous quarter (seasonally adjusted). This was mainly due to a further decline in exports of transport services, while exports of construction and ICT services also fell. Exports of tourism-related services, which al-ready account for almost 40% of total services exports, further increased, but growth was lower compared to previous quarters. Imports of services increased in cur-rent terms (seasonally adjusted), supported by an in-crease in imports of other business services and other services (especially insurance and financial services). Imports of some main service groups (transport, travel, construction, ICT), which otherwise account for around two-thirds of total services imports, declined. Year-on-year growth in trade in services slowed in recent months (exports -0.7%, imports 0.6%). Broken down by main groups, a particularly sharp year-on-year decline was seen in trade of transport services, while tourism-related services recorded a noticeable recovery.

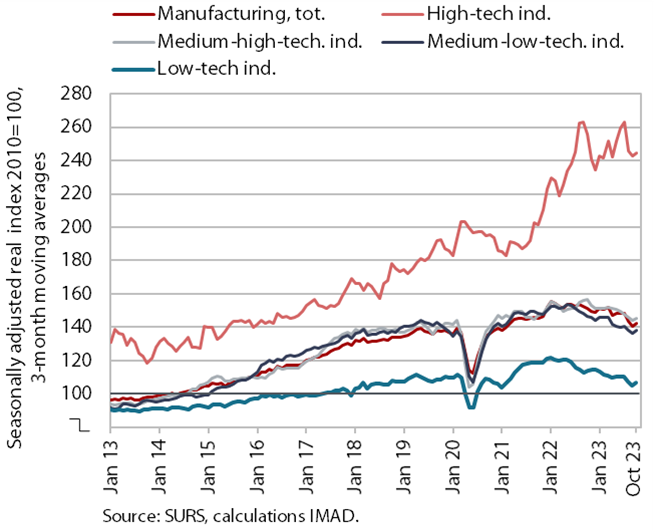

Production volume in manufacturing, October 2023

After manufacturing production had increased in September, it continued to rise slightly in October and was roughly at the same level as a year ago. Low- and medium-technology industries recorded fur-ther month-on-month growth, while production in high-technology industries declined. Amid strong monthly fluctuations, production in both high-technology industries was higher year-on-year in the first ten months. Other industries were mostly down year-on-year (with the exception of manufacture of ma-chinery and equipment, repair and installation, manu-facture of leather, and manufacture of food products). The sharpest declines were seen in the energy-intensive chemical and paper industries (down by more than 20%) and in the manufacture of non-metallic min-eral products and manufacture of basic metals (down by around 10%). Production in some low-technology industries (manufacture of textiles and wood-processing and furniture industries) was also signifi-cantly lower than a year ago.

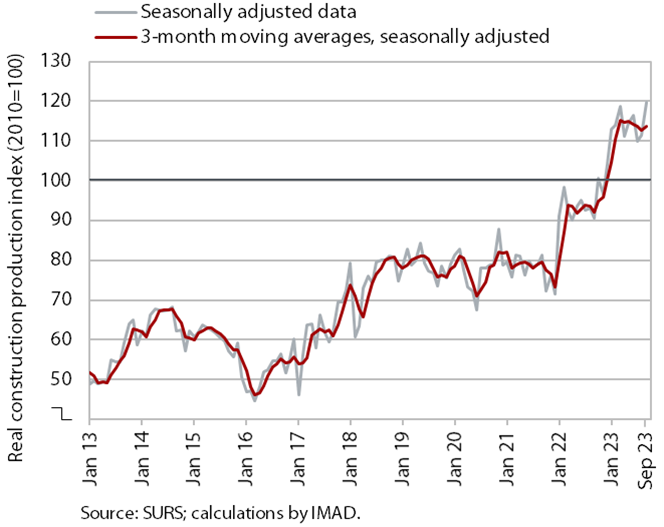

Activity in construction, September 2023

According to data on the value of construction work put in place, construction activity increased in September and remained significantly higher than last year. After a sharp rise at the beginning of the year, activity fluctuated around the high level reached in the following months before rising further in September as a result of the post-flood recovery. Compared with the same period last year, the value of construction put in place rose by 23% in the third quarter. Activity in specialised construction and civil engineering increased by 27% and activity in building construction increased by 13%.

However, other data suggest significantly lower growth in construction activity. According to VAT data, activity of construction companies in the third quarter increased by 11% year-on-year. Compared with the data on the value of construction put in place, the difference in the growth of activity shown was thus 12 p.p.

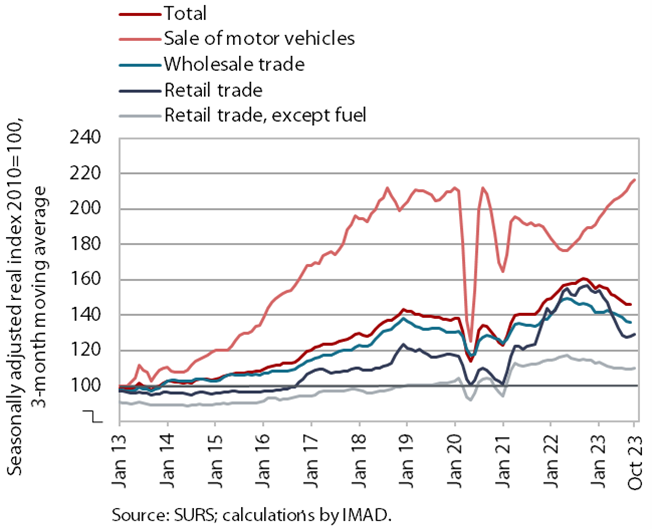

Turnover in trade, September–October 2023

In most trade sectors, real income continued to fall quarter-on-quarter in the third quarter, with only the sale of motor vehicles showing a year-on-year increase; according to preliminary data, it was higher year-on-year also in sale of non-food products in October. The year-on-year decline in turnover in wholesale trade, which has been on the decline in current terms since the spring, deepened in the third quarter (to -8%). The decline in retail trade (excluding automotive fuels) was slightly less pronounced than in the previous quarters due to growth in sales of food, beverages and tobacco products, which nevertheless remained below the previous year’s level (-2%). Sales of non-food products, which continued to decline in current terms, were also down year-on-year (by 8%). Only turnover in the sale of motor vehicles, which has increased in current terms since the middle of last year, remained higher year-on-year (by 13%). According to preliminary SURS data, it was also higher year-on-year in October, while turnover in retail trade was similar to the previous year due to growth in the sale of non-food products.

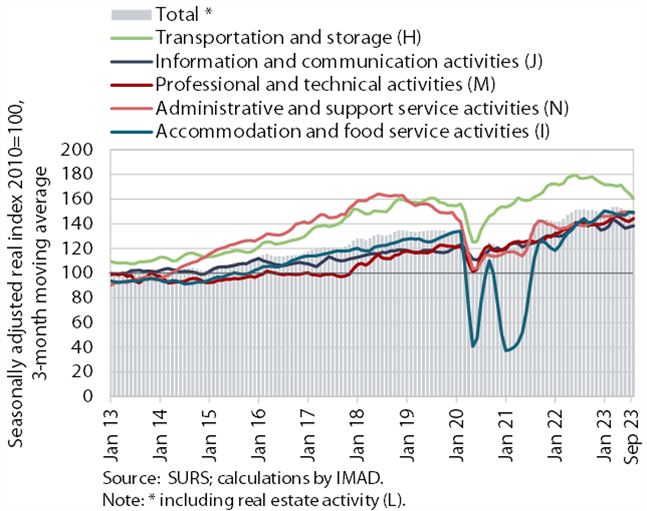

Turnover in market services, September 2023

Real turnover rose in the third quarter compared to the second in most market services. With an increase in the number of overnight stays, it increased in accommodation and food service activities, after falling in the previous quarter. After a sharp decline, it also rose in information and communication, with strong growth in both main sectors (telecommunications and computer services). Turnover also rose in professional and technical services and slightly in administrative and support service activities. In transportation and storage, on the other hand, the decline in turnover that began in the third quarter of last year continued. In the third quarter, land transport fell more sharply in relative terms, while warehousing and storage and postal activities fell less. Total turnover in market services thus stagnated in current terms but fell slightly year-on-year (by 0.3%). In the first nine months, it was 1.5% higher year-on-year in real terms, which can be attributed to growth in most activities (with the exception of transportation). It remained below pre-epidemic levels (compared to the same quarter in 2019) in employment services (by 17%).

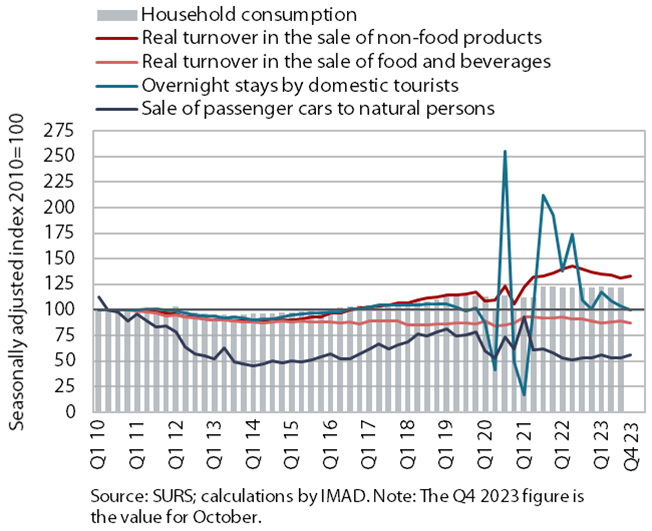

Selected indicators of household consumption, September–October 2023

The available data point to a recovery in household consumption in October. Signs of an improvement in some segments started to show already in September. Sales of new passenger cars to private customers rose year-on-year in September after two months of decline, with growth accelerating to 20% in October. Following a decline in July and August, the number of overnight stays by domestic tourists in Slovenia was higher year-on-year in September and October, as was the number of overnight stays by Slovenians in Croatia in Septem-ber. In October, purchases of non-food products were also higher year-on-year for the first time since January, while spending on food, beverages and tobacco re-mained slightly below the previous year’s level (accord-ing to preliminary SURS data). The recovery of con-sumption in October is also evident from the stronger year-on-year growth in the nominal value of fiscally ver-ified invoices (7%), although this slowed slightly in No-vember (to 4%).

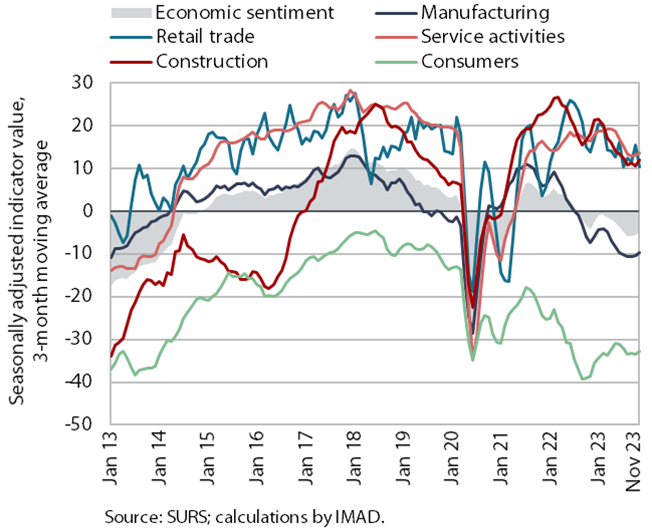

Economic sentiment, November 2023

The economic sentiment indicator rose slightly month-on-month in November, while it was still down year-on-year. Compared to the previous month, confidence was significantly higher in manufacturing, where the indicators for expected production and stock of finished products improved, and in construction. Confidence was also higher among consumers, who were more optimistic about the country’s future eco-nomic situation. On the other hand, confidence in retail trade and in services was lower. Compared to last No-vember, confidence was significantly lower in all activi-ties. It was noticeably higher among consumers, how-ever, with all components of the indicator improving, especially expectations regarding the financial situa-tion of households.

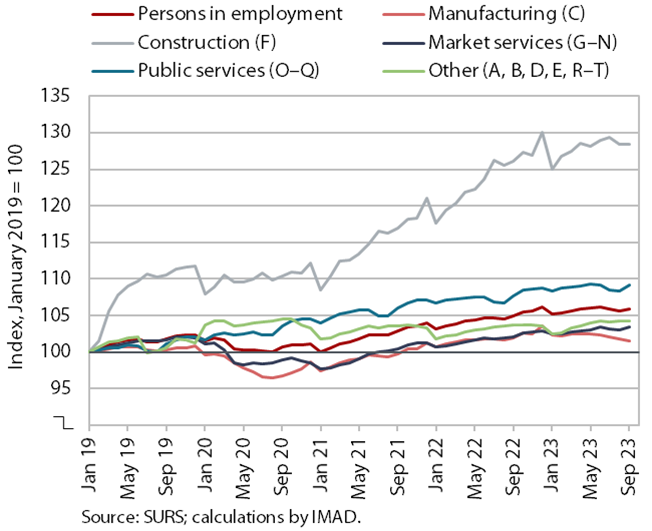

Number of persons in employment, September 2023

Year-on-year growth in the number of persons in employment (0.9%) continued to slow in September. This was mainly due to the decline in the number of persons in employment in construction and in manufacturing, according to seasonally adjusted data. With the number of Slovenians in employment declining slightly year-on-year, an increase in the number of foreign citizens in employment contributed to the overall year-on-year growth in the number of persons in employment in September. Their share among all persons in employment was 14.6%, 0.9 p.p. higher than a year earlier. The activities with the largest shares of foreigners employed are construction (48%), transportation and storage (33%), and administrative and support service activities (27%).

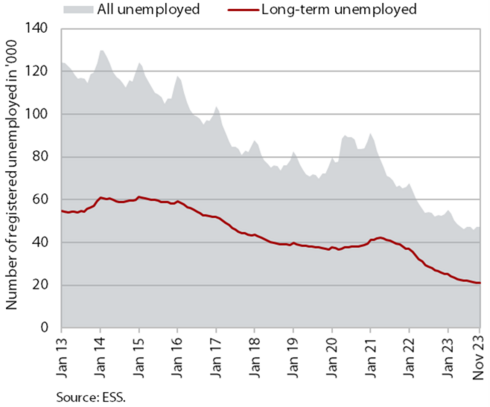

Number of registered unemployed, November 2023

According to the seasonally adjusted data, the monthly decline in the number of registered unemployed in November (0.8%) was similar to previous months but lower than at the beginning of the year. According to original data, 47,175 people were unemployed at the end of November, 0.1% less than at the end of October. Unemployment was down 10.2% year-on-year. Amid labour shortages, the number of long-term unemployed (more than 1 year) was almost one-fifth lower year-on-year at the end of November.

Number of persons in employment and the unemployment rate, Q3 2023

According to survey data, unemployment fell year-on-year in the third quarter, and the number of persons in employment also fell slightly. According to original data, 40 thousand persons were unemployed, which is 4.8% less than in the third quarter of last year. The survey unemployment rate (3.9%) fell by 0.1 p.p. year-on-year. The number of persons in employment fell slightly year-on-year (by 0.4%), as economic activity cooled. The number of employees in labour relations remained largely unchanged, while the numbers of student workers and unpaid family workers fell sharply (by 14.6% and 28.6% respectively). The number of self-employed persons increased year-on-year (by 8.6%).

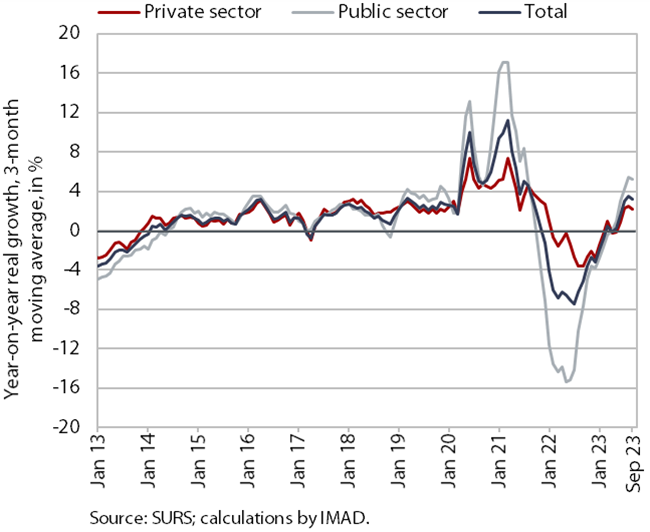

Average nominal gross wage per employee, September 2023

The year-on-year real growth in average gross wage slowed significantly in September amid higher inflation (1.8%). In the private sector, real growth was 0.8% year-on-year. It was highest in administrative and support service activities, which (along with construction and accommodation and food service activities) are among the activities facing the greatest labour shortages. In the public sector, the average gross wage rose by 3.8% year-on-year in real terms. Growth was more pronounced than in the private sector due to the wage increases agreed last year (the first of which took place in October). Average gross wage growth in September (9.5%) was slightly lower year-on-year in nominal terms than in the previous three months (10.2% in the June–August period). Growth in the private sector was 8.4% and in the public sector 11.5%. In the first nine months, the average year-on-year gross wage growth was 1.8% (1.4% in the private sector and 2.6% in the public sector).

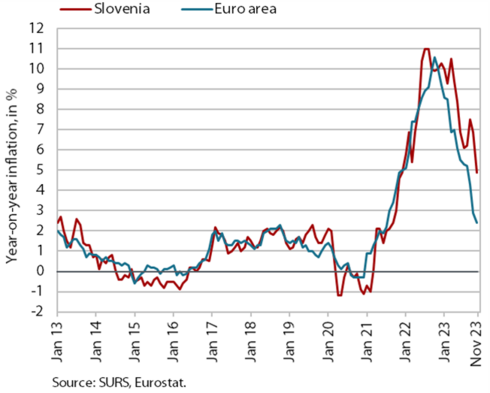

Consumer prices, November 2023

Year-on-year growth in consumer prices slowed to 4.9% in November (down by 2 p.p.), the lowest level since the end of 2021. This was mainly due to energy prices, whose contribution fell primarily as a result of the government’s measure to completely exempt households from paying RES and CHP levies. The price of electricity fell by 18.8% month-on-month and the year-on-year growth rate fell to around 1% (against around 24% in October). In November, prices for solid fuels fell further, by around one-quarter year-on-year. In addition to the decline in current terms, prices for pe-troleum products also fell year-on-year (by around 5% according to our estimate). The slowdown in year-on-year growth in food and non-alcoholic beverages prices is continuing. At 6.2% in November, it was more than two-thirds lower than at the beginning of this year. Year-on-year growth of services prices, which had been running at over 8% since May, fell slightly, to 7.4% in November. We believe this was also due to a significant slowdown in price growth in the health sector, which fell by almost a half year-on-year (to 6.4%) amid a monthly decline (-2.1%) and last year’s high base. Price growth in the restaurants and hotels and leisure and culture groups also slowed slightly.

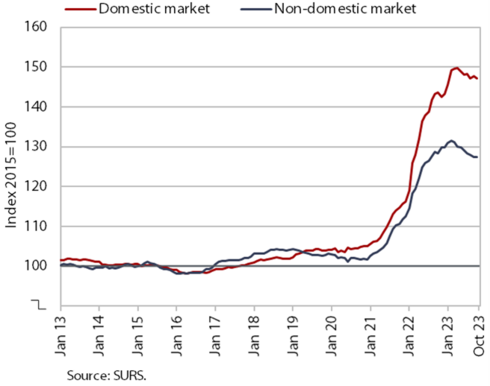

Slovenian industrial producer prices, October 2023

Slovenian industrial producer prices continued to fall in October, with year-on-year growth slowing to 0.9%. The downward momentum of prices, which have been falling month-on-month since April, has weakened in recent months. In October, they fell by 0.1% for the second month in a row. Prices on the domestic market fell (by 0.3%), while prices on foreign markets increased only slightly (by 0.1%). Although the latter prices rose in current terms, they were 0.7% lower year-on-year (they were still 14.3% higher at the beginning of the year), while on the domestic market they were 2.5% higher year-on-year (they were 22.1% higher at the beginning of the year). Of all industrial groups, only intermediate goods prices were down year-on-year in October (-2.9%). Despite the slowdown, the growth of consumer goods prices remained relatively high year-on-year (5.7%), while price growth for energy and capital goods was slightly below 4%.

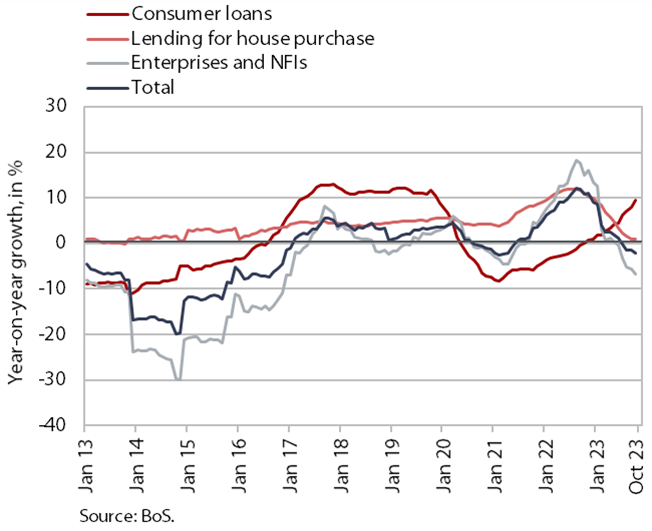

Loans to domestic non-banking sectors, October 2023

The volume of loans to domestic non-banking sectors increased month-on-month in October, while the year-on-year decline deepened slightly (-2%). The volume of corporate and NFI loans continued to shrink in current terms in the face of weakening economic activity and higher interest rates and was already 6.7% lower year-on-year. The volume of government loans financed via the bond markets is also declining (-7.2% year-on-year), although these loans only account for a small proportion of the banks’ lending activity. On the other hand, the year-on-year growth in household loans (3.3%) has remained broadly unchanged in the last three months. Growth in the volume of housing loans continues to slow, while year-on-year growth in the volume of consumer loans is increasing relatively quickly (following the lowering of the threshold for creditworthiness at the beginning of July this year). Growth in the latter loans has more than doubled in this period and stood at 9.5% in October. In the first ten months of this year, new lending in the form of consumer loans increased by around one-third compared to the same period last year (despite higher interest rates) and by almost 60% between July and October this year. Year-on-year growth in domestic non-banking sector deposits remained at around 4% in October. Household deposits are also growing at a similar rate, with term deposits increasing rapidly in recent months, by around 40% year-on-year, as a result of the rise in deposit interest rates. Long-term deposits have increased in particular, indeed have almost doubled, but these still account for less than one-tenth of total household deposits. The quality of banks’ assets remains solid and the share of non-performing loans is still at 1%.

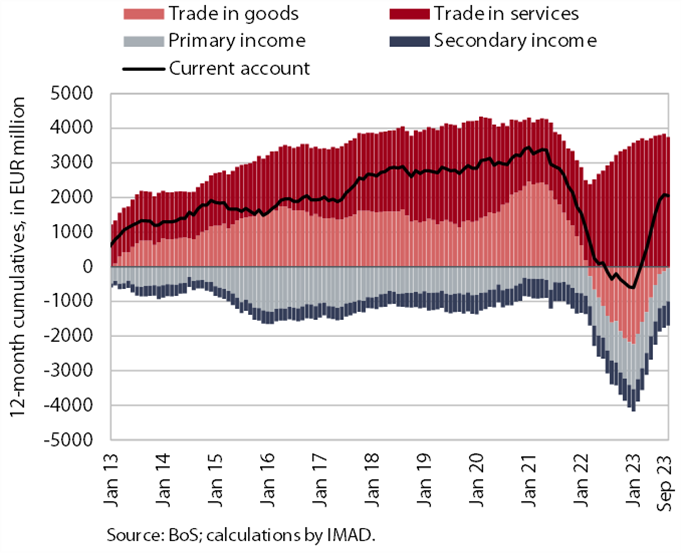

Current account of the balance of payments, September 2023

The current account of the balance of payments recorded a surplus again in the third quarter of this year. This was mainly due to the goods trade balance. Real exports of goods fell significantly year-on-year, but imports fell even more sharply, while the terms of trade improved. We estimate that the quantity fluctuations contributed EUR 445 million to the year-on-year change in the balance of goods trade in the third quar-ter (EUR 484 million) and that the terms of trade con-tributed EUR 39 million. The surplus in trade in services was lower year-on-year due to a lower surplus in trade in technical, trade-related services. The surplus in trade in transportation and travel was higher year-on-year. The primary income deficit was lower year-on-year in the third quarter, mainly due to lower net outflows of dividends and profits and higher net interest income from assets in debt instruments. The higher secondary income deficit came from lower net outflows of private and government sector transfers. The 12-month bal-ance of the current account of the balance of payments showed a surplus of EUR 2.1 billion in September (3.3% of estimated GDP).

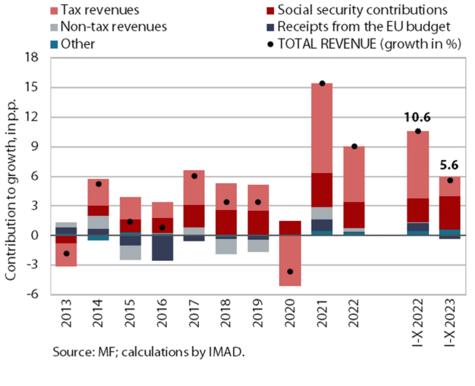

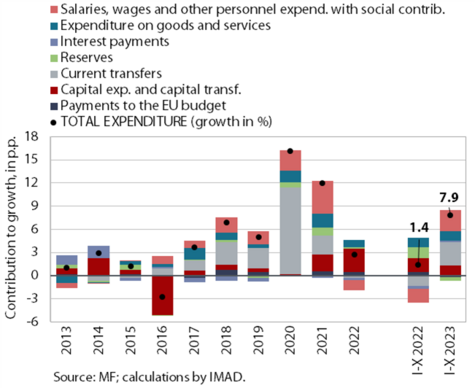

Revenue of the consolidated general government budgetary accounts, October 2023

At EUR 848.2 million, the consolidated general government deficit in the first ten months of the year was EUR 462 million higher than in the same period last year. Revenues in the first ten months were 5.6% higher year-on-year. This year, growth is mainly being driven by social contributions, boosted by higher wage growth, while tax revenues are slowing due to moderation of economic activity and the reduction in the tax burden, with the exception of excise duties, which in energy products have mostly increased up to October, after having been reduced in previous years. In terms of revenue, only receipts from the EU budget were down year-on-year, but these are expected to increase by the end of the year due to the expected inflow of funds based on the second payment request under the Recovery and Resilience Facility. Expenditure in the first ten months was 7.9% higher year-on-year. The growth in expenditure this year is higher than last year. This is partly due to the dynamics of measures to mitigate the consequences of COVID-19 and rising energy prices in recent years. The increase in expenditure this year is mainly due to wages and other remunerations, which were influenced by the agreement on wage increases in the public sector, higher subsidies for companies to mitigate the consequences of rising energy prices, and flood recovery (advance payments based on damage assessment). The disbursements based on measures to mitigate energy poverty (reimbursement of school meals and child benefits) and flood recovery measures (emergency cash assistance) have also had an impact on this year’s growth in transfers to individuals and households. In the last two months of this year, we expect the consolidated general government deficit to be larger than in September and October, when it totalled EUR 49.3 million. This will be due to higher expenditure by municipalities based on the advances received in October from the state budget in connection with flood recovery, the upcoming end of EU funds absorption under the 2014–2020 financial perspective and certain payments at the end of the year to ease the cost of living crisis (higher expenditure on pensions).

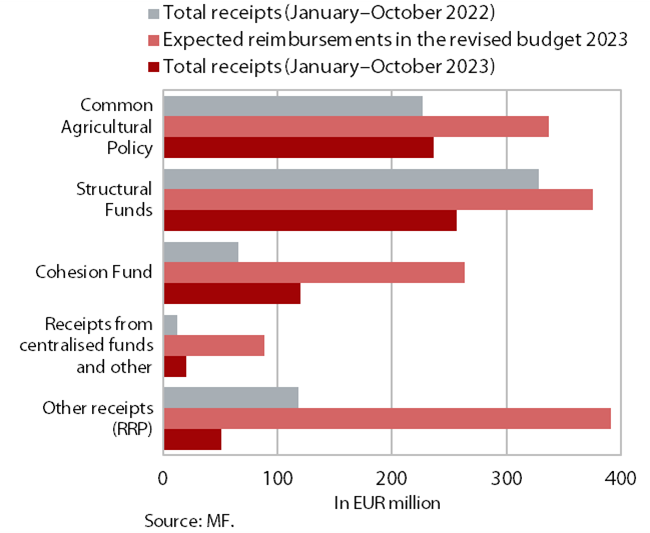

EU budget receipts, October 2023

Slovenia’s net budgetary position against the EU budget was positive in the first ten months of this year (at EUR 135.6 million). In this period, Slovenia re-ceived EUR 683.9 million from the EU budget (47.0% of receipts envisaged in the revised state budget for 2023) and paid EUR 548.3 million into it (75.1% of planned payments). The bulk of receipts were resources from structural funds (37.4% of all reimbursements to the state budget, 68.2% of the planned reimbursements in 2023) and resources under the Common Agricultural and Fisheries Policy (34.6% of all reimbursements, 70.3% of the planned reimbursements). Reimburse-ments from the Cohesion Fund amounted to 17.5% of all reimbursements (45.5% of the planned reimburse-ments). EUR 51.1 million (13.1% of planned reim-bursements) were disbursed from the Recovery and Re-silience Facility. The highest payments into the EU budget came from GNI-based payments (54.9% of all payments).