Charts of the Week

Charts of the week from 15 to 19 January 2024: number of persons in employment, electricity consumption by consumption group and other charts

In November, the subdued growth in the number of persons in employment continued. The year-on-year increase was largely due to the employment of foreign workers, while the number of employed Slovenian citizens fell year-on-year. Electricity consumption fell in all consumer groups in 2023, with the largest decline recorded in industrial consumption. On average, Slovenian industrial producer prices remained unchanged in 2023 compared to the previous year, when they had risen by almost one-fifth. However, they have been falling month-on-month since April. The value of construction work put in place remained unchanged in November, although it was one-fifth higher between January and November than in the same period of 2022. The current account surplus increased further in November, with the largest contribution to growth last year coming from the goods trade balance, which turned from a deficit into a surplus.

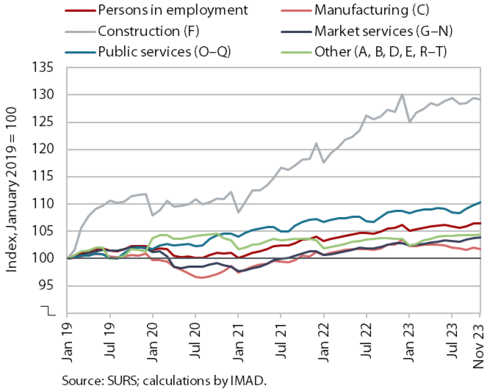

Number of persons in employment, November 2023

In November, the subdued growth in the number of persons in employment continued. Year-on-year growth in November was similar to October (0.8%) but lower than in previous months. This was primarily due to the year-on-year decline in the number of persons in employment in manufacturing, where the number of persons in employment has fallen continuously month-on-month since September (seasonally adjusted). The overall year-on-year increase in the number of persons in employment was due to a higher number of employed foreign nationals, while the number of employed Slovenian citizens fell. The share of foreign citizens among all persons in employment was 14.7% in November, 0.9 p.p. higher than a year earlier. Activities with the largest share of foreigners are construction (48%), transportation and storage (33%) and administrative and support service activities (27%).

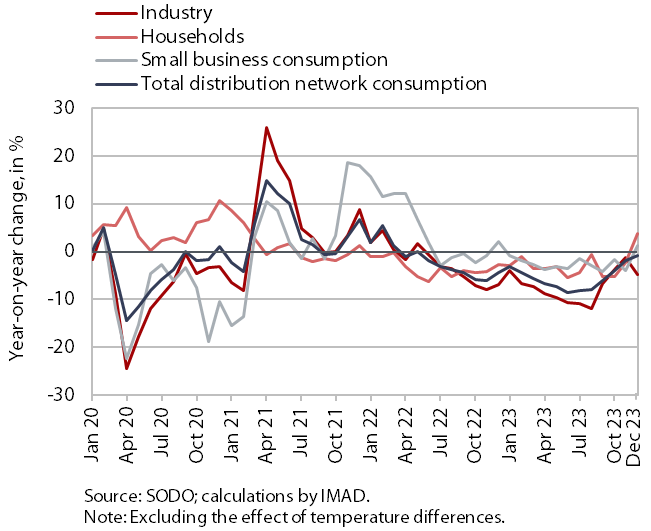

Electricity consumption by consumption group, December 2023

Electricity consumption in December last year was lower year-on-year partly due to the fewer working days. With two working days less, industrial consumption was 4.8% lower year-on-year in December, while household consumption was 3.8% higher year-on-year. Small business consumption was also higher year-on-year in December (up 1.2%). Electricity consumption in 2023 was lower in all consumer groups than in the previous year, with the sharpest decline in industrial consumption. This trend is linked to a slowdown in economic activity, lower consumption in energy-intensive industries due to high electricity prices and the floods in August.

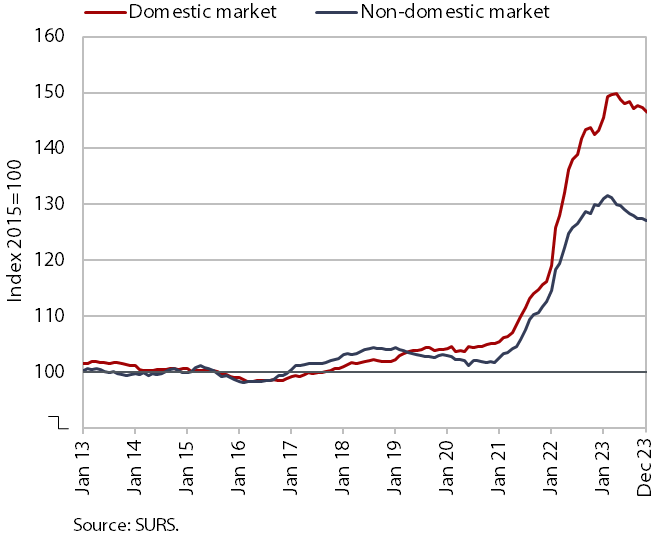

Slovenian industrial producer prices, December 2023

Slovenian industrial producer prices, which increased by almost one-fifth in 2022, remained unchanged last year. Price pressures eased as economic activity slowed, the situation on the energy and non-energy commodity markets normalised and problems in the supply chains dissipated. As a result, producer prices have fallen month-on-month since April. Only prices of intermediate goods fell year-on-year (-3.7%), while prices for energy, capital goods and consumer goods rose by around 3–4%, although their growth has slowed significantly over the past year. Prices on the domestic market increased by 2% year-on-year, while prices on foreign markets fell by 2%.

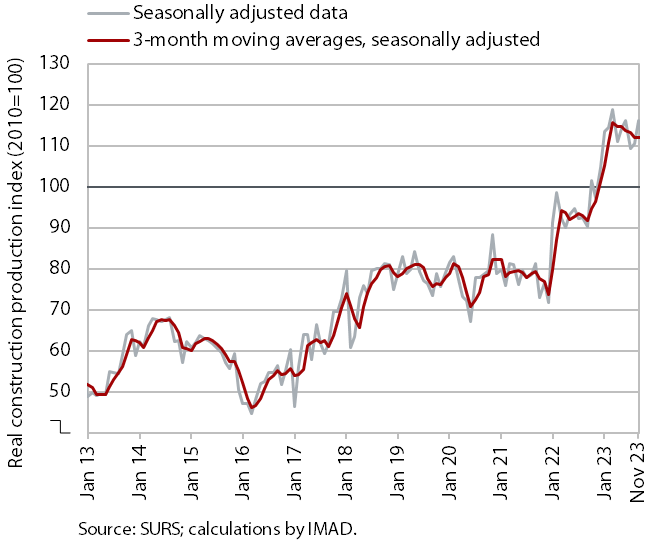

Activity in construction, November 2023

According to data on construction put in place, construction activity in November 2023 remained unchanged compared to the previous month but was higher than a year earlier. After a sharp rise in the value of construction put in place at the start of 2023, activity fluctuated greatly in the following months and was slightly lower in October and November than at the start of the year. The total value of construction put in place was 20% higher in the first 11 months of 2023 than in the same period of 2022. Activity was higher in all three segments covered by the statistics: in specialised construction by 32%, in civil engineering by 21% and in building construction by 11%.

Some other data, however, point to much lower growth in construction activity. According to VAT data, the activity of construction companies in the first 11 months of 2023 was only 11% higher than a year earlier. Compared with data on the value of construction put in place, the difference shown in the growth of this activity was thus 9 p.p.

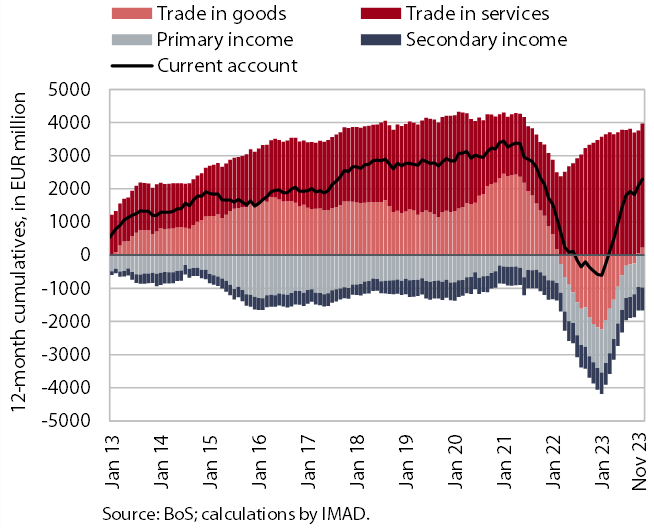

The balance of payments, November 2023

The current account of the balance of payments in the first 11 months of 2023 recorded a surplus of EUR 2.6 billion, compared to a deficit of EUR 239.9 million in the same period of 2022. The main reason for the significant year-on-year change in the current account balance is the goods trade balance, which, with imports falling more sharply than exports, once again showed a surplus. The growth of the services surplus continued, especially in trade in transport services. The decline in imports of transport services was much larger than the decline in exports, which is related to the development of trade in goods, where the decline was also larger for imports, and to the lower activity in manufacturing in 2023. Growth in the services surplus was also driven by trade in construction services and other knowledge-based services (telecommunications, computer and information services, financial services, and research and development services). The primary income deficit was lower year-on-year, mainly due to lower net outflows from equity income (dividends and profits) and higher net interest receipts from abroad. The higher secondary income deficit stemmed mainly from higher pension transfers to foreign countries. The 12-month balance of the current account of the balance of payments showed a surplus of EUR 2.3 billion in November (3.7% of estimated GDP).