Charts of the Week

Charts of the week from 18 to 22 March 2024: economic sentiment, value of fiscally verified invoices, slovenian industrial producer prices and other charts

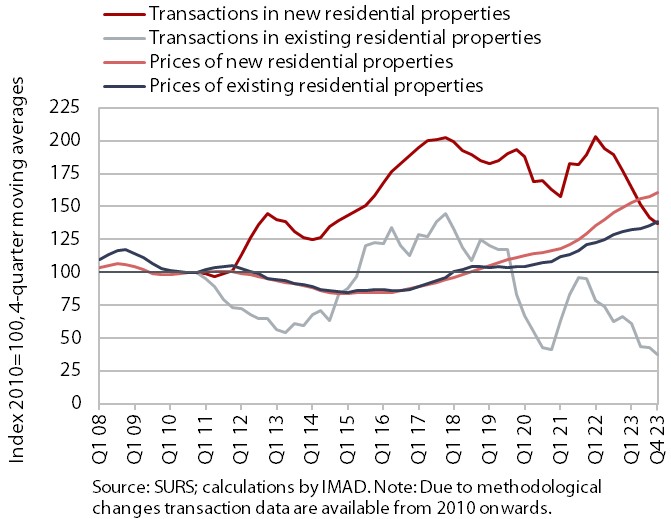

The value of the economic sentiment indicator, after improving for several months, decreased for the second month in a row in March and remained lower than a year ago. In the first half of March, the year-on-year growth in the nominal value of fiscally verified invoices remained similar to the previous weeks of this year (5%). Slovenian industrial producer prices continued to fall in February in most industrial groups (most significantly of energy) and were also lower year-on-year. The year-on-year growth in the number of persons in employment was slightly higher in January due to methodological changes compared to previous months. Growth was primarily due to the higher number of employed foreign citizens, with particularly high shares of foreign citizens in construction, transportation and storage, and administrative and support service activities. Amid lower inflation and an increase in the minimum wage, the increase in average gross wage per employee was more pronounced in real terms in January than in previous months. Growth of dwelling prices has halved on average over the past year, amid the further decline in the total number of transactions. Compared to 2008, prices of existing dwellings were around 50% higher, while prices of newly built dwellings were approximately 20% higher.

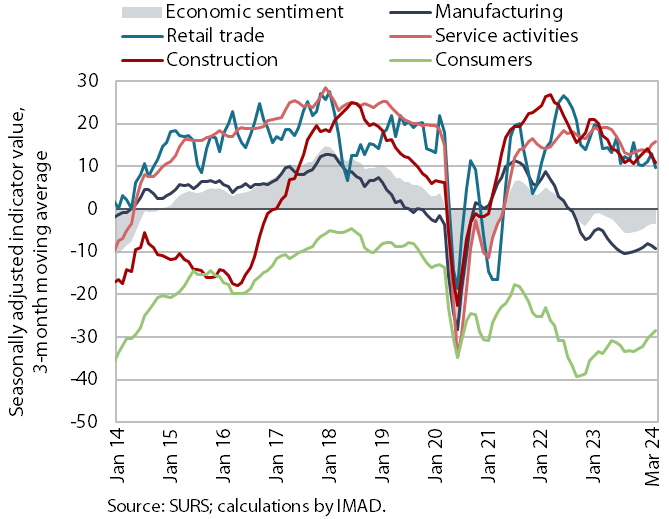

Economic sentiment, March 2024

In March, the economic sentiment indicator fell again month-on-month and also year-on-year. Compared to February, confidence fell in service and manufacturing activities and in retail trade. It was only higher in construction, while it remained roughly unchanged among consumers. Compared to March 2023, confidence was down in all activities and, with price developments easing, higher only among consumers, where it is still significantly more below the long-term average than in the years before the epidemic. The year-on-year lower values of most confidence indicators point to persistent insecurities in the international environment.

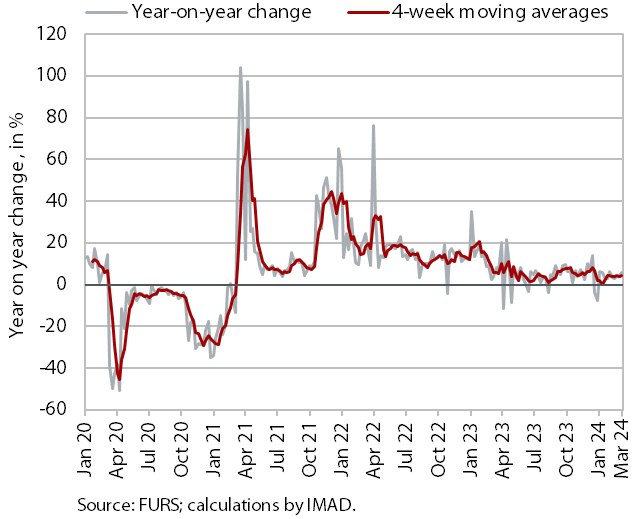

Value of fiscally verified invoices, in nominal terms, 3–16 March 2024

The nominal value of fiscally verified invoices between 3 and 16 March 2024 was 5% higher year-on-year. The year-on-year growth, which has been around 5% since the beginning of the year, is mainly influenced by turnover in trade, which usually accounts for almost 80 % of fiscally verified invoices. In the period analysed, turnover in trade increased by 4% year-on-year, similar to the previous 14-day periods of this year. Turnover growth was still the highest in retail trade (6%), while turnover in wholesale trade remained lower year-on-year. Year-on-year turnover growth in accommodation and food service activities and in certain creative, arts, entertainment, and sports services and betting and gambling remained similar (and relatively high) to the previous periods (total growth in other service activities was 8%).

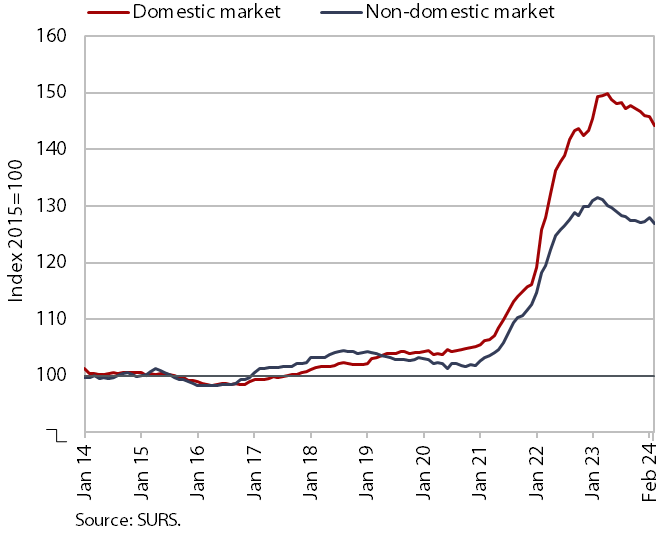

Slovenian industrial producer prices, February 2024

In February, the year-on-year decline in Slovenian producer prices intensified (-3.5%) due to the monthly decline in prices (-1.0%) and a high last year’s base. Month-on-month, prices fell in most industrial groups (with the sharpest fall in energy prices: -8.3), while only prices for capital goods rose slightly. The monthly decline in prices of products on the domestic market was similar to the decline on foreign market (-1.1% and -0.9% respectively). Differences between domestic (-3.4%) and foreign markets (-3.6%) were also small in a year-on-year comparison. Intermediate goods prices further weakened in February (-5.5% year-on-year), and energy prices were also lower year-on-year for the first time since the start of 2021 (by almost one-fifth). The rise in prices for capital and consumer goods continued to weaken, with growth of just over 1%.

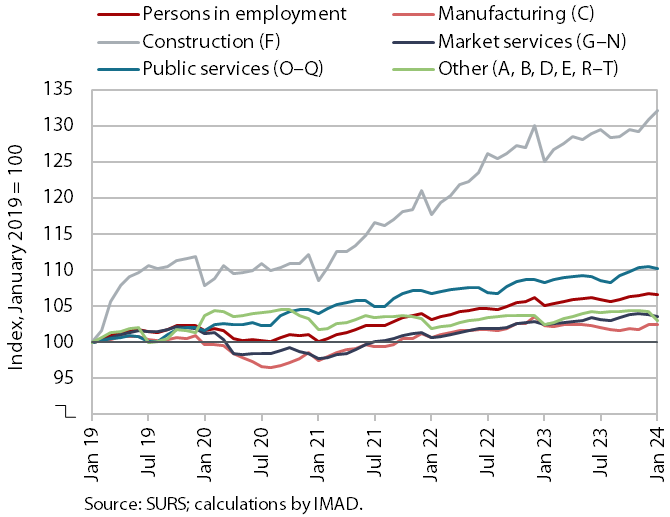

Number of persons in employment, January 2024

The number of persons in employment continued to rise year-on-year in January. Growth was higher (1.3%) than in the final months of 2023 (still 0.6% in December), when year-on-year growth slowed, and was mainly due to a change in the definition of persons in employment. The strongest growth was seen in construction, which is facing a major labour shortage and saw the largest increase in the number of persons in employment compared to the same period in 2019. The number of persons in employment declined year-on-year in administrative and support service activities. The year-on-year increase in the number of persons in employment was due to a higher number of employed foreign nationals, while the number of employed Slovenian citizens fell. The share of foreign citizens among all persons in employment was 15.3% in January, 1.3 p.p. higher than a year earlier. Activities with the largest shares were construction (49%), transportation and storage (33%) and administrative and support service activities (28%).

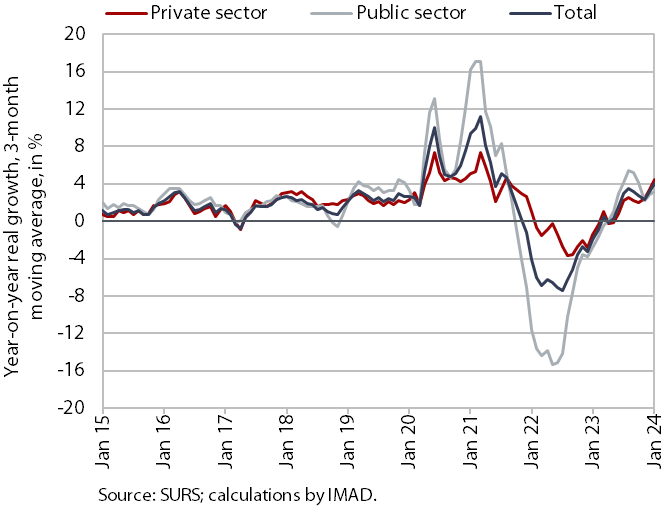

Average gross wage per employee, January 2024

Amid lower inflation and an increase in the minimum wage, the year-on-year growth in the average gross wage in January (4.6%) was higher in real terms than in the previous months. In the private sector, the average gross wage increased by 5.5% year-on-year in real terms. Growth was strongest in administrative and support service activities, manufacturing activities and transportation and storage. Growth in the public sector (3%) was lower than in December, when the higher growth was partly due to public servants' promotion raises at the end of the year and to the performance-related bonus payments for regular work.

Nominal year-on-year growth in the average gross wage was slightly lower in January (8.1%) than in previous months. Growth was 8.9% in the private sector and 6.4% in the public sector.

Real estate, Q4 2023

Amid a further decline in the volume of sales, growth in dwelling prices halved in 2023 as a whole. Following average growth of 14.8% in 2022 and 11.5% in 2021, dwelling prices were 7.1% higher year-on-year last year. Prices of existing dwellings, where the number of transactions fell below 10,000 for the first time since 2014 (and was almost one-quarter lower year-on-year), were 7.3% higher year-on-year. Prices of newly built dwellings were also higher (by 5.4%), but these dwellings accounted for only 3% of all transactions. They were 43.9% higher than in 2008, with prices of existing dwellings rising by 51.3% (by 41.1% in Ljubljana and by 71.8% elsewhere) and prices of newly built dwellings by 18.2%.