Charts of the Week

Charts of the week from 23 October to 3 November 2023: consumer prices, economic sentiment, value of fiscally verified invoices and other charts

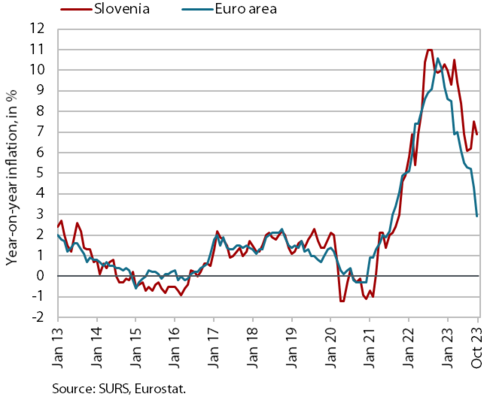

Year-on-year growth in consumer prices fell slightly in October. This was mainly due to the continued moderation of price increases of food and non-alcoholic beverages, which remain the largest contributors to inflation. The value of the economic sentiment indicator fell slightly in October, mainly due to lower confidence in manufacturing, retail trade and construction. The nominal value of fiscally verified invoices was higher year-on-year in the second half of October, but growth halved compared to the previous two-week periods, also due to the different timing of holidays. Real turnover continued to fall in most trade sectors in August and, according to preliminary data, also in September, while it remained unchanged in market service activities in August. Real exports and imports of goods fell in the third quarter compared to the second quarter. Lower demand from Slovenia’s main trading partners and lower import demand in Slovenia remain the main reasons for the decline in trade in goods. The year-on-year growth of the average gross wage strengthened slightly in August; it was higher in the public sector, mainly due to the last year’s agreement on wage increases.

Consumer prices, October 2023

The year-on-year increase in consumer prices slowed slightly in October (to 6.9%). This was mainly due to the continued moderation of price increases in the group food and non-alcoholic beverages, which remains the largest contributor to inflation among the ECOICOP groups (1.3 p.p.). After the year-on-year price increase in this group had reached almost 20% at the beginning of the year, it fell to 7.3% by October. The slowdown in price growth in the group clothing and footwear (2.7%), where year-on-year growth has weakened significantly in the last two months, with the seasonal increase being slightly less pronounced than in the same period last year, has also contributed significantly to the downward trend in inflation. This has also slowed the year-on-year increase in semi-durable goods prices, which at 3.2% reached its lowest level since July last year, and growth in the prices of durable goods (0.4%) has also continued to weaken. Services price growth remains high, at just over 8%. Year-on-year price growth rates remain high in the groups health (11.4%) and restaurants and hotels (9.1%).

Economic sentiment, October 2023

In October, the value of the sentiment indicator deteriorated slightly. Month-on-month, confidence fell in manufacturing, retail trade and construction, while it rose in services. Consumer confidence remained at a similar level to the previous month and higher than in October last year, but still well below the long-term average. In retail trade, the indicator remained above the long-term average and was also higher year-on-year. In other activities, however, confidence was lower than a year ago, particularly in construction, which is also due to the labour shortage.

Value of fiscally verified invoices, in nominal terms, 15–28 October 2023

The nominal value of fiscally verified invoices between 15 and 28 October was 4% higher year-on-year. The half lower turnover growth compared to the three previous two-week periods was also due to the difference in the timing of the last working day before the holidays this year and last year (30 October this year). Growth of turnover in trade, which accounted for almost 80% of the total value of fiscally verified invoices, fell by half (to 3%). An even more significant slowdown in year-on-year turnover growth was recorded in accommodation and food service activities (from 20% to 5%) and in certain creative, arts, entertainment, and sports services and betting and gambling (total growth in other service activities fell from 26% to 2%).

Trade in goods, September 2023

Trade in goods slowed in the third quarter compared to the second quarter. Amid strong monthly fluctuations, real exports of goods fell by 4.7% and imports by 3.7% compared to the previous quarter. As in the previous quarters, this was due to a decline in demand from Slovenia’s main trading partners and lower export demand in Slovenia. According to the detailed data, lower trade with Germany, Italy, Austria and Croatia contributed significantly to the decline, and the decline in exports of intermediate products (metals and other materials) and machinery and equipment excluding vehicles was also noticeable. Year-on-year, the decline in exports and imports in the third quarter was even more pronounced as in the previous quarters (-13.5% and -12.5% respectively). At the beginning of the last quarter, sentiment in export-oriented manufacturing activities remained very low in Slovenia, but has not deteriorated any further. As in the previous quarters, companies state that the uncertain economic situation, low domestic and foreign demand and the lack of skilled labour are the main obstacles to business activity. Export orders also remain very low.

Turnover in trade, August–September 2023

In most trade sectors, real turnover continued to fall in August and, according to preliminary data, also in September; only turnover in the sale of motor vehicles remained higher year-on-year. Turnover in wholesale and retail trade (excluding automotive fuels), which has been declining since the spring, was down 5% year-on-year in the first eight months. Turnover in retail sale of food, beverages and tobacco fell by 4% year-on-year, while in the sale of non-food products it fell by 5%. Among non-food products, the largest year-on-year decline was seen in the sale of durable and certain semi-durable goods. In the first eight months of the year, turnover in the sale of motor vehicles, which has been recovering in current terms since the second half of last year, increased by 14% year-on-year. According to preliminary SURS data, turnover in September was still lower year-on-year in retail trade, while it was higher in the sale of motor vehicles.

Turnover in market services, August 2023

The level of real turnover in market services remained unchanged in August. Total turnover stagnated in current terms, having already declined significantly in the second quarter (by 2.3%). The decline of turnover in transportation and storage further deepened, with the negative trend continuing since May last year. The decline was mainly due to postal activities and land transport. Against the backdrop of a sharp decline in overnight stays, which was also influenced by the floods in August, turnover in accommodation and food service activities also fell significantly. It also fell slightly in administrative and support service activities and in information and communication. Only professional and technical activities saw an acceleration in turnover growth. Year-on-year, total turnover fell by 2.2% in real terms in August, due to declines in information and communication, transportation and real estate activities. It remained below pre-epidemic (August 2019) levels in employment services (by 11%).

Average gross wage per employee, August 2023

The average gross wage increased year-on-year in real terms in August (by 4.2%). In the private sector, it increased by 2.9% year-on-year in real terms. Growth was strongest in accommodation and food service activities, which is facing a major labour shortage. The average gross wage in the public sector increased by 6.7% year-on-year in real terms, mainly due to the last year’s agreement on wage increases. Compared to August last year, the average gross wage increased by 10.7% in nominal terms – by 13.3% in the public sector and by 9.3% in the private sector. In the first eight months, the average year-on-year gross wage growth was 1.5% (1.2% in the private sector and 2.2% in the public sector).