Charts of the Week

Charts of the week from 18 to 22 September 2023: economic sentiment, value of fiscally verified invoices, Slovenian industrial producer prices and other charts

The economic climate indicator improved slightly in September, although it remains well below its long-term average. Year-on-year nominal growth in the value of fiscally verified invoices strengthened in all activities in the first half of September, with the strongest growth in accommodation and food service activities and other service activities. The monthly decline in Slovenian industrial producer prices continued in August and year-on-year growth also continues to slow. Employment growth in July was slightly lower than in previous months, mainly due to a slowdown in year-on-year growth in construction and manufacturing; for some time now, employment of foreign workers has contributed more than 80% to employment growth. The average wage in the first seven months, including July, was higher year-on-year in real terms. The increase in the public sector was more pronounced than in the private sector, mainly due to the wage increase agreed last year. In the second quarter, subdued growth of dwelling prices continued amid a further decline in the volume of sales.

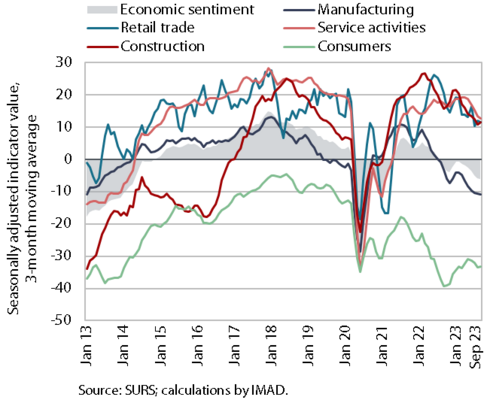

Economic sentiment, September 2023

In September, the value of the economic sentiment indicator rose slightly, although it remained relatively low. Compared to the previous month, confidence was higher in services, construction and among consumers, while it was lower in retail trade. Confidence in manufacturing remained at the previous month’s level and was noticeably lower than in September last year. This is mainly related to the uncertain economic situation and weak domestic and foreign demand. Confidence in most sectors remained lower than a year ago and in the pre-epidemic period. Consumer confidence is an exception, but the indicator is still well below its long-term average.

Value of fiscally verified invoices – in nominal terms, 3–16 September 2023

The nominal value of fiscally verified invoices between 3 and 16 September 2023 was 8% higher year-on-year. Turnover growth, which had already strengthened in the previous 14-day period after being weak in early August, was the highest in five months at the beginning of September. Turnover in trade rose 5% year-on-year, following a 4% increase in the previous 14-day period. Turnover in retail trade, which accounted for more than half of the total value of fiscally verified invoices, increased by 5% year-on-year, turnover in the sale of motor vehicles by 14%, and turnover in wholesale trade by 1%. Turnover growth strengthened significantly in accommodation and food service activities (from 9% to 15%) and in certain creative, arts, entertainment, and sports services and betting and gambling (total growth in other service activities was 27%, compared to 17% in the previous period).

Slovenian industrial producer prices, August 2023

Slovenian industrial producer prices fell at the monthly level for the fifth month in a row in August. They were 0.5% lower than in July, with decreases in both the domestic market (0.7%) and the foreign markets (0.2%). This means that the year-on-year growth rate has slowed to 2.1%, compared to the growth of almost 20% at the end of last year. The main reason for the slowdown were price developments in the intermediate goods group, where prices fell year-on-year in August for the first time since January 2021, by 3.9% (19.4% growth at the end of the year). Price growth is also weakening in other industrial groups. The slowdown was most pronounced in the energy group, where prices had still risen by almost 80% year-on-year at the end of last year, while growth in August was 7.4%. However, we estimate that their contribution to the slowdown in overall growth is lower than that of intermediate goods, as their share in the price structure of industrial products is relatively small. A similar price increase (6.8%) was recorded for consumer goods, while the year-on-year price increase for capital goods remained largely unchanged (4.4%).

Number of persons in employment, July 2023

Year-on-year growth in the number of persons in employment was lower in July than in the previous months (1.2%). This was mainly due to a slowdown in year-on-year growth in construction and also manufacturing. The strongest growth was in information and communication. For some time now, the employment of foreigners has contributed almost exclusively to the overall growth in the number of persons in employment – 96% year-on-year in July, slightly more than in previous months. Foreigners accounted for 14.6% of total employment in July, up 1 p.p. year-on-year. The sectors with the highest share of foreigners were construction (48%), transportation and storage (33%), and administrative and support service activities (27%).

Average gross wage per employee, July 2023

The average gross wage increased by 3.7% year-on-year in real terms in July. In the private sector, the average gross wage increased by 2.8% year-on-year in real terms. Growth was strongest in administrative and support service activities and in accommodation and food service activities, which are facing a major labour shortage. The average gross wage in the public sector increased by 5.2% year-on-year in real terms, mainly due to the last year’s agreement on wage increases. Compared to July last year, the average gross wage increased by 10% in nominal terms – by 11.6% in the public sector and by 9% in the private sector. In the first seven months, the average year-on-year gross wage growth was 1.4% (1.2% in the private sector and 1.9% in the public sector).

Residential housing – Q2 2023

In the second quarter, subdued growth of dwelling prices continued amid a further decline in the volume of sales. Prices were 1.9% higher than in the first quarter and 7.4% higher than in the second quarter of 2022. Year-on-year growth, which weakened considerably compared to previous years, was driven by higher prices for existing dwellings (+7.9%). Prices of newly built dwellings were also slightly higher year-on-year (by 0.7%), but these dwellings accounted for only slightly more than 1% of all transactions due to insufficient supply. A total of 2,421 dwellings were sold. This is a drop of almost one-third compared to the second quarter of last year and the lowest level since the second quarter of 2020, when the number of transactions was severely affected by business restrictions due to the outbreak of the epidemic.