Charts of the Week

Charts of the week from 8 to 12 January 2024: production volume in manufacturing and value of fiscally verified invoices

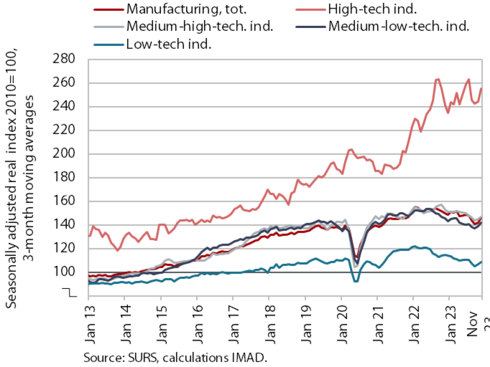

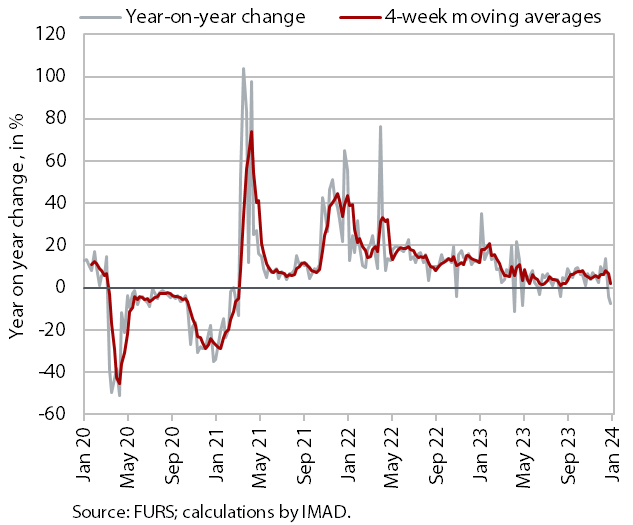

Production volume in manufacturing, which began to rise in all industry groups according to technology intensity in September 2023, was still lower in November than a year ago. In the first eleven months of 2023, it was 3.2% lower year-on-year. The effects of high energy prices, which had the greatest impact on energy-intensive industries, started to ease gradually in the autumn months. According to data on the fiscal verification of invoices, turnover between 24 December 2023 and 6 January 2024 was lower year-on-year. It was more than one-tenth higher than in the previous 14-day period, due to the timing of the last working day before the Christmas holidays and the number of working days.

Production volume in manufacturing, November 2023

Production volume in manufacturing, which started to strengthen in September 2023, was still lower in November than a year ago. After bottoming out in August 2023, manufacturing production has risen in all industry groups according to technology intensity since the end of the third quarter. Against the backdrop of monthly production growth and the low base effect (influenced by high energy prices), the year-on-year decline in production weakened in October and November 2023. The effect of high energy prices, which had the greatest impact on energy-intensive industries, started to ease gradually. Only in the paper industry did the year-on-year decline in the final months of 2023 remain similar to the average for the first nine months of 2023 (around 20%), while in the other sectors the year-on-year decline was smaller or production increased year-on-year (in the manufacture of basic metals also due to the resumption of part of the production of a large direct customer). The year-on-year decline in most other manufacturing activities has also slowed since the middle of the third quarter, and production in October–November was on average around 0.5% lower than in the same period in 2022. In the first eleven months of 2023, manufacturing output was on average 3.2% lower year-on-year.

Value of fiscally verified invoices, in nominal terms, 24 December 2023–6 January 2024

With two fewer working days than a year ago, the nominal value of fiscally verified invoices between 24 December 2023 and 6 January 2024 was 6% lower year-on-year. After almost doubling in the previous 14-day period (11%), turnover fell year-on-year in the aforementioned period. Fluctuations in the last two periods were influenced by the timing of the last working day before the Christmas holidays and the number of working days. This had a particular impact on turnover in trade, where sales fell by 7% year-on-year after doubling in the previous period (to 10%). Year-on-year turnover growth in accommodation and food service activities and certain creative, arts, entertainment, and sports services and betting and gambling was lower than in the previous two 14-day periods (overall growth in accommodation and food service activities and in other service activities fell from 12% to 7%).