Charts of the Week

Charts of the week from 24 to 29 September 2023: consumer prices, turnover in trade and turnover in market services

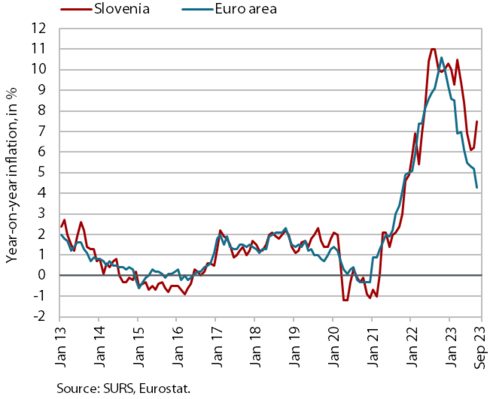

As expected, year-on-year growth in consumer prices accelerated in September (from 6.2% to 7.5%). This was mainly due to the lifting of measures to mitigate the impact of high energy prices. In addition, the prices of food, whose growth has slowed and reached the lowest level since April 2022, and services, especially health and catering services, continue to be major contributors to year-on-year inflation. Real turnover in market services fell in July, particularly in transportation. According to preliminary data, turnover fell in most trade segments also in August.

Consumer prices, September 2023

As expected, year-on-year growth in consumer prices accelerated in September (from 6.2% to 7.5%). This was mainly due to the lifting of measures to mitigate the impact of high energy prices. On 1 September this year, the Decree on the method of determining and calculating the contribution for ensuring support for the production of electricity from high-efficiency cogeneration and renewable energy sources, which reduced the monthly contribution for the provision of the mentioned support by half, expired. The electricity price thus increased by one-tenth month-on-month. The higher year-on-year growth was also due to the lower base related to the reduction in VAT rates on certain energy products from September last year to May this year. Growth in prices of food and non-alcoholic beverages continued to moderate gradually and at 9.2% was the lowest since April 2022. The year-on-year growth in durable goods prices slowed further (1.0%) and the growth in semi-durable goods prices also slowed (5.5%), with a slightly less pronounced seasonal increase in the clothing and footwear group. Since May this year, price growth in services has remained roughly unchanged (between 8 and 8.4%). The highest year-on-year price growth was recorded in the health group (10.7%), and prices in the group restaurants and hotels also rose sharply (9.2%).

Turnover in trade, July–August 2023

In most trade sectors, real turnover continued to fall in July and, according to preliminary data, also in August; only turnover in the sale of motor vehicles remained higher year-on-year. Turnover in the sale of motor vehicles, which has been rising in current terms since the second half of last year, rose by 17% year-on-year in July. Turnover in wholesale trade, which continued to decline in July, fell by 6% year-on-year, and turnover in retail trade (excluding automotive fuel) fell by 4%. After rising slightly in July, turnover in retail sale of food, beverages and tobacco fell by 3% year-on-year, while it fell by 5% in the sale of non-food products. Among non-food products, the largest year-on-year decline, as in previous months, was seen in the sale of durable and certain semi-durable goods. According to preliminary SURS data, turnover in August was still lower year-on-year in retail trade and higher in the sale of motor vehicles.

Turnover in market services, July 2023

After decreasing in the second quarter, real turnover in market services declined further in July. Total turnover thus declined by 0.2% in current terms, having already declined significantly in the second quarter (by 2.3%). Turnover in transportation and storage continued to decline, with the negative trend continuing since May last year. This time the decline came mainly from postal activities and warehousing and storage. Turnover also declined in administrative and support service activities, amid weak growth in employment and a further decline in travel agencies, which has been observed since March. Due to the high growth in overnight stays by foreign tourists, accommodation and food service activities experienced a strong upswing in turnover. Growth also accelerated in professional and technical activities, although turnover in architectural and engineering services dropped significantly. Turnover also continued to grow in information and communication activities, mainly due to the increase of turnover in computer services on the domestic and foreign markets. Year-on-year, total turnover in market services fell by 0.1% in real terms in July, due to declines in transportation and storage and real estate activities. After a long time, turnover in transportation and storage again fell below pre-epidemic (July 2019) levels (by 8%), whereas in administrative and support service activities it was still below pre-epidemic levels (by 6%), among which the sharpest decline was in employment activities (by 19%).