Charts of the Week

Charts of the week from 1 to 5 April 2024: number of registered unemployed, value of fiscally verified invoices, electricity consumption and other charts

In March, the monthly decline in the number of registered unemployed (0.9%, seasonally adjusted) was similar to February, while the number of unemployed fell by 6.9% year-on-year at the end of March. In the second half of March, the year-on-year growth in the nominal value of fiscally verified invoices was slightly higher than in the previous weeks of the year (8%), which is due to a different timing of the Easter holidays. Electricity consumption in March was 8% lower year-on-year. Yields to maturity of euro area government bonds decreased slightly in the first quarter of this year as inflationary pressure gradually eased. In February, real exports and imports of goods continued to fall month-on-month; exports were higher year-on-year, while imports remained lower. In January, total real turnover in market services remained at the level of December 2023, while it was higher year-on-year, with the exception of real estate activities.

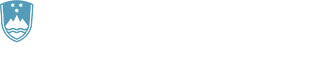

Number of registered unemployed, March 2024

According to the seasonally adjusted data, the monthly decline in the number of registered unemployed in March (0.9%) was similar to February. According to original data, 46,877 people were unemployed at the end of March, 6.9% less than a year ago. Amid labour shortages, the number of long-term unemployed (more than 1 year) fell by 14.9% year-on-year at the end of March, while the number of unemployed over 50 fell by 9%.

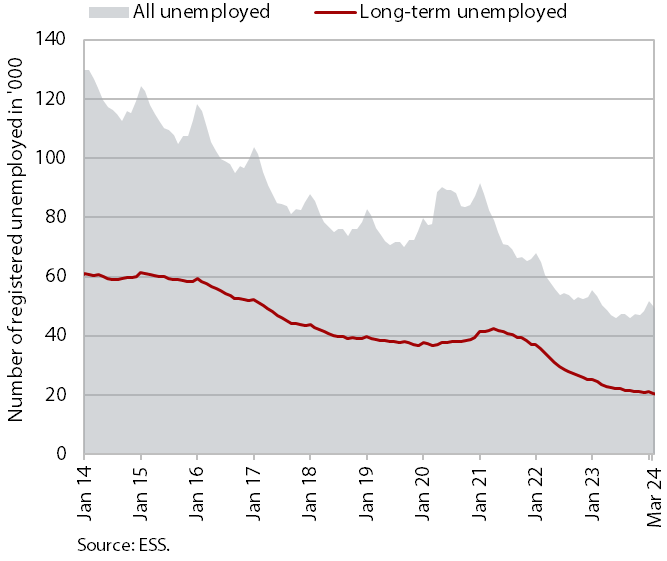

Value of fiscally verified invoices, in nominal terms, 17–30 March 2024

The nominal value of fiscally verified invoices between 17 and 30 March 2024 was 8% higher year-on-year. The stronger growth compared to previous periods was due to the Easter holidays, which were a week earlier this year than last year and usually have a strong impact on spending dynamics in this period. Year-on-year turnover growth in retail trade, which accounted for almost half of the total value of fiscally verified invoices, almost doubled, reaching 11%. Growth of turnover in the sale of motor vehicles was high (13%), while turnover in wholesale trade remained lower year-on-year. Year-on-year turnover growth in accommodation and food service activities, certain creative, arts, entertainment, and sports services, and betting and gambling also accelerated (overall growth in accommodation and food service activities and in other service activities was 13%, compared with an average of 8% in the previous 14-day periods of the year).

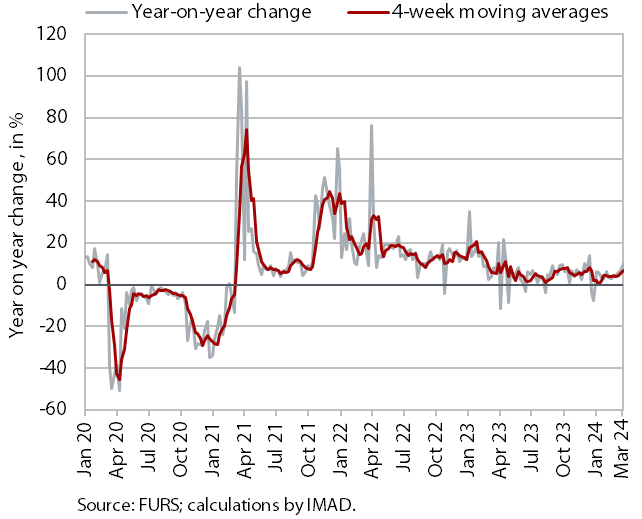

Electricity consumption, March 2024

Electricity consumption in March was 8% lower year-on-year. On a high base of last year, the year-on-year decline was, in our view, due to both lower industrial and lower household consumption. The latter is also related to the limited operation of ski resorts and the nearby tourist accommodations, which are part of household consumption. Among Slovenia’s main trading partners, lower consumption compared to March 2023 was recorded by Austria (-5%), Croatia (–2%) and Germany (-2%), while consumption was higher year-on-year in Italy (1%) and France (3%).

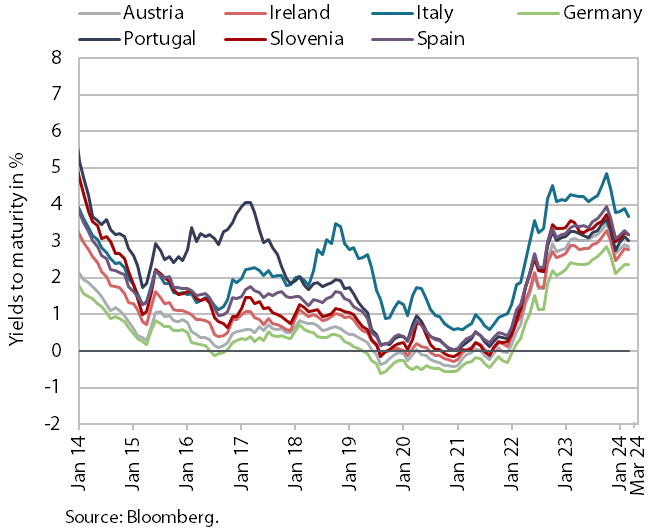

Bond, Q1 2024

Yields to maturity of euro area government bonds decreased slightly in the first quarter of this year as inflationary pressure gradually eased. The yield to maturity of the Slovenian bond fell by 25 basis points compared to the previous quarter to 3.16%, the lowest level since the fourth quarter of 2022. The spread to the German bond, which, at 84 basis points, was the lowest since the beginning of 2022, also narrowed slightly.

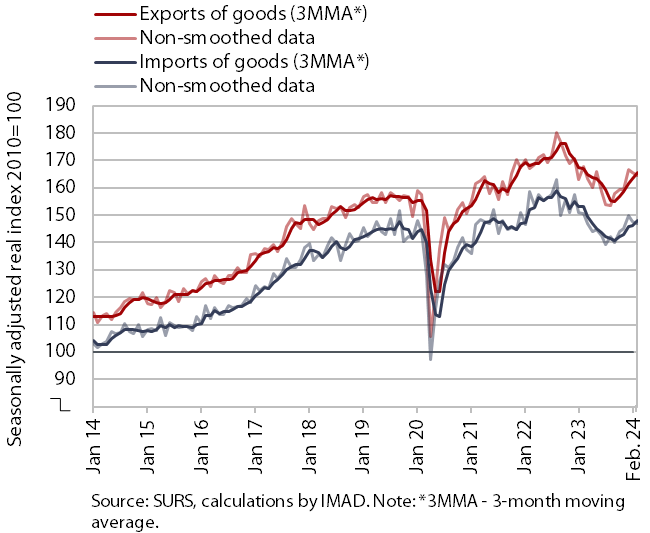

Trade in goods – in real terms, February 2024

In February, real exports and imports of goods continued to decline month-on-month; exports were higher year-on-year, while imports remained lower. As in previous months, the external trade movements were primarily influenced by the slow economic recovery in Slovenia’s main EU trading partners. Real exports fell by 0.6% in February, due to lower exports of most main product groups, with the exception of motor vehicles exports, which rose for the third month in a row (seasonally adjusted). Real imports fell by 0.5%, with imports of intermediate and consumer goods declining, particularly from non-EU countries (seasonally adjusted). In the first two months, exports (to EU and non-EU countries) was 2.4% higher compared to the same period last year, while the year-on-year decline in imports narrowed (to -1.8%). Sentiment in export-oriented activities improved slightly in March, but export orders remained at a very low level.

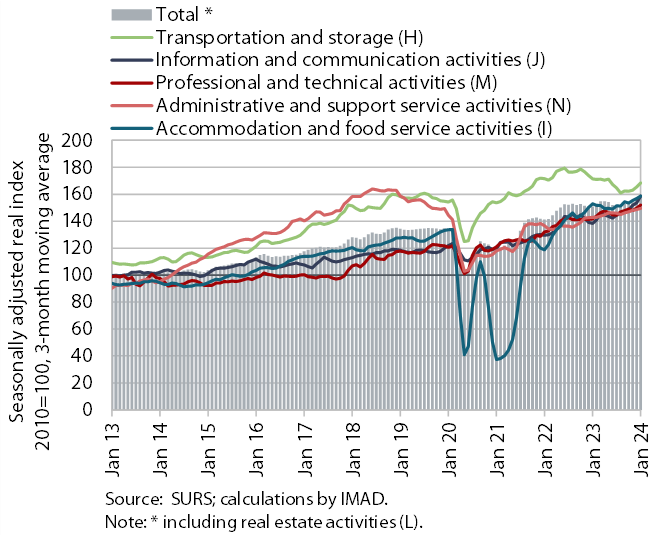

Turnover in market services, January 2024

Total real turnover remained at the level of December 2023, while it was 6.3% higher year-on-year in real terms. After two months of growth, turnover fell in administrative and support service activities, but with continued growth in employment services. Turnover also declined in the accommodation and food service activities, mainly due to a fall in turnover in the accommodation sector. A decline was recorded also in transportation and storage, this time mainly in warehousing and storage. After a decline in December, turnover growth was the highest in information and communication. The strong growth came mainly from the computer services, where turnover increased primarily on the domestic market. Turnover growth continued in professional and technical activities, with robust growth in architectural and engineering services. Total turnover in market services rose by 6.3% year-on-year in real terms in January, which can be attributed to growth in all market services with the exception of real estate activities.