Charts of the Week

Charts of the week from 15 to 19 April 2024: number of persons in employment, activity in construction, value of fiscally verified invoices and other charts

In February, the number of persons in employment continued to rise year-on-year. This increase was mainly driven by a higher number of foreigners in employment, particularly in construction, transportation and storage, and administrative and support service activities. According to data on the value of construction work put in place, construction activity increased in February and was similar to the beginning of last year, while VAT data showed a higher level of activity compared to last year. The nominal value of fiscally verified invoices in the first two weeks of April remained similar to the same period last year. Fluctuations in turnover growth in the last month were attributed to the different timing of the Easter holidays. In March, industrial producer prices experienced a slight monthly increase, while the year-on-year decline showed signs of slowing down. In the fourth quarter of 2023, road freight transport continued to decline, while rail transport witnessed an increase.

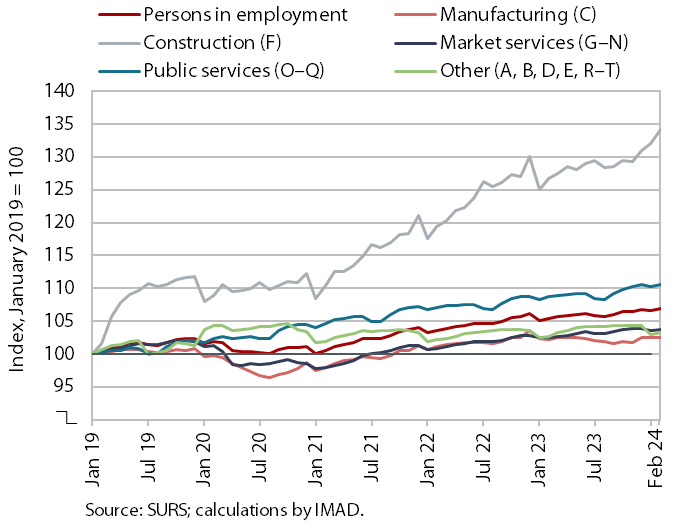

Number of persons in employment, February 2024

In February, the number of persons in employment continued to rise year-on-year. Growth was similar (1.4%) to January and higher than in the final months of 2023. The acceleration was mainly due to a change in the definition of persons in employment. This is also the reason why the highest growth was recorded in construction, which is facing a significant labour shortage and experienced the largest increase in the number of persons in employment compared to the same period in 2019. However, in administrative and support service activities, the number of persons in employment declined year-on-year. The year-on-year increase in the number of persons in employment was solely attributed to a higher number of foreign workers, as the number of Slovenian workers decreased. The share of foreign citizens among all persons in employment was 15.5% in January, 1.4 p.p. higher than a year earlier. Notably, the activities with the largest shares of foreign workers were construction (50%), transportation and storage (33%) and administrative and support service activities (28%).

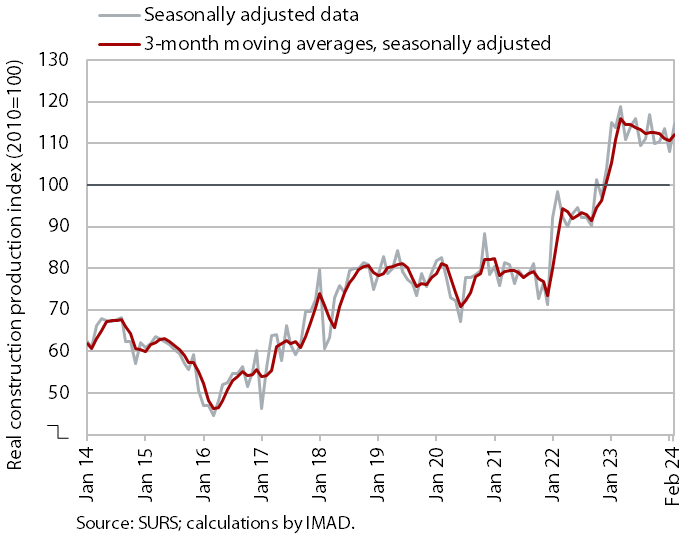

Activity in construction, February 2024

According to data on the value of construction work put in place, construction activity increased in February, reaching levels similar to those observed at the beginning of last year. Following a period of notable growth in the value of construction work put in place at the beginning of last year, activity gradually declined amid monthly fluctuations. It increased again in February, while it was slightly lower in the first two months combined than in the same period last year (-2.4%).

Some other data, however, point to growth in construction activity. According to VAT data, the activity of construction companies in January and February surpassed last year's figures by 11%. When compared to the data on the value of construction put in place, this represents a notable difference of 14 p.p. in the growth of this activity.

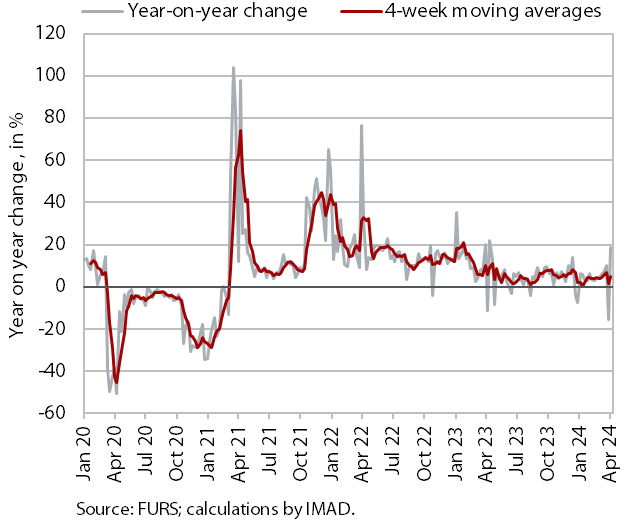

Value of fiscally verified invoices, in nominal terms, 31 March–13 April 2024

The nominal value of fiscally verified invoices between 31 March and 13 April 2024 was similar to the same period last year. Fluctuations in turnover during the preceding 14-day period (wherein year-on-year growth surged to 8%) and during the analysed period were attributed to the timing of the Easter holidays, which this year occurred a week earlier than last year, traditionally exerting a significant impact on spending dynamics during this period. Turnover in trade, which accounted for more than three-quarters of the total value of fiscally verified invoices, experienced a 1% decline in the analysed period after doubling in the previous period (to 8%). Year-on-year turnover growth in accommodation and food service activities, certain creative, arts, entertainment, and sports services, and betting and gambling also saw a slight decline (overall growth in accommodation and food service activities and in other service activities was 8%, compared to 13% in the previous 14-day period).

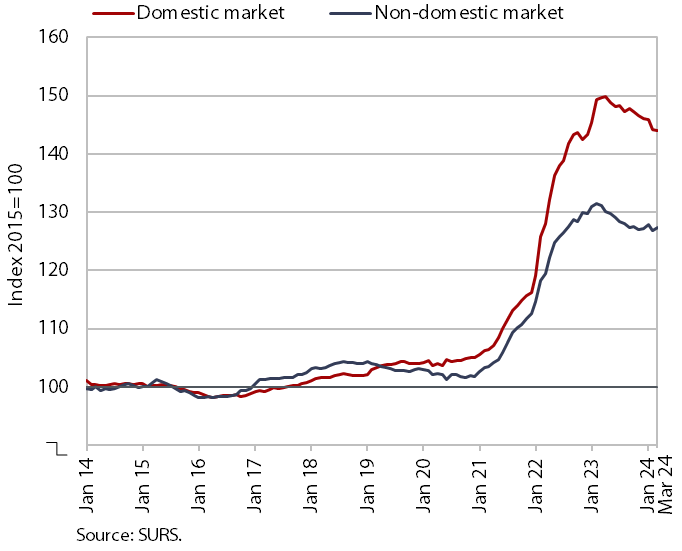

Slovenian industrial producer prices, March 2024

In March, industrial producer prices saw a slight month-on-month increase (0.1%), while the year-on-year decline has slowed somewhat (-3.3%). The monthly increase was mainly due to a 4.1% rise in energy prices, with prices for capital goods (0.5%) and consumer goods (0.2%) also experiencing a slight rise. Prices of intermediate goods fell slightly and the year-on-year decline in prices in this group accelerated slightly (-5.8%). Against the backdrop of relatively high monthly price increases, the year-on-year price decline in the energy product group slowed somewhat, yet remained substantial at 12.2%. The growth of prices for capital and consumer goods continued to weaken, registering a year-on-year increase of slightly below 1%. The decline in Slovenian producer prices was somewhat more pronounced on the domestic market (-3.7%) than on the foreign markets (-3.0%).

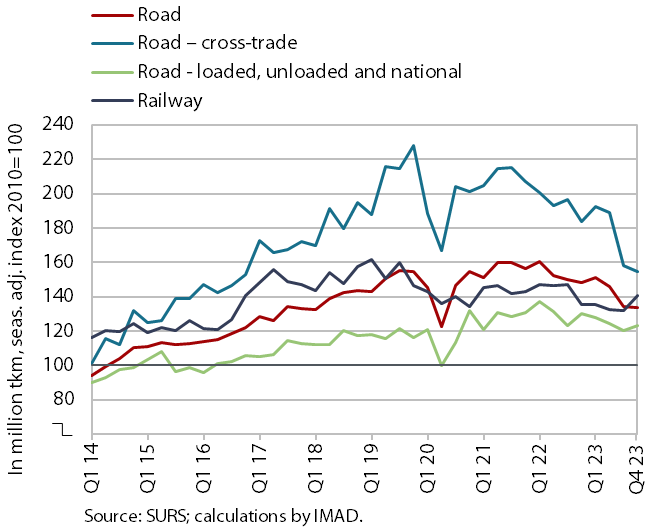

Road and rail freight transport, Q4 2023

Road freight transport further declined in the fourth quarter of 2023, while rail transport experienced growth. The decline in the volume of road transport performed by Slovenian vehicles, which was lower than in the previous two quarters, was still influenced by reduced cross-trade (by more than 2%), while road traffic performed at least partially on Slovenian territory (exports, imports and national transport) exhibited a slight overall increase. Year-on-year, the volume of road goods transport fell by more than one-tenth, and even slightly more compared to the fourth quarter of 2019 (pre-epidemic period). The share of cross-trade, which accounted for half of all goods transport a few years ago, fell to less than 40%. Rail freight transport, which had been on a downward trajectory already before the epidemic, saw a significant increase in the fourth quarter (by 7%). It was also several percentages higher year-on-year, while it was lower compared to the same period in 2019.